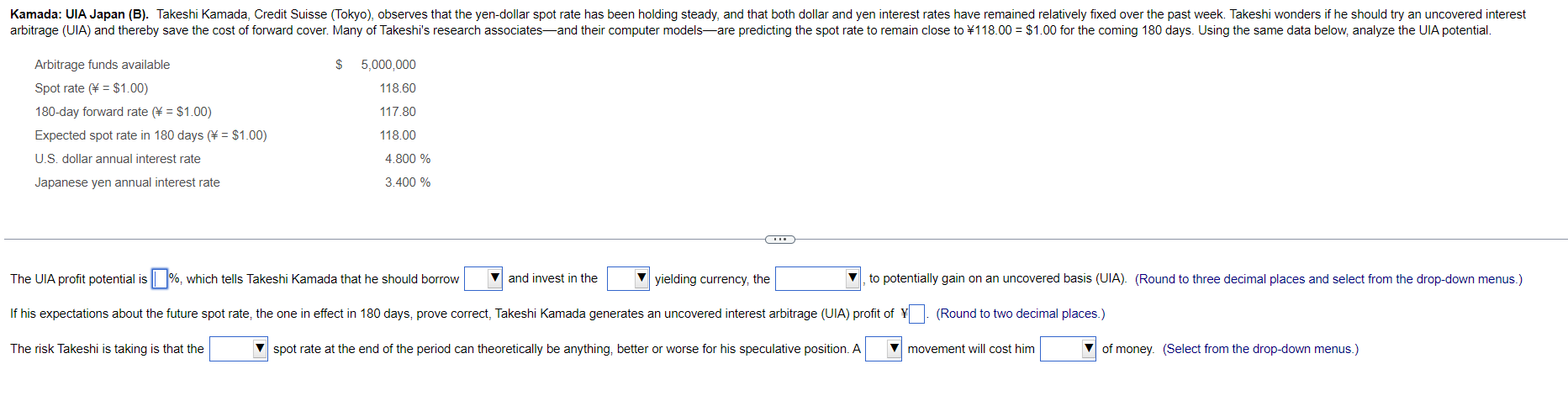

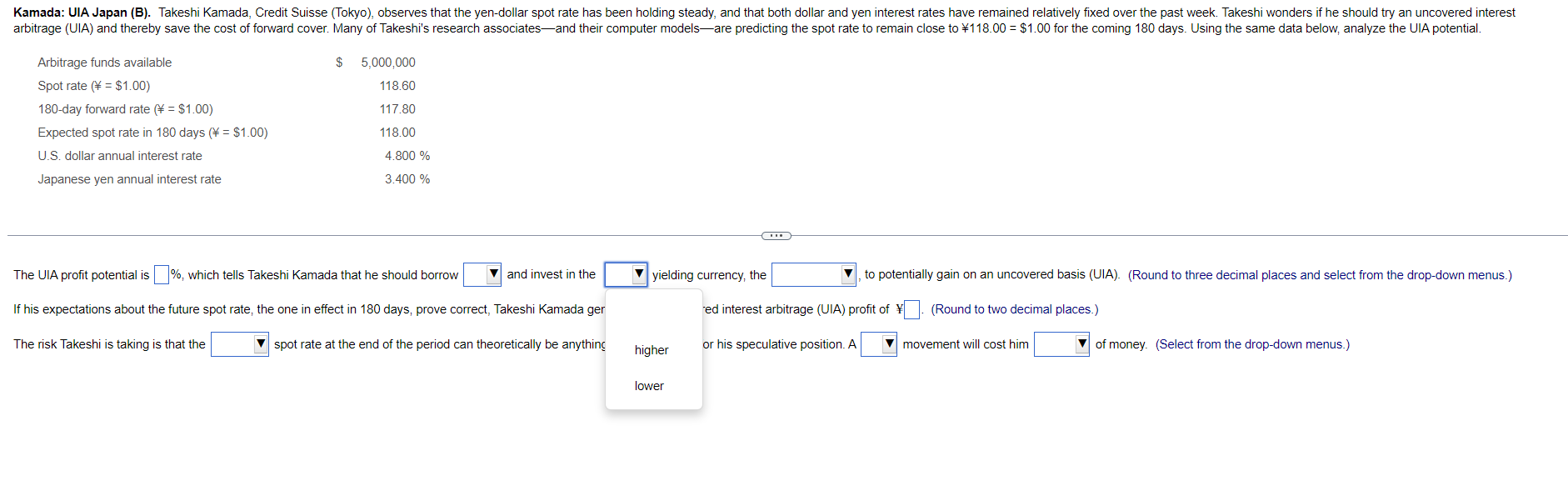

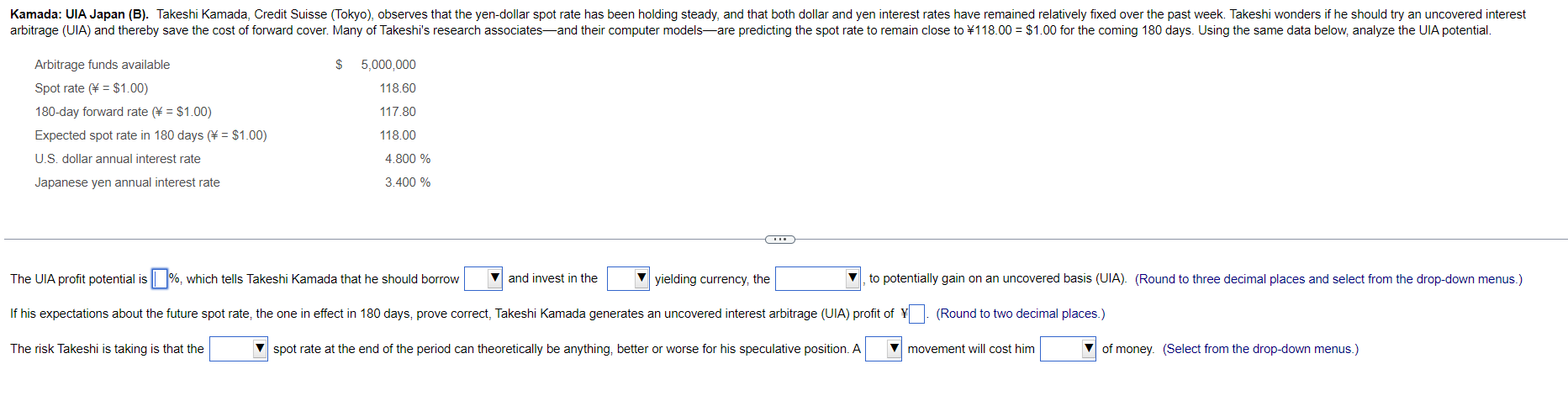

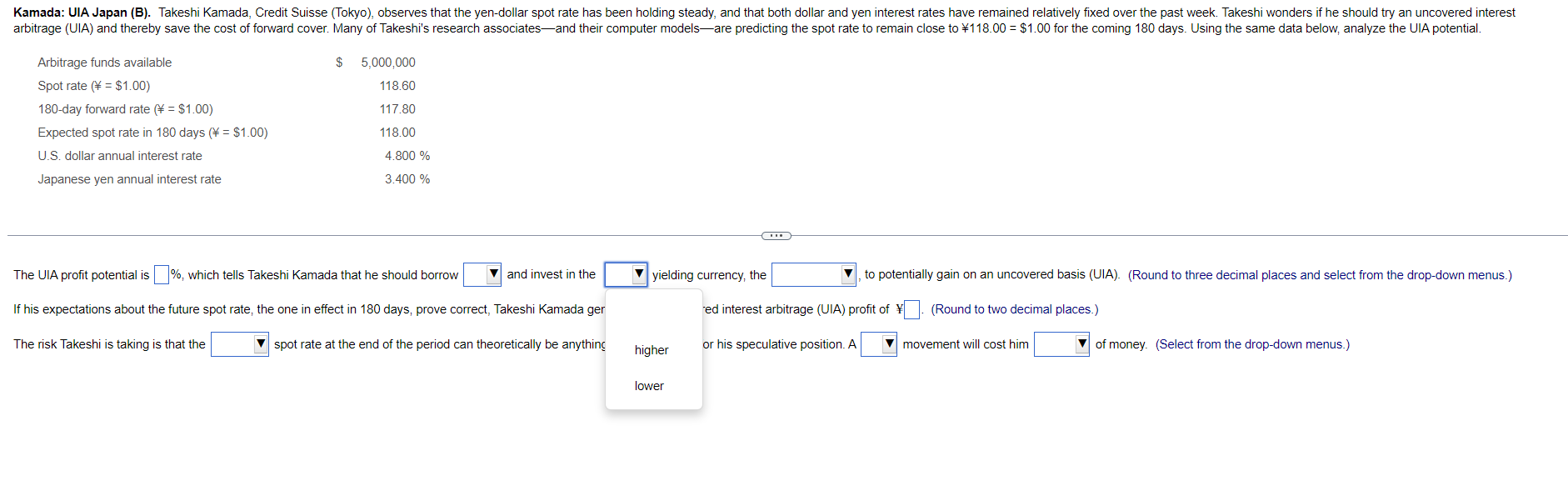

Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the yen-dollar spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associatesand their computer modelsare predicting the spot rate to remain close to 118.00 = $1.00 for the coming 180 days. Using the same data below, analyze the UIA potential. Arbitrage funds available $ 5,000,000 118.60 117.80 Spot rate (= $1.00) 180-day forward rate (* = $1.00) Expected spot rate in 180 days (W = $1.00) U.S. dollar annual interest rate Japanese yen annual interest rate 118.00 4.800 % 3.400 % The UIA profit potential is (%, which tells Takeshi Kamada that he should borrow and invest in the yielding currency, the to potentially gain on an uncovered basis (UIA). (Round to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct, Takeshi Kamada generates an uncovered interest arbitrage (UIA) profit of . (Round to two decimal places.) The risk Takeshi is taking is that the V spot rate at the end of the period can theoretically be anything, better or worse for his speculative position. A movement will cost him of money. (Select from the drop-down menus.) Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the yen-dollar spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associatesand their computer modelsare predicting the spot rate to remain close to #118.00 = $1.00 for the coming 180 days. Using the same data below, analyze the UIA potential. $ 