Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kalex Inc., a CCPC, was incorporated in 2020 and chose a December 31 taxation year-end. Kalex is a family-owned company with four equal shareholders, all

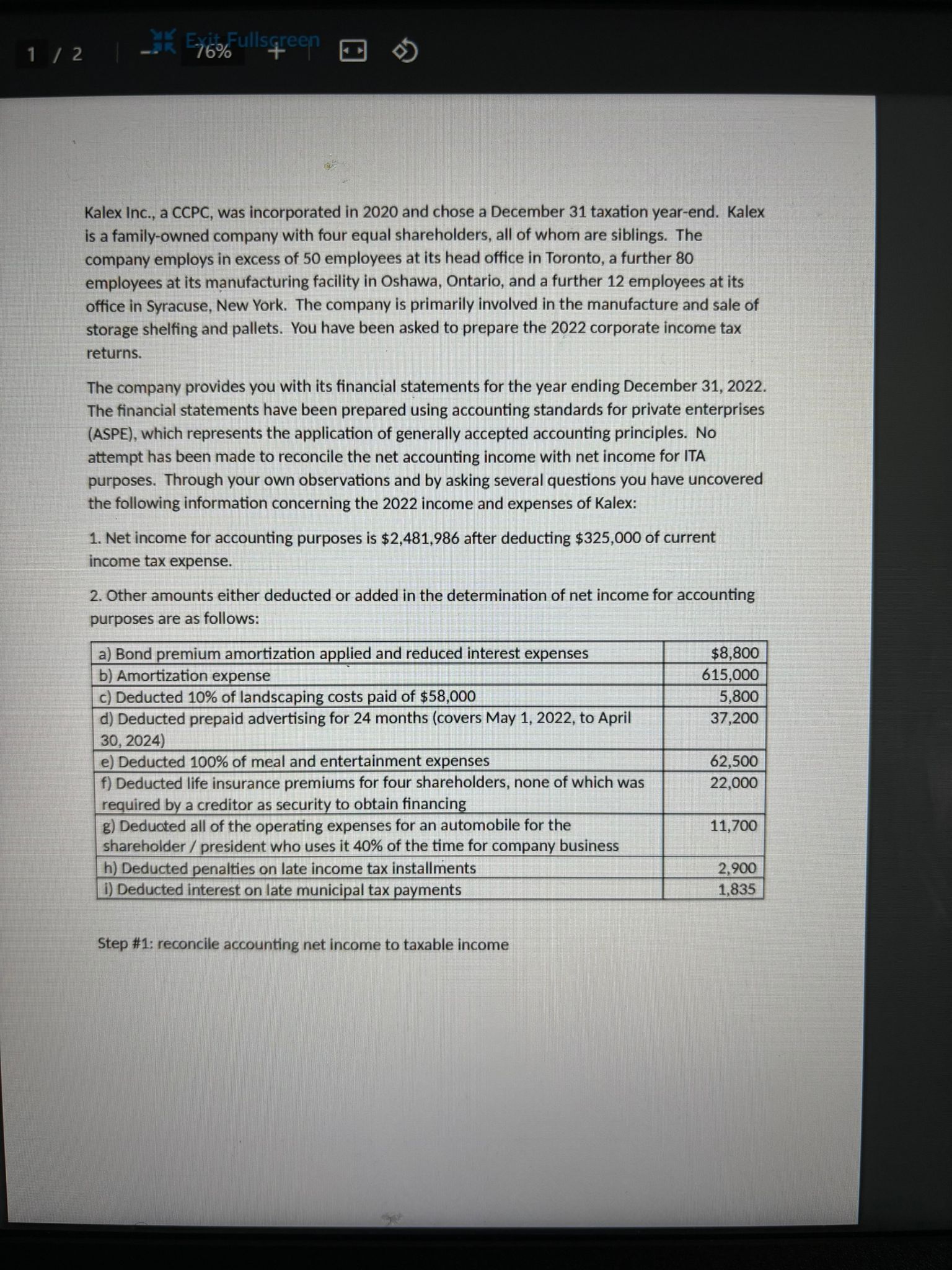

Kalex Inc., a CCPC, was incorporated in 2020 and chose a December 31 taxation year-end. Kalex is a family-owned company with four equal shareholders, all of whom are siblings. The company employs in excess of 50 employees at its head office in Toronto, a further 80 employees at its manufacturing facility in Oshawa, Ontario, and a further 12 employees at its office in Syracuse, New York. The company is primarily involved in the manufacture and sale of storage shelfing and pallets. You have been asked to prepare the 2022 corporate income tax returns. The company provides you with its financial statements for the year ending December 31, 2022. The financial statements have been prepared using accounting standards for private enterprises (ASPE), which represents the application of generally accepted accounting principles. No attempt has been made to reconcile the net accounting income with net income for ITA purposes. Through your own observations and by asking several questions you have uncovered the following information concerning the 2022 income and expenses of Kalex: 1. Net income for accounting purposes is $2,481,986 after deducting $325,000 of current income tax expense. 2. Other amounts either deducted or added in the determination of net income for accounting purposes are as follows: Step \#1: reconcile accounting net income to taxable income

Kalex Inc., a CCPC, was incorporated in 2020 and chose a December 31 taxation year-end. Kalex is a family-owned company with four equal shareholders, all of whom are siblings. The company employs in excess of 50 employees at its head office in Toronto, a further 80 employees at its manufacturing facility in Oshawa, Ontario, and a further 12 employees at its office in Syracuse, New York. The company is primarily involved in the manufacture and sale of storage shelfing and pallets. You have been asked to prepare the 2022 corporate income tax returns. The company provides you with its financial statements for the year ending December 31, 2022. The financial statements have been prepared using accounting standards for private enterprises (ASPE), which represents the application of generally accepted accounting principles. No attempt has been made to reconcile the net accounting income with net income for ITA purposes. Through your own observations and by asking several questions you have uncovered the following information concerning the 2022 income and expenses of Kalex: 1. Net income for accounting purposes is $2,481,986 after deducting $325,000 of current income tax expense. 2. Other amounts either deducted or added in the determination of net income for accounting purposes are as follows: Step \#1: reconcile accounting net income to taxable income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started