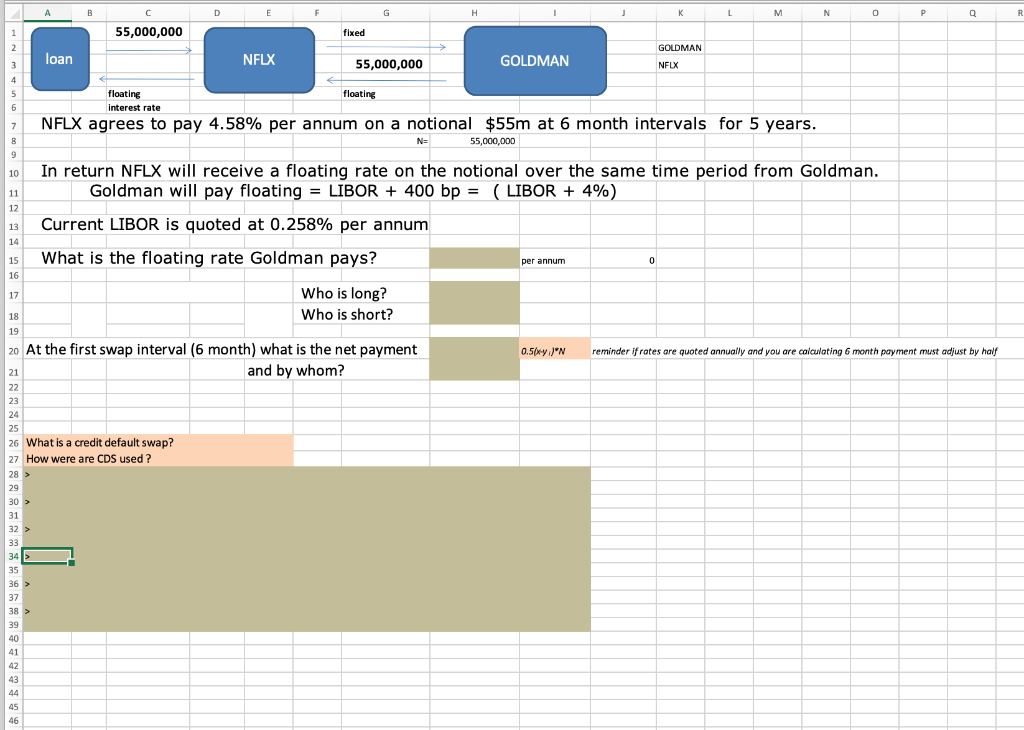

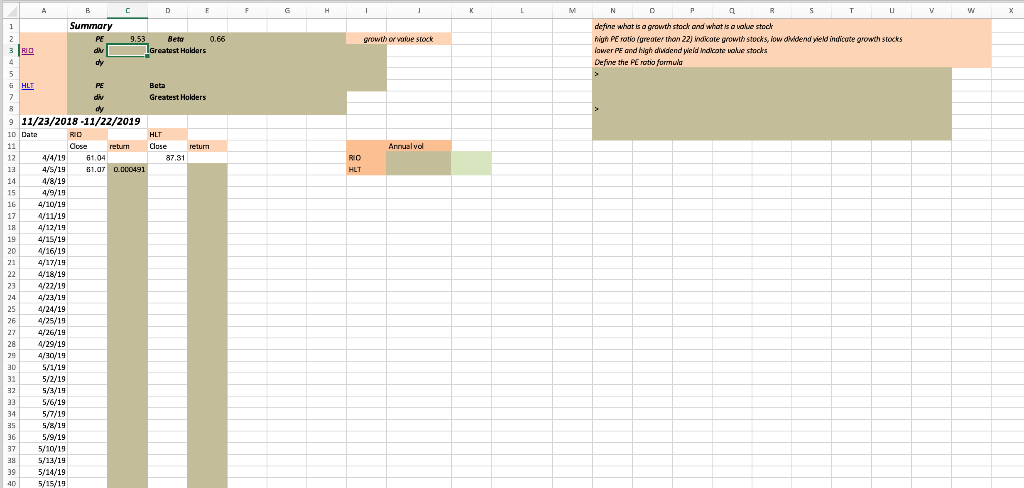

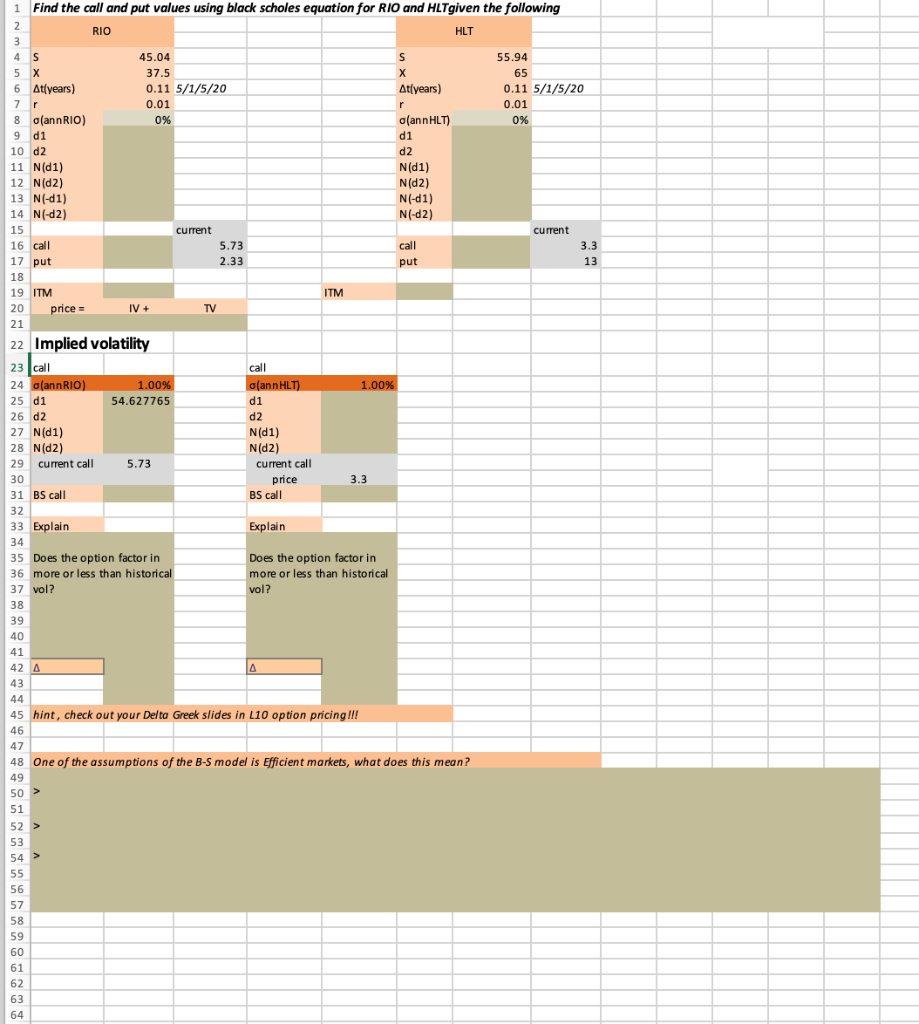

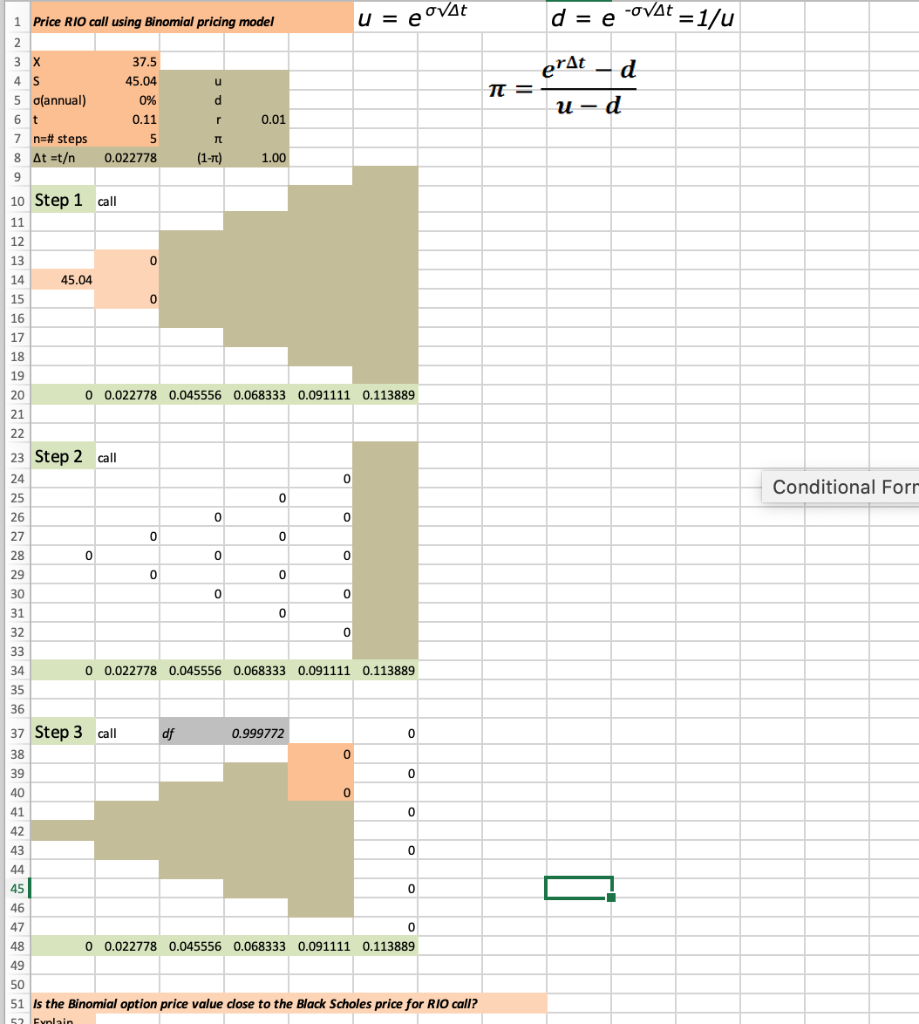

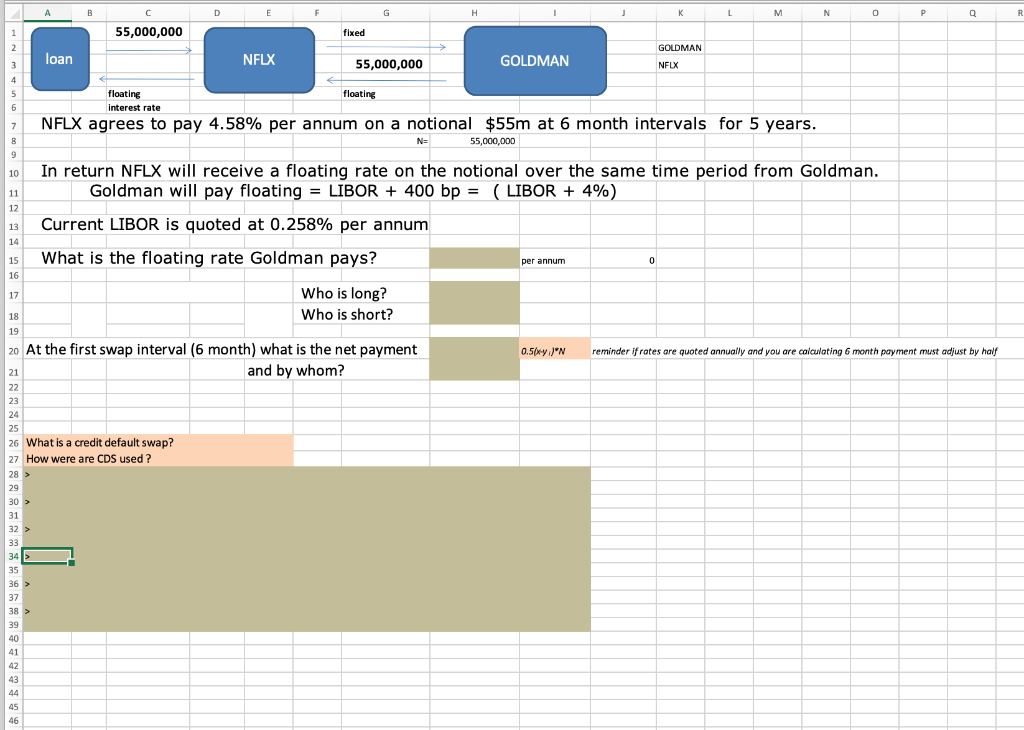

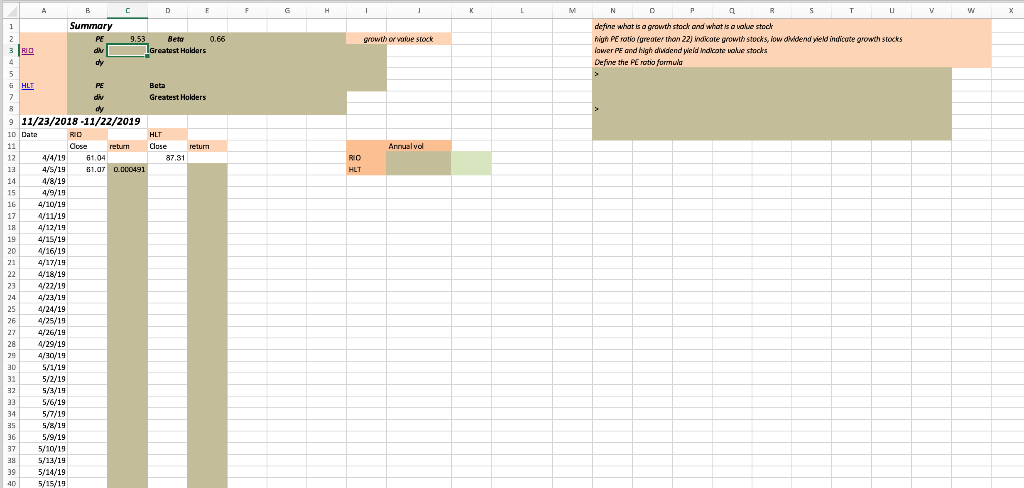

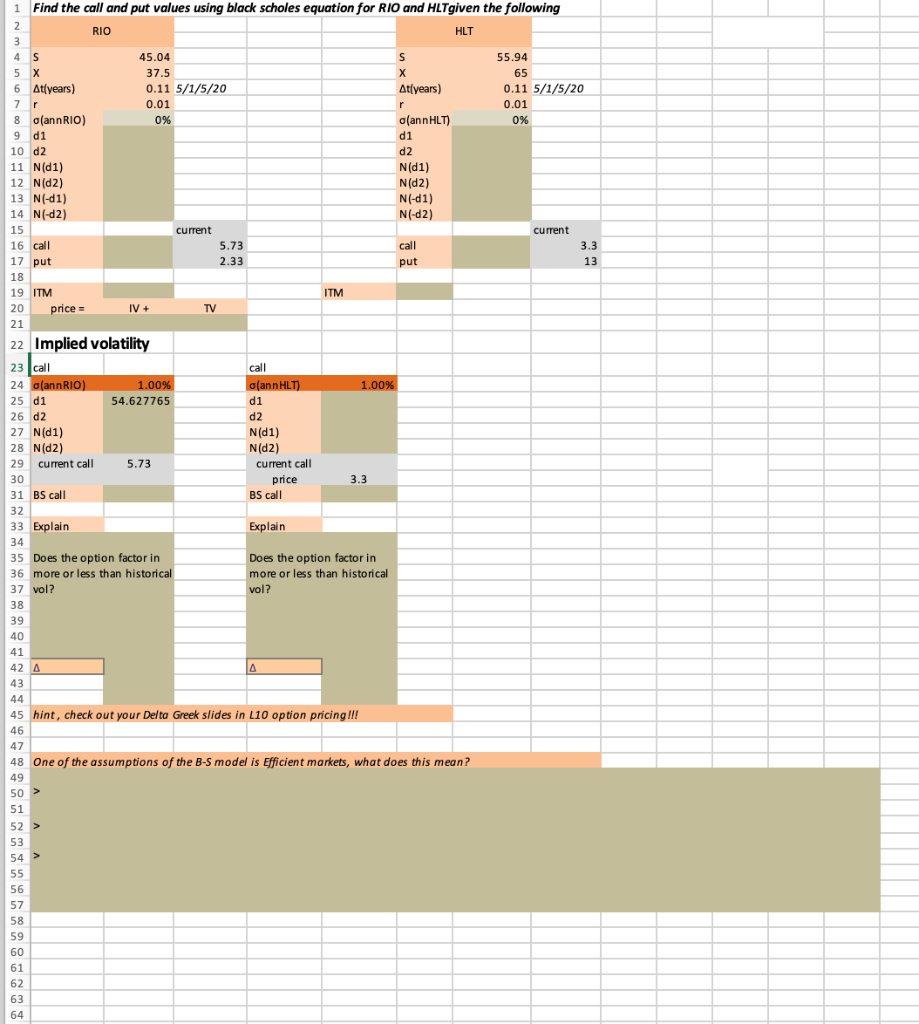

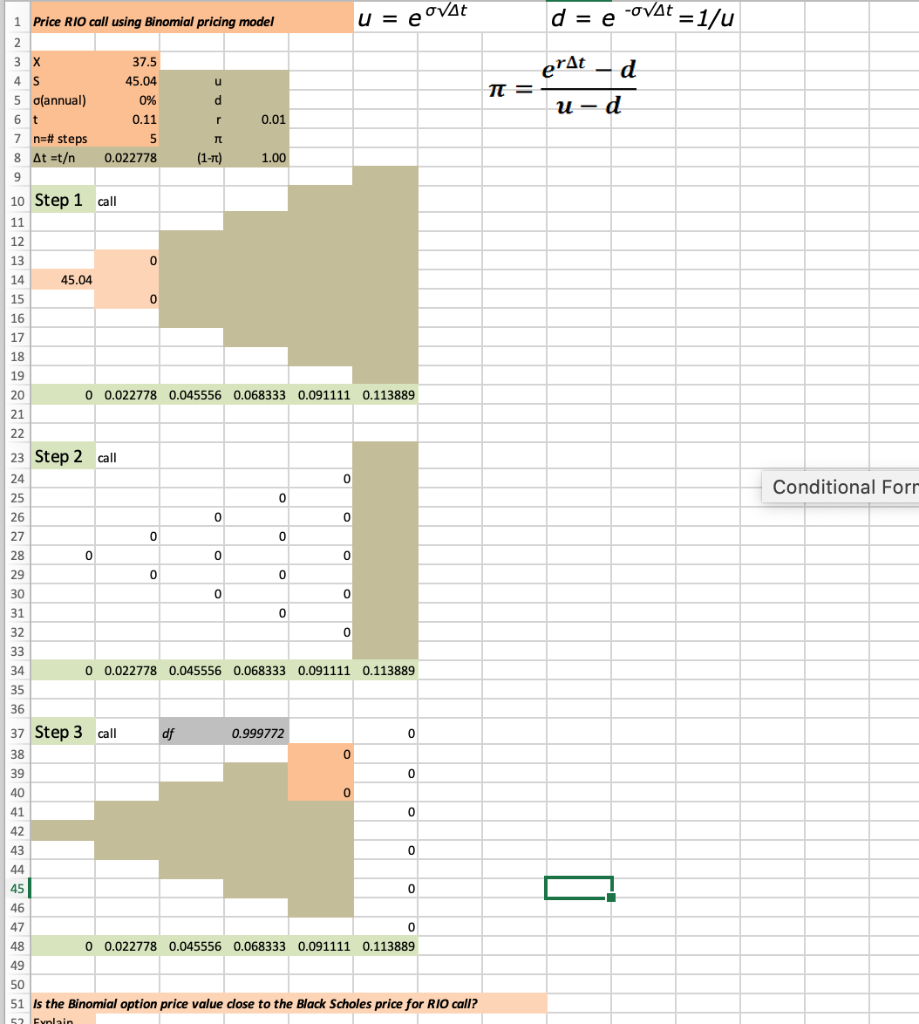

K L M N P Q R 55,000,000 fixed loan NFLX 55,000,000 GOLDMAN GOLDMAN NFLX floating floating interest rate NFLX agrees to pay 4.58% per annum on a notional $55m at 6 month intervals for 5 years. 55,000,000 In return NFLX will receive a floating rate on the notional over the same time period from Goldman. Goldman will pay floating = LIBOR + 400 bp = ( LIBOR + 4%) Current LIBOR is quoted at 0.258% per annum What is the floating rate Goldman pays? per annum Who is long? Who is short? 