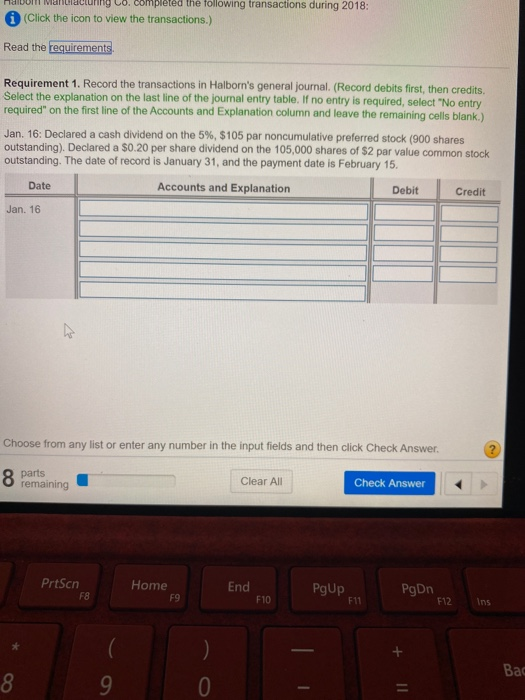

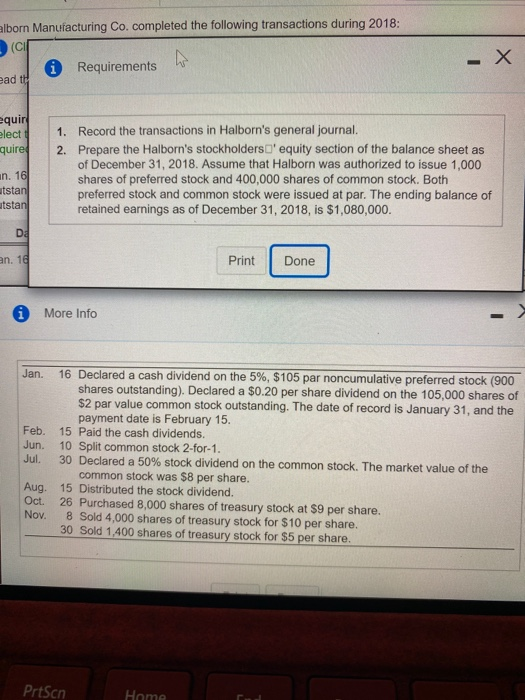

nabol ng Co. completed the following transactions during 2018: i (Click the icon to view the transactions.) Read the requirements Requirement 1. Record the transactions in Halborn's general journal. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Jan. 16: Declared a cash dividend on the 5%, $105 par noncumulative preferred stock (900 shares outstanding). Declared a $0.20 per share dividend on the 105,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Date Accounts and Explanation Debit Credit Jan. 16 Choose from any list or enter any number in the input fields and then click Check Answer. 8 parts remaining Clear All Check Answer PrtScn F8 Home F9 End PgUp PgDn F10 F11 F12 Ins 8 9 o alborn Manufacturing Co. completed the following transactions during 2018: (Cup A Requirements ead to - X equir elect quired an. 16 utstan utstan 1. Record the transactions in Halborn's general journal. 2. Prepare the Halborn's stockholders' equity section of the balance sheet as of December 31, 2018. Assume that Halborn was authorized to issue 1,000 shares of preferred stock and 400,000 shares of common stock. Both preferred stock and common stock were issued at par. The ending balance of retained earnings as of December 31, 2018, is $1,080,000. Da an. 16 Print Done More Info Jan. 16 Declared a cash dividend on the 5%, $105 par noncumulative preferred stock (900 shares outstanding). Declared a $0.20 per share dividend on the 105,000 shares of $2 par value common stock outstanding. The date of record is January 31, and the payment date is February 15. Feb. 15 Paid the cash dividends. Jun. 10 Split common stock 2-for-1. Jul. 30 Declared a 50% stock dividend on the common stock. The market value of the common stock was $8 per share. Aug. 15 Distributed the stock dividend. Oct. 26 Purchased 8,000 shares of treasury stock at $9 per share. Nov. 8 Sold 4,000 shares of treasury stock for $10 per share. 30 Sold 1,400 shares of treasury stock for $5 per share. PrtScn Home