Answered step by step

Verified Expert Solution

Question

1 Approved Answer

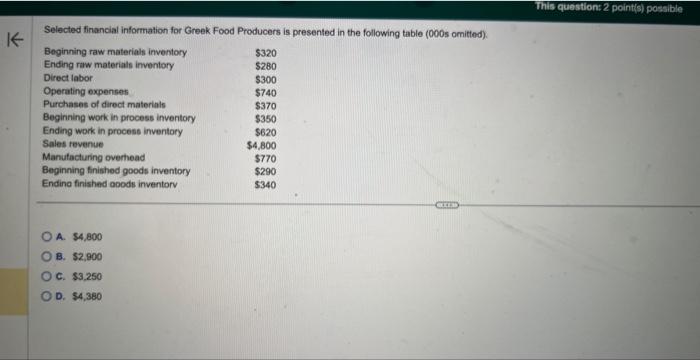

K This question: 2 point(s) possible Selected financial information for Greek Food Producers is presented in the following table (000s omitted). Beginning raw materials

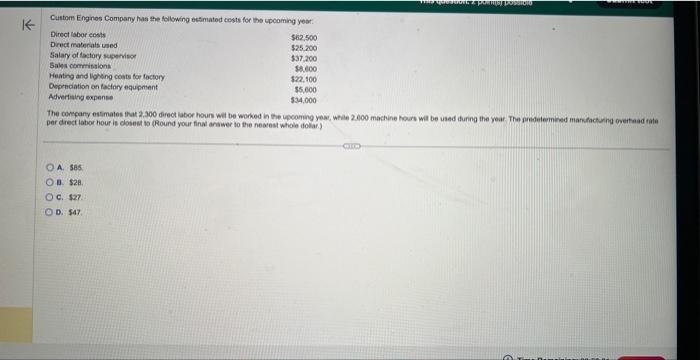

K This question: 2 point(s) possible Selected financial information for Greek Food Producers is presented in the following table (000s omitted). Beginning raw materials inventory $320 Ending raw materials inventory $280 Direct labor. $300 Operating expenses $740 Purchases of direct materials $370 Beginning work in process inventory $350 Ending work in process inventory $620 Sales revenue $4,800 Manufacturing overhead $770 Beginning finished goods inventory $290 Endina finished goods inventory $340 OA. $4,800 B. $2,900 Oc. $3,250 OD. $4,380 K- Custom Engines Company has the following estimated costs for the upcoming year. Direct labor costs $62,500 Direct materials used i Salary of factory supervisor $25.200 $37,200 Sales commissions Heating and lighting costs for factory Depreciation on factory equipment Advertising expense $8,000 $22,100 $5,000 $34,000 The company estimates that 2.300 direct labor hours will be worked in the upcoming year, while 2.000 machine hours will be used during the year. The predetermined manufacturing overhead rate per direct labor hour is closest to (Round your final answer to the nearest whole dollar) OA. $85 OB. $28. OC. $27. OD. $47.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started