Answered step by step

Verified Expert Solution

Question

1 Approved Answer

K Leicester Industries Inc. began carrying on business in 2019 and has a December 31 taxation year end. While it was fairly successful in

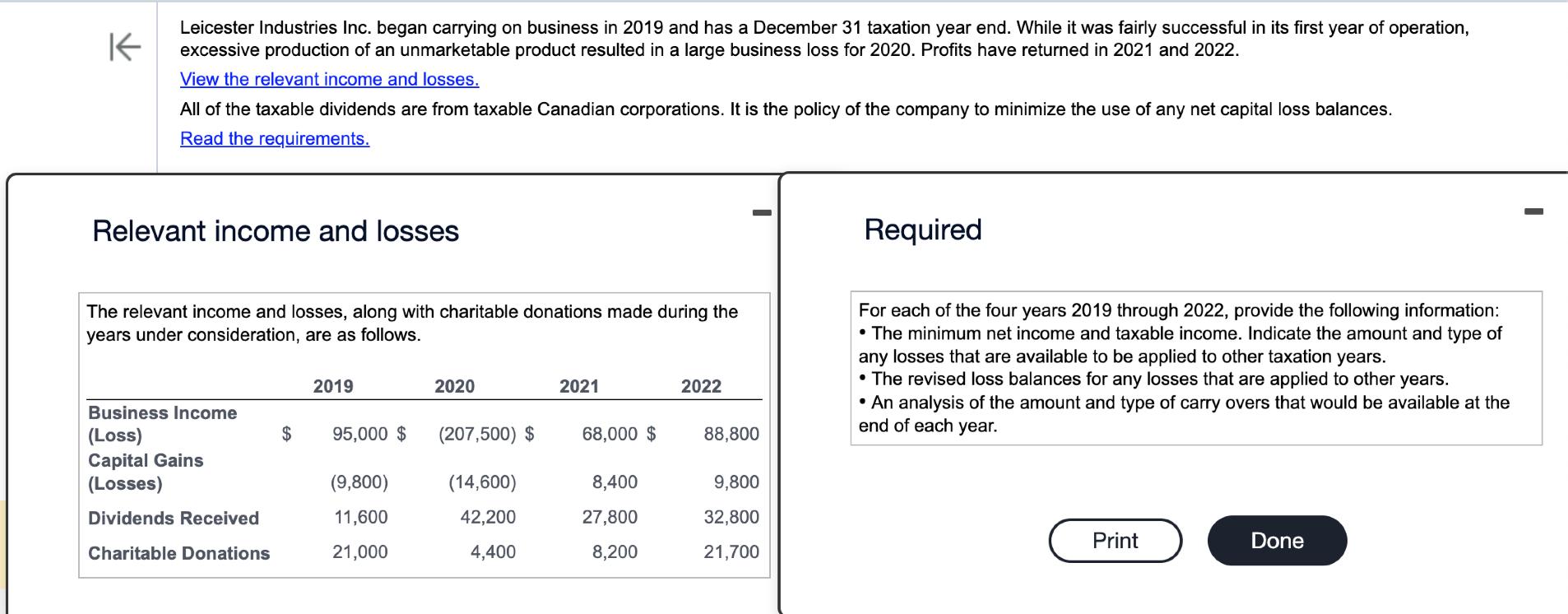

K Leicester Industries Inc. began carrying on business in 2019 and has a December 31 taxation year end. While it was fairly successful in its first year of operation, excessive production of an unmarketable product resulted in a large business loss for 2020. Profits have returned in 2021 and 2022. View the relevant income and losses. All of the taxable dividends are from taxable Canadian corporations. It is the policy of the company to minimize the use of any net capital loss balances. Read the requirements. Relevant income and losses The relevant income and losses, along with charitable donations made during the years under consideration, are as follows. Business Income (Loss) Capital Gains (Losses) Dividends Received Charitable Donations $ 2019 95,000 $ (9,800) 11,600 21,000 2020 (207,500) $ (14,600) 42,200 4,400 2021 68,000 $ 8,400 27,800 8,200 2022 88,800 9,800 32,800 21,700 Required For each of the four years 2019 through 2022, provide the following information: The minimum net income and taxable income. Indicate the amount and type of any losses that are available to be applied to other taxation years. The revised loss balances for any losses that are applied to other years. An analysis of the amount and type of carry overs that would be available at the end of each year. Print Done

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the minimum net income and taxable income for each year and determine the losses availa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started