Answered step by step

Verified Expert Solution

Question

1 Approved Answer

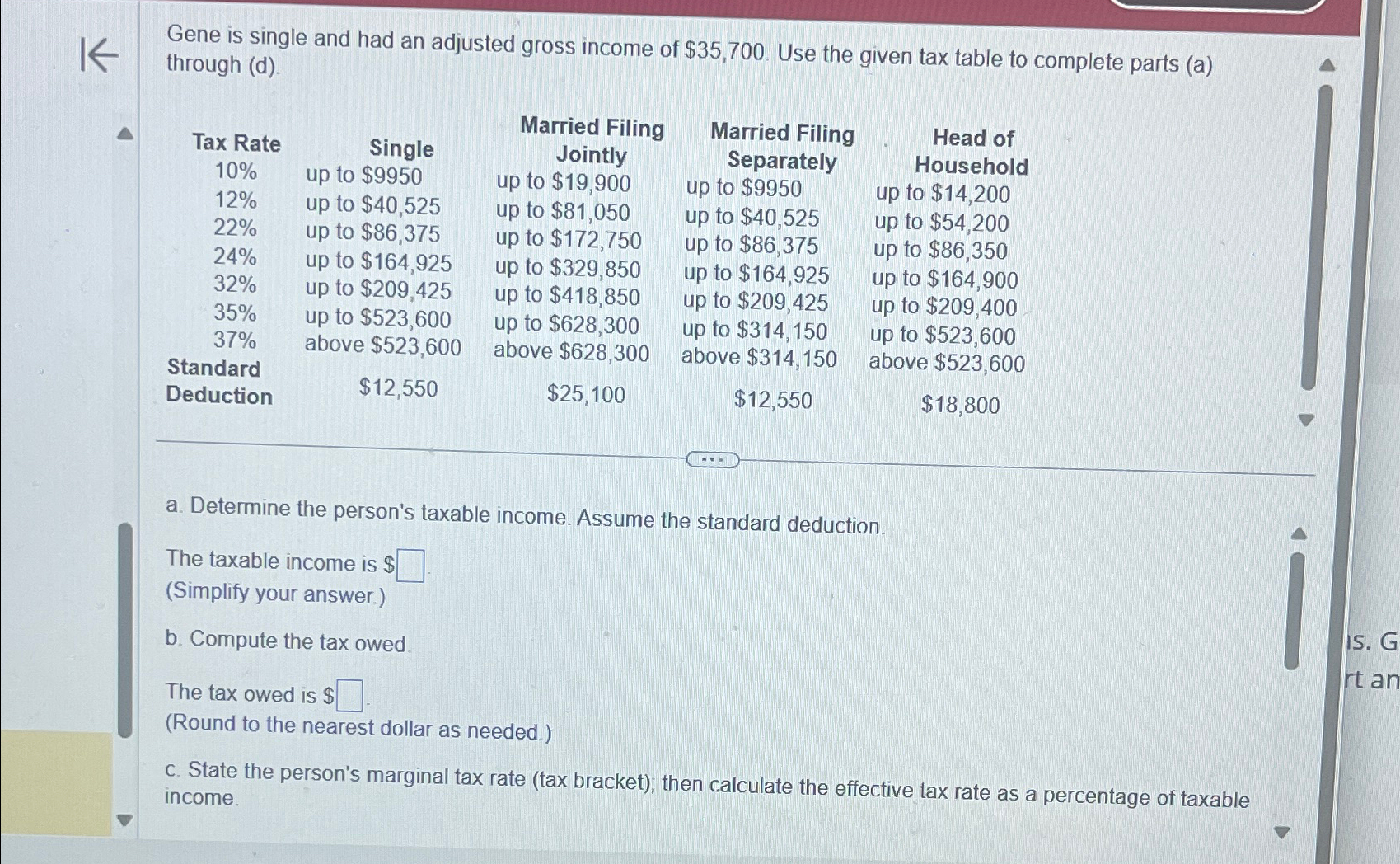

K Gene is single and had an adjusted gross income of $35,700. Use the given tax table to complete parts (a) through (d). Married

K Gene is single and had an adjusted gross income of $35,700. Use the given tax table to complete parts (a) through (d). Married Filing Jointly Head of Household up to $14,200 up to $54,200 up to $86,350 up to $164,900 up to $209,400 Tax Rate Single Married Filing Separately 10% up to $9950 up to $19,900 12% up to $40,525 up to $81,050 22% up to $86,375 up to $172,750 24% up to $164,925 up to $329,850 32% up to $209,425 up to $418,850 up to $9950 up to $40,525 up to $86,375 up to $164,925 up to $209,425 35% up to $523,600 37% above $523,600 up to $628,300 above $628,300 up to $314,150 up to $523,600 above $314,150 above $523,600 Standard $12,550 $25,100 Deduction $12,550 $18,800 a. Determine the person's taxable income. Assume the standard deduction. The taxable income is $ (Simplify your answer.) b. Compute the tax owed. The tax owed is $ (Round to the nearest dollar as needed.) c. State the person's marginal tax rate (tax bracket); then calculate the effective tax rate as a percentage of taxable income. IS. G rt an

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started