Answered step by step

Verified Expert Solution

Question

1 Approved Answer

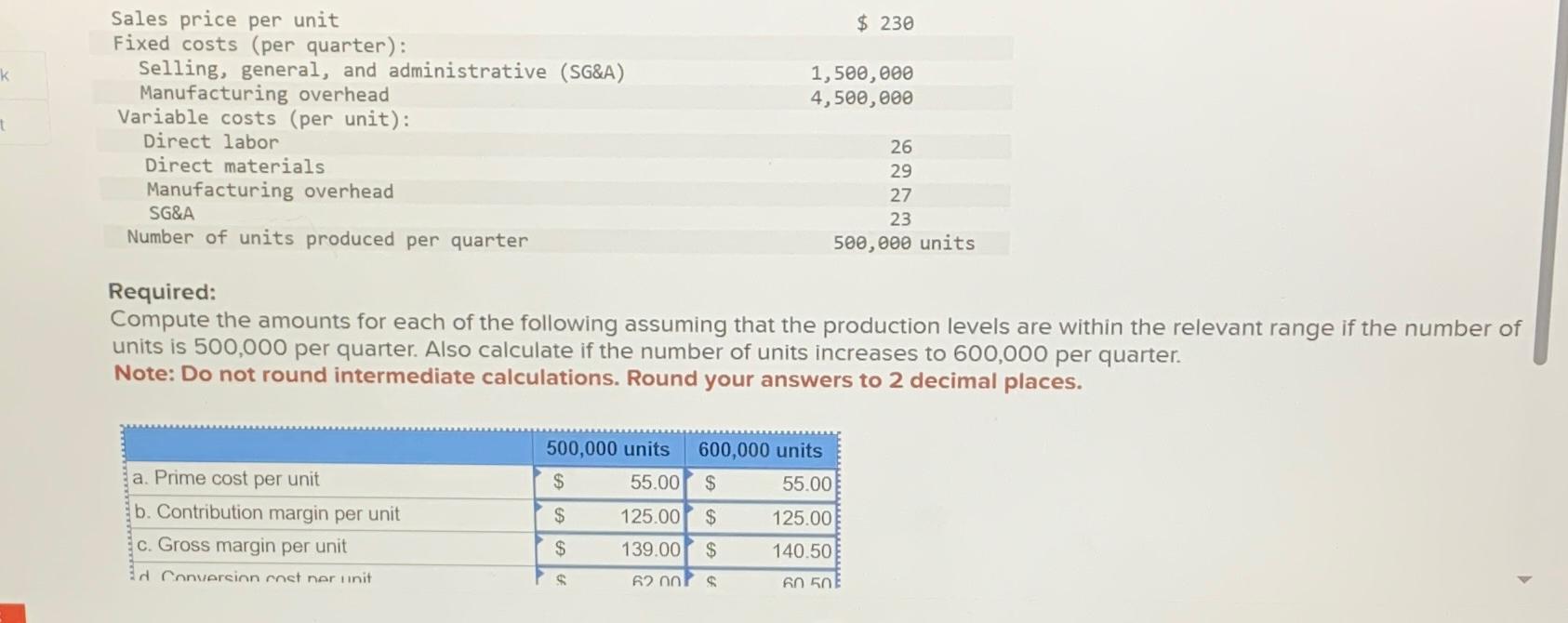

k t Sales price per unit Fixed costs (per quarter): Selling, general, and administrative (SG&A) Manufacturing overhead Variable costs (per unit): Direct labor Direct

k t Sales price per unit Fixed costs (per quarter): Selling, general, and administrative (SG&A) Manufacturing overhead Variable costs (per unit): Direct labor Direct materials Manufacturing overhead SG&A Number of units produced per quarter a. Prime cost per unit b. Contribution margin per unit c. Gross margin per unit Ed Conversion cost ner unit 1,500,000 4,500,000 Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. 500,000 units 600,000 units 55.00 $ 55.00 125.00 $ 125.00 140.50 139.00 $ 62.00 $ $ $ $ S $ 230 26 29 27 23 500,000 units 60 50E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the required amounts for each scenario Given Number of units produced per quarter 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started