Answered step by step

Verified Expert Solution

Question

1 Approved Answer

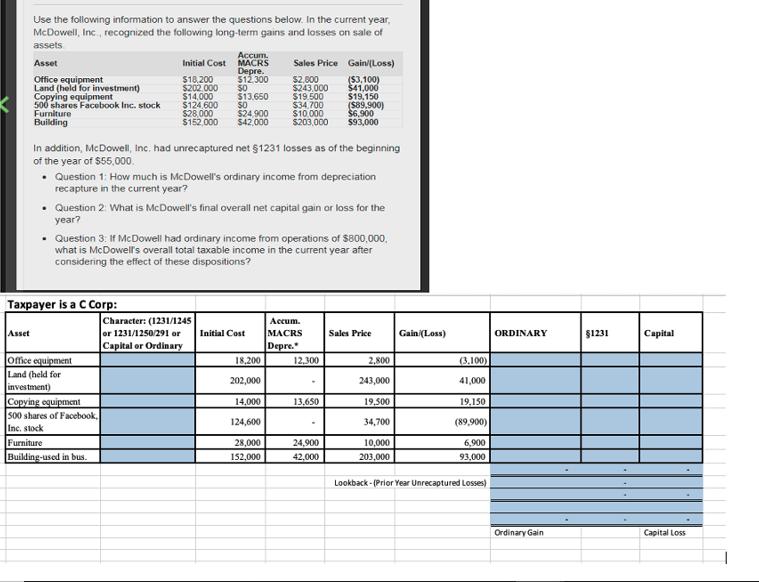

K Use the following information to answer the questions below. In the current year, McDowell, Inc., recognized the following long-term gains and losses on

K Use the following information to answer the questions below. In the current year, McDowell, Inc., recognized the following long-term gains and losses on sale of assets Asset Office equipment Land (held for investment) Copying equipment 500 shares Facebook Inc. stock Asset Furniture Building Accum. MACRS Depre. $12,300 $0 $13.650 $0 $28,000 $24.900 $152,000 $42,000 Taxpayer is a C Corp: Initial Cost $18,200 $202.000 $14,000 $124,600 In addition, McDowell, Inc. had unrecaptured net 1231 losses as of the beginning of the year of $55,000. Office equipment Land (held for Question 1: How much is McDowell's ordinary income from depreciation recapture in the current year? investment) Copying equipment 500 shares of Facebook, Inc. stock Furniture Building-used in bus. Question 2: What is McDowell's final overall net capital gain or loss for the year? Question 3: If McDowell had ordinary income from operations of $800,000. what is McDowell's overall total taxable income in the current year after considering the effect of these dispositions? Sales Price Gain/(Loss) $2,000 $243,000 $19.500 $34.700 $10,000 $203,000 Character: (1231/1245 or 1231/1250/291 or Capital or Ordinary Initial Cost 18,200 202,000 14,000 124,600 28,000 152,000 Accum. MACRS Depre. ($3,100) $41,000 $19,150 12,300 ($89,900) $6,900 $93,000 . 13.650 24,900 42,000 Sales Price 2,800 243,000 19,500 34,700 10,000 203,000 Gain (Loss) (3.100) 41,000 19,150 (89,900) 6,900 93,000 Lookback-(Prior Year Unrecaptured Losses) ORDINARY Ordinary Gain $1231 Capital Capital Loss

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate McDowell Incs ordinary income from depreciation recapture we need to identify the assets that are subject to recapture Typically only dep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started