Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kairi Company acquired 85% of the outstanding shares that carrying voting rights of Namine Company on January 1, 2020 for P2,580,000. Acquisition expenses, direct and

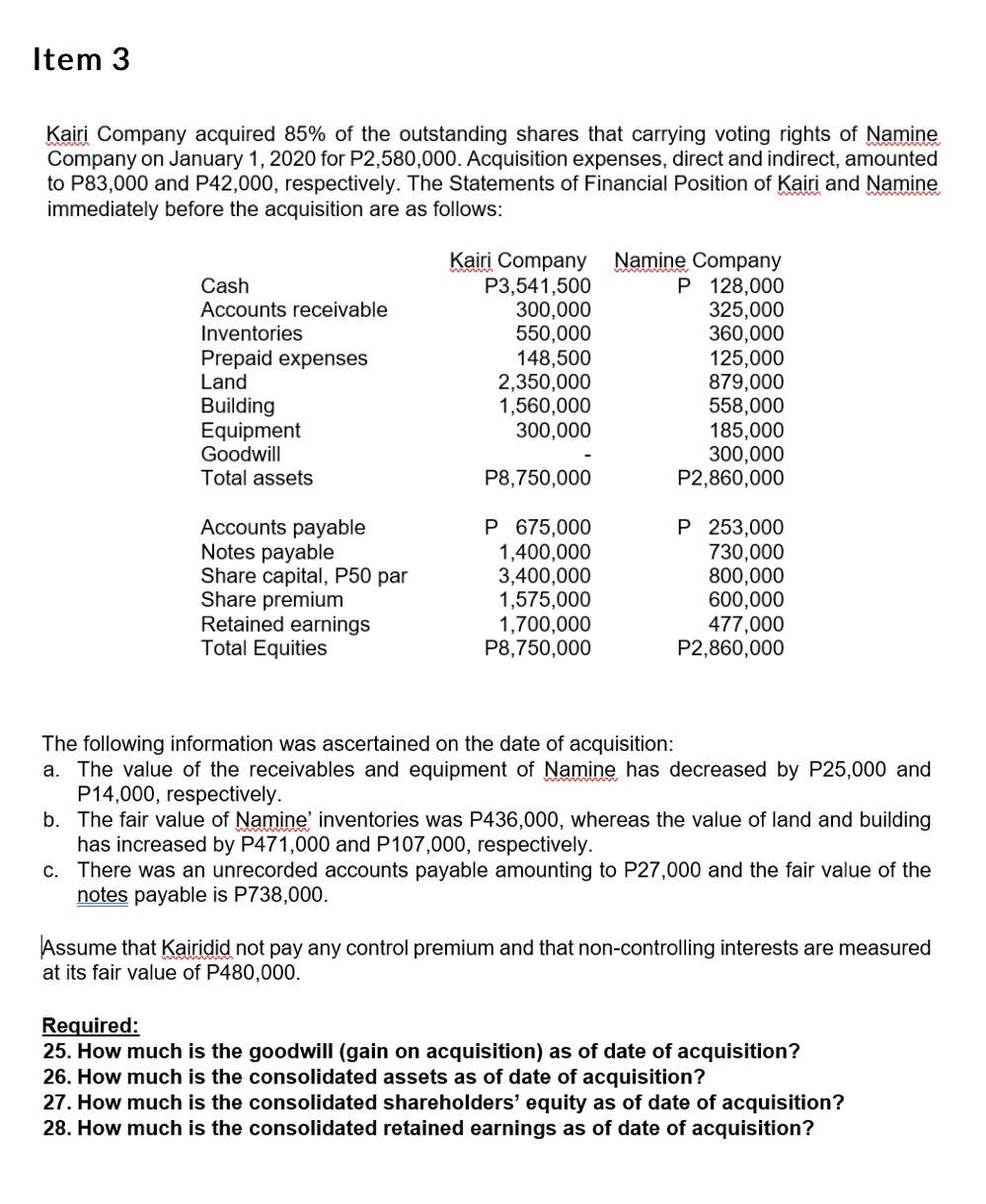

Kairi Company acquired 85% of the outstanding shares that carrying voting rights of Namine Company on January 1, 2020 for P2,580,000. Acquisition expenses, direct and indirect, amounted to P83,000 and P42,000, respectively. The Statements of Financial Position of Kairi and Namine immediately before the acquisition are as follows: The following information was ascertained on the date of acquisition: a. The value of the receivables and equipment of Namine has decreased by P25,000 and P14,000, respectively. b. The fair value of Namine' inventories was P436,000, whereas the value of land and building has increased by P471,000 and P107,000, respectively. c. There was an unrecorded accounts payable amounting to P27,000 and the fair value of the notes payable is P738,000. Assume that Kairidid not pay any control premium and that non-controlling interests are measured at its fair value of P480,000. Required: 25. How much is the goodwill (gain on acquisition) as of date of acquisition? 26. How much is the consolidated assets as of date of acquisition? 27. How much is the consolidated shareholders' equity as of date of acquisition? 28. How much is the consolidated retained earnings as of date of acquisition

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started