0.5/xy/N reminder if rotes are quoted annually and you are calculating 6 month payment must adjust by hall 20 At the first swap interval (6 month) what is the net payment and by whom? 26 What is a credit default swap? 27 How were are CDS used ? Summary PE dh 0.66 growth or be stock 9.53 l Bet Greatest Holders define what so growth stock and what is a vole stock Non Proto (greater than 22) indicate growth stocks, low didend yield indicute growth stocks lawer PE and high dwdend weld indloote waluestacks Defve the PE ratio formula Beta Greatest Holders return Annualvol RIO HLT 11/23/2018 - 11/22/2019 10 Date RID HLT Close return Close 4/4/19 61,04 87.31 4/5/19 61.0.000491 4/8/19 4/9/19 4/10/19 4/11/19 4/12/19 4/15/19 4/16/19 4/17/19 4/18/19 4/22/19 4/23/19 4/24/19 4/25/19 4/26/19 4/29/19 4/30/19 5/1/19 5/2/19 5/3/19 5/6/19 5/7/19 5/8/19 5/9/19 5/10/19 5/12/19 5/14/19 5/15/19 1 Find the call and put values using black scholes equation for RIO and HLTgiven the following RIO HLT 4 5 6 S X At(years) 45.04 37.5 0.11 5/1/5/20 0.01 0% 55.94 65 0.11 5/1/5/20 0.01 At(years) 7 o(ann HLT) d1 d2 8 (ann RIO) 9 di 10 d2 11 N(d1) 12 N(D2) 13 N(-d1) 14 N-d2) N(1) N(D2) N(-d1) N(-d2) current current 5.73 16 call 17 put call put 2.33 ITM 19 ITM 20 price = - IV+ TV call (ann HLT) 1.00% 22 Implied volatility 23 call 24 (annRIO) 1.00% 25 d1 54.627765 26 d2 27 N(D1) 28 N(D2) 29 current call 5.73 di d2 N(1) Nd2) current call price BS call 3.3 31 BS call 32 33 Explain Explain 35 Does the option factor in 36 more or less than historical 37 vol? Does the option factor in more or less than historical vol? 44 45 hint, check out your Delta Greek slides in L10 option pricing !!! 