5,000,000 118.60 117.80 Arbitrage funds available Spot rate (* = $1.00) 180-day forward rate (* = $1.00) Expected spot rate in 180 days (W = $1.00) U.S. dollar annual interest rate Japanese yen annual interest rate 118.00 4.800 % 3.400 % TO The UIA profit potential is %, which tells Takeshi Kamada that he should borrow and invest in the yielding currency, the V, to potentially gain on an uncovered basis (UIA). (Round to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct, Takeshi Kamada ger ed interest arbitrage (UIA) profit of y (Round to two decimal places.) The risk Takeshi is taking is that the spot rate at the end of the period can theoretically be anything higher or his speculative position. A V movement will cost him V of money. (Select from the drop-down menus.) lower Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the yen-dollar spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associatesand their computer modelsare predicting the spot rate to remain close to 118.00 = $1.00 for the coming 180 days. Using the same data below, analyze the UIA potential. Arbitrage funds available $ 5,000,000 118.60 117.80 Spot rate (= $1.00) 180-day forward rate (* = $1.00) Expected spot rate in 180 days (W = $1.00) U.S. dollar annual interest rate Japanese yen annual interest rate 118.00 4.800 % 3.400 % The UIA profit potential is (%, which tells Takeshi Kamada that he should borrow and invest in the yielding currency, the to potentially gain on an uncovered basis (UIA). (Round to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct, Takeshi Kamada