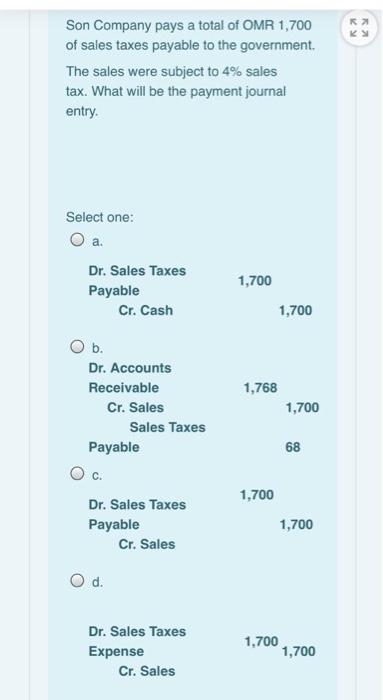

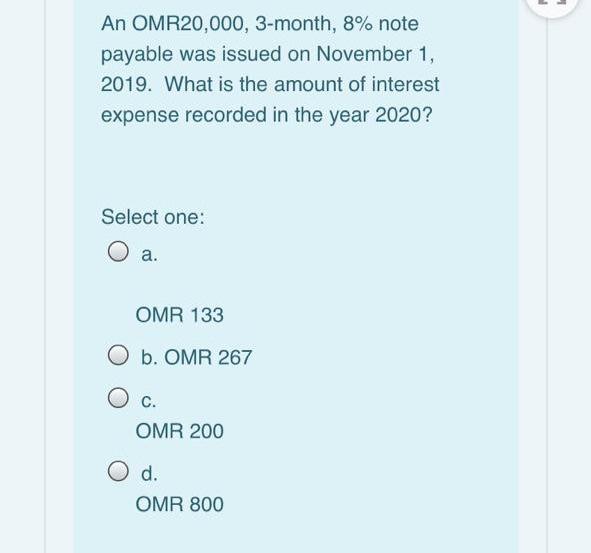

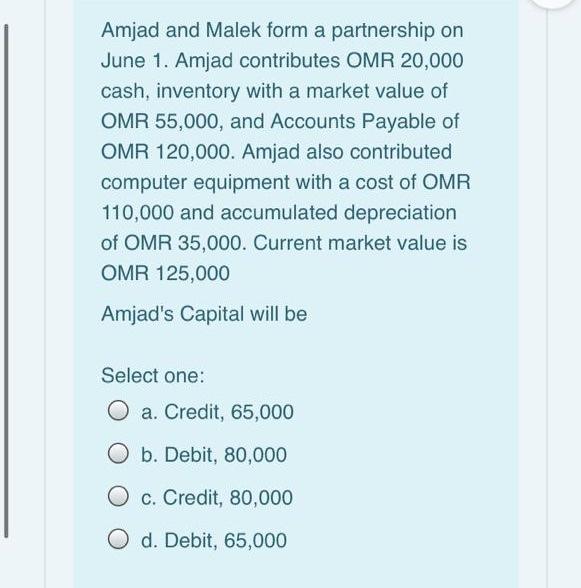

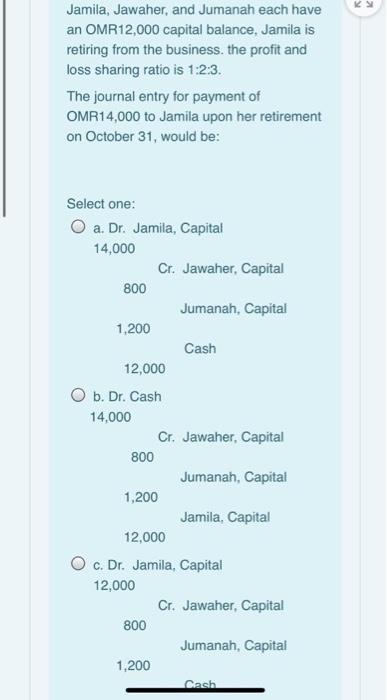

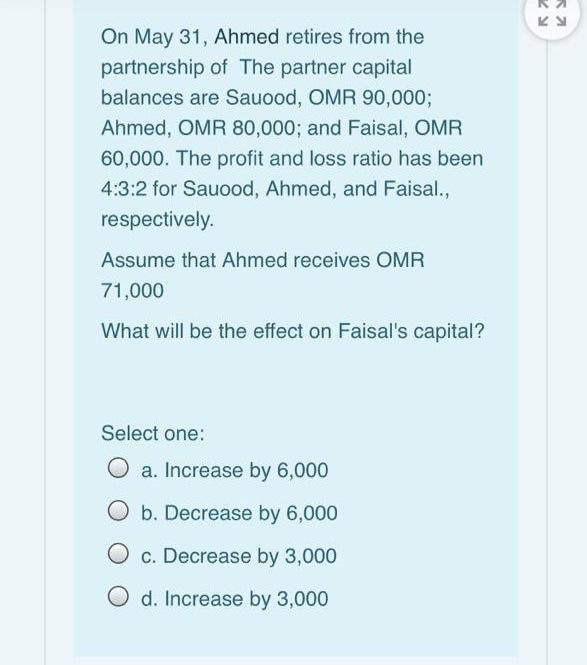

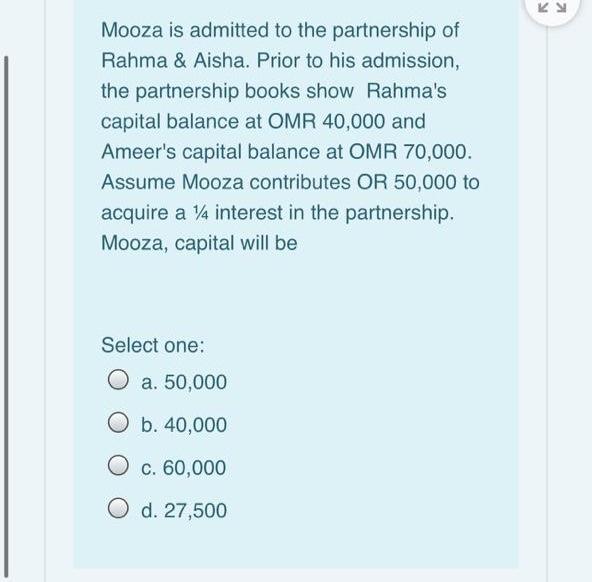

K Son Company pays a total of OMR 1,700 of sales taxes payable to the government The sales were subject to 4% sales tax. What will be the payment journal entry. Select one: a. Dr. Sales Taxes Payable Cr. Cash 1,700 1,700 1,768 1,700 b. Dr. Accounts Receivable Cr. Sales Sales Taxes Payable c. Dr. Sales Taxes Payable Cr. Sales 68 1,700 1,700 d. Dr. Sales Taxes Expense Cr. Sales 1,700 1,700 E An OMR20,000, 3-month, 8% note payable was issued on November 1, 2019. What is the amount of interest expense recorded in the year 2020? Select one: a. OMR 133 O b. OMR 267 C. OMR 200 O d. OMR 800 Amjad and Malek form a partnership on June 1. Amjad contributes OMR 20,000 cash, inventory with a market value of OMR 55,000, and Accounts Payable of OMR 120,000. Amjad also contributed computer equipment with a cost of OMR 110,000 and accumulated depreciation of OMR 35,000. Current market value is OMR 125,000 Amjad's Capital will be Select one: O a. Credit, 65,000 O b. Debit, 80,000 O c. Credit, 80,000 O d. Debit, 65,000 Jamila, Jawaher, and