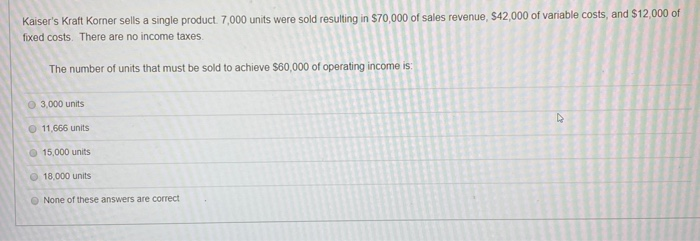

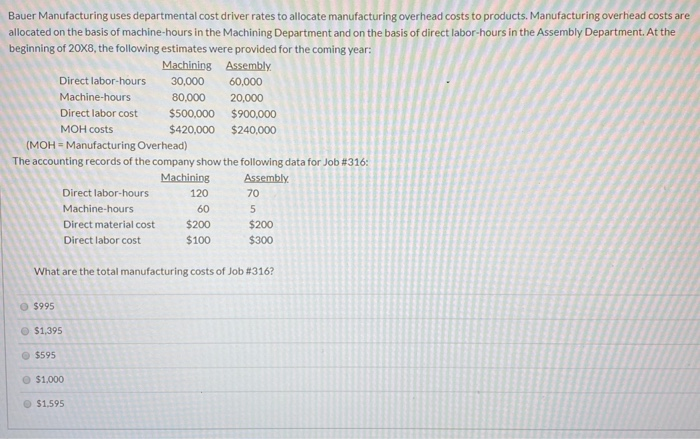

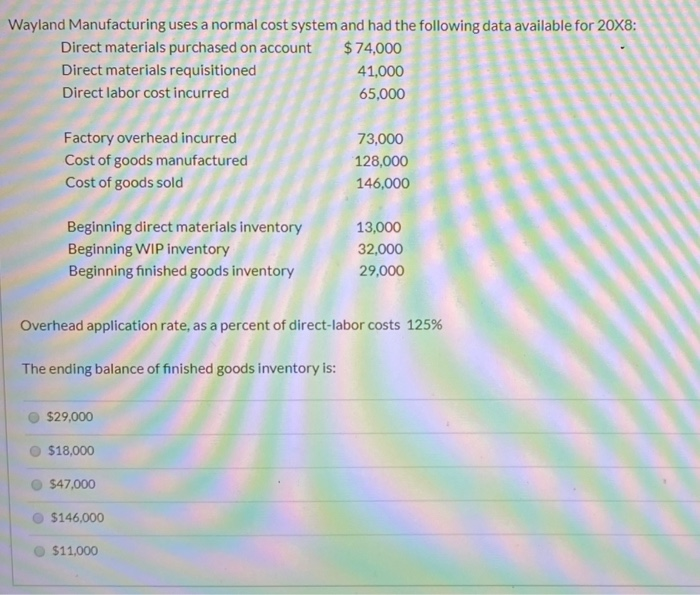

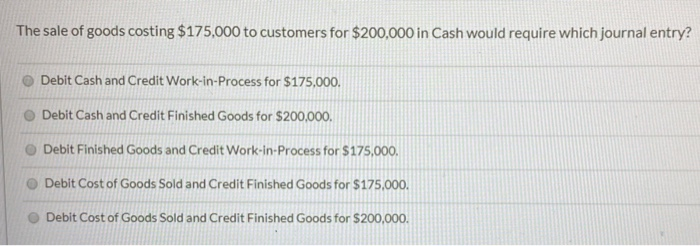

Kaiser's Kraft Korner sells a single product. 7,000 units were sold resulting in $70,000 of sales revenue, S42,000 of variable costs, and $12,000 of fixed costs. There are no income taxes. The number of units that must be sold to achieve $60,000 of operating income is: 3,000 units 11,666 units 15,000 units 18,000 units None of these answers are correct Bauer Manufacturing uses departmental cost driver rates to allocate manufacturing overhead costs to products. Manufacturing overhead costs are allocated on the basis of machine-hours in the Machining Department and on the basis of direct labor-hours in the Assembly Department. At the beginning of 20x8, the following estimates were provided for the coming year: Machining Assembly Direct labor-hours 30,000 60,000 Machine-hours 80,000 20,000 Direct labor cost $500,000 $900,000 MOH costs $420,000 $240,000 (MOH = Manufacturing Overhead) The accounting records of the company show the following data for Job #316: Machining Assembly Direct labor-hours Machine-hours Direct material cost $200 $200 Direct labor cost $100 $300 70 120 60 5 What are the total manufacturing costs of Job #316? $995 $1,395 $595 $1.000 $1.595 Wayland Manufacturing uses a normal cost system and had the following data available for 20X8: Direct materials purchased on account $ 74,000 Direct materials requisitioned 41,000 Direct labor cost incurred 65,000 Factory overhead incurred Cost of goods manufactured Cost of goods sold 73,000 128,000 146,000 Beginning direct materials inventory Beginning WIP inventory Beginning finished goods inventory 13,000 32,000 29,000 Overhead application rate, as a percent of direct-labor costs 125% The ending balance of finished goods inventory is: $29,000 $18,000 $47.000 $146,000 $11,000 The sale of goods costing $175,000 to customers for $200,000 in Cash would require which journal entry? Debit Cash and Credit Work-in-Process for $175,000. Debit Cash and Credit Finished Goods for $200,000. Debit Finished Goods and Credit Work-in-Process for $175,000. Debit Cost of Goods Sold and Credit Finished Goods for $175,000. Debit Cost of Goods Sold and Credit Finished Goods for $200,000