46 48 One of the assumptions of the B-S model is Efficient markets, what does this mean? Price RIO call using Binomial pricing model u = e ovat d = e ovat =1/u u T = erat - d u-d 5 37.5 45.04 0% 0.11 5 0.022778 o(annual) 0.01 7 n=# steps (1-1) 1.00 10 Step 1 call 45.04 0 0.022778 0.045556 0.068333 0.091111 0.113889 23 Step 2 call Conditional Forr 0 0.022778 0.045556 0.068333 0.091111 0.113889 37 Step 3 call df 0.999772 0 0.022778 0.045556 0.068333 0.091111 0.113889 51 Is the Binomial option price value close to the Black Scholes price for RIO call? Evolain K L M N P Q R 55,000,000 fixed loan NFLX 55,000,000 GOLDMAN GOLDMAN NFLX floating floating interest rate NFLX agrees to pay 4.58% per annum on a notional $55m at 6 month intervals for 5 years. 55,000,000 In return NFLX will receive a floating rate on the notional over the same time period from Goldman. Goldman will pay floating = LIBOR + 400 bp = ( LIBOR + 4%) Current LIBOR is quoted at 0.258% per annum What is the floating rate Goldman pays? per annum Who is long? Who is short? 0.5/xy/N reminder if rotes are quoted annually and you are calculating 6 month payment must adjust by hall 20 At the first swap interval (6 month) what is the net payment and by whom? 26 What is a credit default swap? 27 How were are CDS used ? Summary PE dh 0.66 growth or be stock 9.53 l Bet Greatest Holders define what so growth stock and what is a vole stock Non Proto (greater than 22) indicate growth stocks, low didend yield indicute growth stocks lawer PE and high dwdend weld indloote waluestacks Defve the PE ratio formula Beta Greatest Holders return Annualvol RIO HLT 