Jumanah each have an OMR12,000 capital balance, Jamila is retiring from the business, the profit and loss sharing ratio is 1:2:3. The journal entry for payment of OMR14,000 to Jamila upon her retirement on October 31, would be: Select one: a. Dr. Jamila, Capital 14,000 Cr. Jawaher, Capital 800 Jumanah, Capital 1,200 Cash 12,000 O b. Dr. Cash 14,000 Cr. Jawaher, Capital 800 Jumanah, Capital 1,200 Jamila, Capital 12,000 O c. Dr. Jamila, Capital 12,000 Cr. Jawaher, Capital 800 Jumanah, Capital 1,200 Dash KSI On May 31, Ahmed retires from the partnership of the partner capital balances are Sauood, OMR 90,000; Ahmed, OMR 80,000; and Faisal, OMR 60,000. The profit and loss ratio has been 4:3:2 for Sauood, Ahmed, and Faisal., respectively. Assume that Ahmed receives OMR 71,000 What will be the effect on Faisal's capital? Select one: a. Increase by 6,000 O b. Decrease by 6,000 c. Decrease by 3,000 d. Increase by 3,000 KS Mooza is admitted to the partnership of Rahma & Aisha. Prior to his admission, the partnership books show Rahma's capital balance at OMR 40,000 and Ameer's capital balance at OMR 70,000. Assume Mooza contributes OR 50,000 to acquire a 14 interest in the partnership. Mooza, capital will be Select one: O a. 50,000 O b. 40,000 O c. 60,000 O d. 27,500