Question

KADS, Inc. has spent $400,000 on research to develop a new computer game. The firm is planning to spend $200,000 on a machine to produce

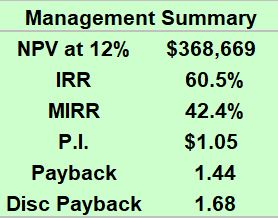

KADS, Inc. has spent $400,000 on research to develop a new computer game. The firm is planning to spend $200,000 on a machine to produce the new game. Shipping and installation costs of the machine will be capitalized and depreciated; they total $50,000. The machine has an expected life of three years, a $75,000 estimated resale value, and falls under the MACRSLinks to an external site. 7-year class life. Revenue from the new game is expected to be $600,000 per year, with costs of $250,000 per year. The firm has a tax rate of 35 percent, KADS has an opportunity cost of capital of 15 percent, and it expects net working capital to increase by $100,000 at the beginning of the project. Q.1 According to the Management Report, should KADS go forward with the project? Explain your answers in detail using the Capital Budgeting key topics and tools

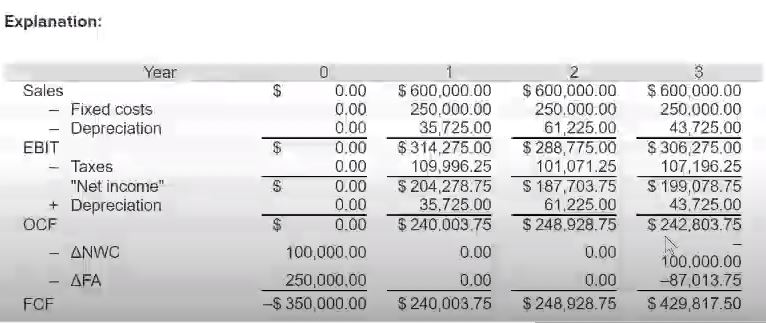

I already have confirmed with my professor and through a computer website that the FCF for years 0 through 3 are as follows:

Year 0: -$350,000

Year 1: $240,003.75

Year 2: 248,928.75

Year 3: $429,817.50

Please answer the question using these FCFs and considering NPV

Management Report:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started