Kabili Bites Ltd. operates a chain of restaurants across Canada. Most of the companys business is from customers who enjoy in-restaurant lunches and dinners and

Kabili Bites Ltd. operates a chain of restaurants across Canada. Most of the companys business is from customers who enjoy in-restaurant lunches and dinners and pay before they leave. The company also provides catered food for functions outside of the restaurant. Catering customers are required to pay a 40% deposit at the time of booking the event. The remaining 60% is due on the day of the function. During 2020, the restaurant chain collected $7,131,000 from restaurant and catered sales. At year end, December 31, 2020, the catered sales amount included $111,000 for a convention scheduled for January 12, 2021. Kabili Bites Ltd. paid $3,464,000 for food supplies during the year and $1,144,000 for wages for the chefs and other restaurant staff. The restaurant owed $66,000 in wages to its staff at year end, which will be paid on January 4, 2021, as part of the normal weekly pay schedule.

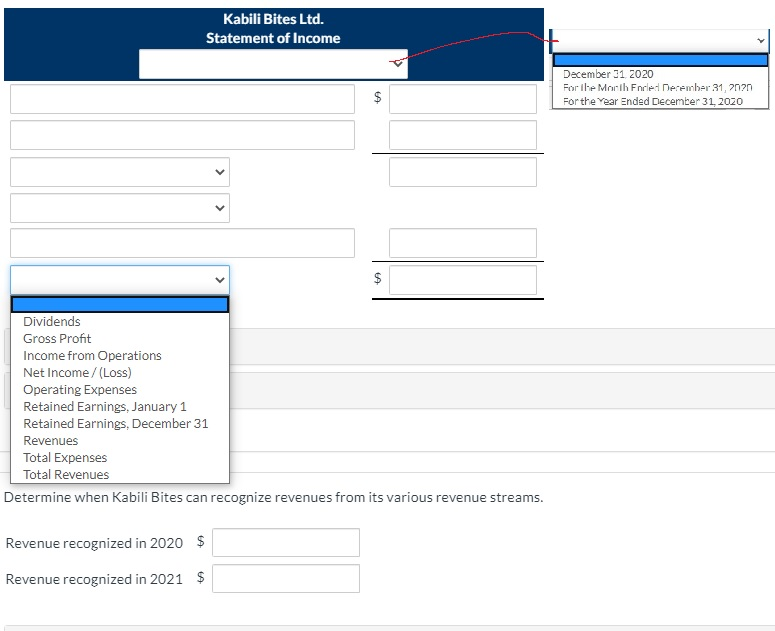

Prepare as much of the multi-step statement of income for Kabili Bites Ltd. as you can, showing the amount of sales and any other amounts that should be included.

List of Accounts

-Accounts Receivable

- Administration Expenses

- Advertising Expense

- Architectural Activities

- Cash

- Cost of Goods Sold

- Depreciation Expense

- Distribution Expenses

- Dividend Revenue

- Engineering Expenses

- Financing Expenses

- Income Tax Expense

- Insurance Expense

- Interest Expense

- Interest Revenue

- Inventory

- No Entry

- Other Expenses

- Refund Liability

- Rent Expense

- Rent Revenue

- Research and Development Expenses

- Sales and Marketing Expenses

- Sales Revenue

- Selling Expenses

- Service Revenue

- Subscription Revenue

- Supplies Expense

- Unearned Revenue

- Utilities Expense

- Wages Expense

- Warranty Expense

- Warranty Liability

Kabili Bites Ltd. Statement of Income $ December 31 2020 For the Morih Endled Derember 31, 2020 For the Year Ended December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started