Answered step by step

Verified Expert Solution

Question

1 Approved Answer

K IS A 20% GENERAL PARTNER IN A REAL ESTATE PARTNERSHIP. HE IS NOT A REAL ESTATE PROFESSIONAL BUT HE DOES ACTUALLY PARTICIPATE IN THE

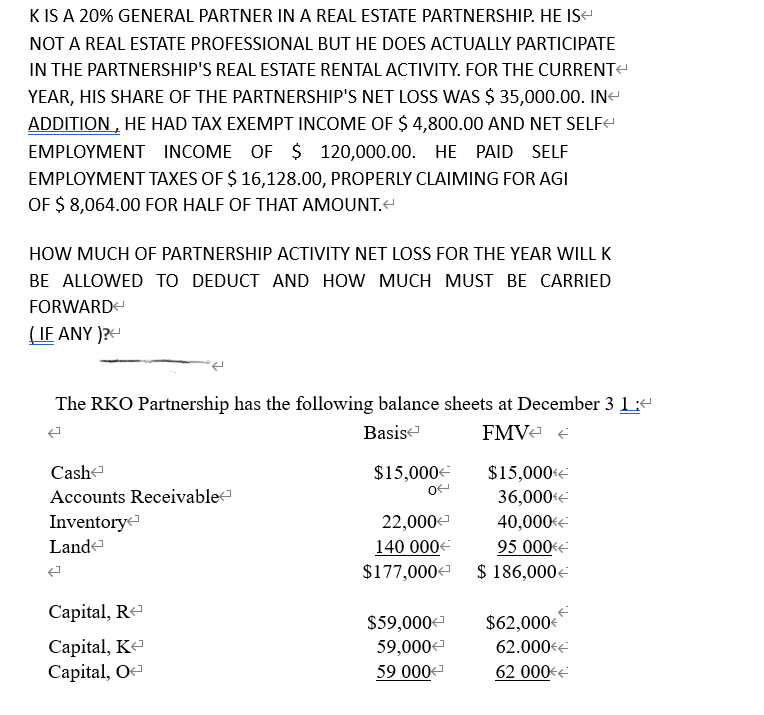

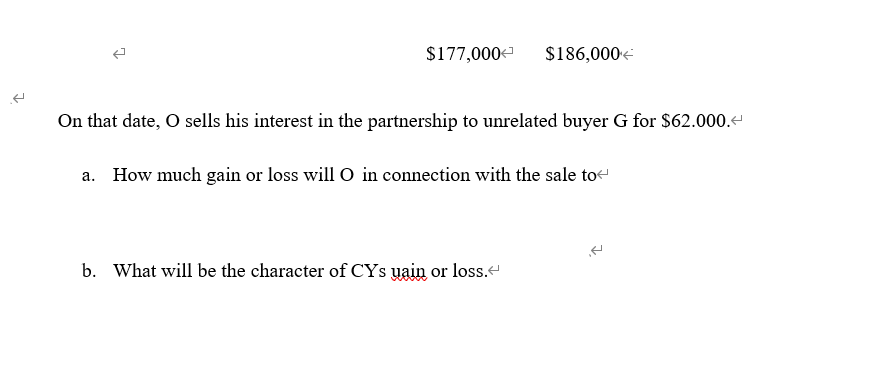

K IS A 20\% GENERAL PARTNER IN A REAL ESTATE PARTNERSHIP. HE IS NOT A REAL ESTATE PROFESSIONAL BUT HE DOES ACTUALLY PARTICIPATE IN THE PARTNERSHIP'S REAL ESTATE RENTAL ACTIVITY. FOR THE CURRENT YEAR, HIS SHARE OF THE PARTNERSHIP'S NET LOSS WAS $35,000.00. IN ADDITION, HE HAD TAX EXEMPT INCOME OF $4,800.00 AND NET SELF EMPLOYMENT INCOME OF $120,000.00. HE PAID SELF EMPLOYMENT TAXES OF $16,128.00, PROPERLY CLAIMING FOR AGI OF $8,064.00 FOR HALF OF THAT AMOUNT. HOW MUCH OF PARTNERSHIP ACTIVITY NET LOSS FOR THE YEAR WILL K BE ALLOWED TO DEDUCT AND HOW MUCH MUST BE CARRIED FORWARD (IF ANY)? The RKO Partnership has the following balance sheets at December 31 : On that date, O sells his interest in the partnership to unrelated buyer G for $62.000. a. How much gain or loss will O in connection with the sale to b. What will be the character of CYs uain or loss

K IS A 20\% GENERAL PARTNER IN A REAL ESTATE PARTNERSHIP. HE IS NOT A REAL ESTATE PROFESSIONAL BUT HE DOES ACTUALLY PARTICIPATE IN THE PARTNERSHIP'S REAL ESTATE RENTAL ACTIVITY. FOR THE CURRENT YEAR, HIS SHARE OF THE PARTNERSHIP'S NET LOSS WAS $35,000.00. IN ADDITION, HE HAD TAX EXEMPT INCOME OF $4,800.00 AND NET SELF EMPLOYMENT INCOME OF $120,000.00. HE PAID SELF EMPLOYMENT TAXES OF $16,128.00, PROPERLY CLAIMING FOR AGI OF $8,064.00 FOR HALF OF THAT AMOUNT. HOW MUCH OF PARTNERSHIP ACTIVITY NET LOSS FOR THE YEAR WILL K BE ALLOWED TO DEDUCT AND HOW MUCH MUST BE CARRIED FORWARD (IF ANY)? The RKO Partnership has the following balance sheets at December 31 : On that date, O sells his interest in the partnership to unrelated buyer G for $62.000. a. How much gain or loss will O in connection with the sale to b. What will be the character of CYs uain or loss Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started