generates an uncovered interest arbitrage (UIA) profit of . (Round to two decimal places.) The risk Takeshi is taking is that the V spot rate at the end of the period can theoretically be anything, better or worse for his speculative position. A movement will cost him of money. (Select from the drop-down menus.) Kamada: UIA Japan (B). Takeshi Kamada, Credit Suisse (Tokyo), observes that the yen-dollar spot rate has been holding steady, and that both dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research associatesand their computer modelsare predicting the spot rate to remain close to #118.00 = $1.00 for the coming 180 days. Using the same data below, analyze the UIA potential. $ 5,000,000 118.60 117.80 Arbitrage funds available Spot rate (* = $1.00) 180-day forward rate (* = $1.00) Expected spot rate in 180 days (W = $1.00) U.S. dollar annual interest rate Japanese yen annual interest rate 118.00 4.800 % 3.400 % TO The UIA profit potential is %, which tells Takeshi Kamada that he should borrow and invest in the yielding currency, the V, to potentially gain on an uncovered basis (UIA). (Round to three decimal places and select from the drop-down menus.) If his expectations about the future spot rate, the one in effect in 180 days, prove correct, Takeshi Kamada ger ed interest arbitrage (UIA) profit of y (Round to two decimal places.) The risk Takeshi is taking is that the spot rate at the end of the period can theoretically be anything higher or his speculative position. A V movement will cost him V of money. (Select from the drop-down menus.) lower