11/23/2018 - 11/22/2019 10 Date RID HLT Close return Close 4/4/19 61,04 87.31 4/5/19 61.0.000491 4/8/19 4/9/19 4/10/19 4/11/19 4/12/19 4/15/19 4/16/19 4/17/19 4/18/19 4/22/19 4/23/19 4/24/19 4/25/19 4/26/19 4/29/19 4/30/19 5/1/19 5/2/19 5/3/19 5/6/19 5/7/19 5/8/19 5/9/19 5/10/19 5/12/19 5/14/19 5/15/19 1 Find the call and put values using black scholes equation for RIO and HLTgiven the following RIO HLT 4 5 6 S X At(years) 45.04 37.5 0.11 5/1/5/20 0.01 0% 55.94 65 0.11 5/1/5/20 0.01 At(years) 7 o(ann HLT) d1 d2 8 (ann RIO) 9 di 10 d2 11 N(d1) 12 N(D2) 13 N(-d1) 14 N-d2) N(1) N(D2) N(-d1) N(-d2) current current 5.73 16 call 17 put call put 2.33 ITM 19 ITM 20 price = - IV+ TV call (ann HLT) 1.00% 22 Implied volatility 23 call 24 (annRIO) 1.00% 25 d1 54.627765 26 d2 27 N(D1) 28 N(D2) 29 current call 5.73 di d2 N(1) Nd2) current call price BS call 3.3 31 BS call 32 33 Explain Explain 35 Does the option factor in 36 more or less than historical 37 vol? Does the option factor in more or less than historical vol? 44 45 hint, check out your Delta Greek slides in L10 option pricing !!! 46 48 One of the assumptions of the B-S model is Efficient markets, what does this mean? Price RIO call using Binomial pricing model u = e ovat d = e ovat =1/u u T = erat - d u-d 5 37.5 45.04 0% 0.11 5 0.022778 o(annual) 0.01 7 n=# steps (1-1) 1.00 10 Step 1 call 45.04 0 0.022778 0.045556 0.068333 0.091111 0.113889 23 Step 2 call Conditional Forr 0 0.022778 0.045556 0.068333 0.091111 0.113889 37 Step 3 call df 0.999772 0 0.022778 0.045556 0.068333 0.091111 0.113889 51 Is the Binomial option price value close to the Black Scholes price for RIO call? Evolain