Answered step by step

Verified Expert Solution

Question

1 Approved Answer

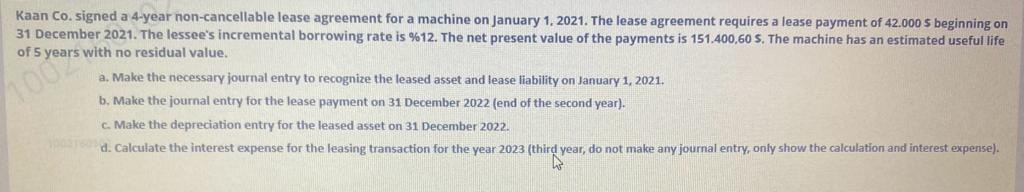

Kaan Co. signed a 4-year non-cancellable lease agreement for a machine on January 1, 2021. The lease agreement requires a lease payment of 42.0005 beginning

Kaan Co. signed a 4-year non-cancellable lease agreement for a machine on January 1, 2021. The lease agreement requires a lease payment of 42.0005 beginning on 31 December 2021. The lessee's incremental borrowing rate is %12. The net present value of the payments is 151.400,60s. The machine has an estimated useful life of 5 years with no residual value. a. Make the necessary journal entry to recognize the leased asset and lease liability on January 1,2021. b, Make the journal entry for the lease payment on 31 December 2022 (end of the second year). c. Make the depreciation entry for the leased asset on 31 December 2022. d. Calculate the interest expense for the leasing transaction for the year 2023 (third year, do not make any joumal entry, only show the calculation and interest expense)

Kaan Co. signed a 4-year non-cancellable lease agreement for a machine on January 1, 2021. The lease agreement requires a lease payment of 42.0005 beginning on 31 December 2021. The lessee's incremental borrowing rate is %12. The net present value of the payments is 151.400,60s. The machine has an estimated useful life of 5 years with no residual value. a. Make the necessary journal entry to recognize the leased asset and lease liability on January 1,2021. b, Make the journal entry for the lease payment on 31 December 2022 (end of the second year). c. Make the depreciation entry for the leased asset on 31 December 2022. d. Calculate the interest expense for the leasing transaction for the year 2023 (third year, do not make any joumal entry, only show the calculation and interest expense) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started