Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kamau uhuru recorded the following wages and salaries ksh 2000 rent ksh 8000 depreciation ksh 1000 entertainment for self ksh 2000 calculate the total dis

kamau uhuru recorded the following

wages and salaries ksh 2000

rent ksh 8000

depreciation ksh 1000

entertainment for self ksh 2000

calculate the total dis allowable expenses

a.

18,000

b.

10000

c.

12000

d.

3000

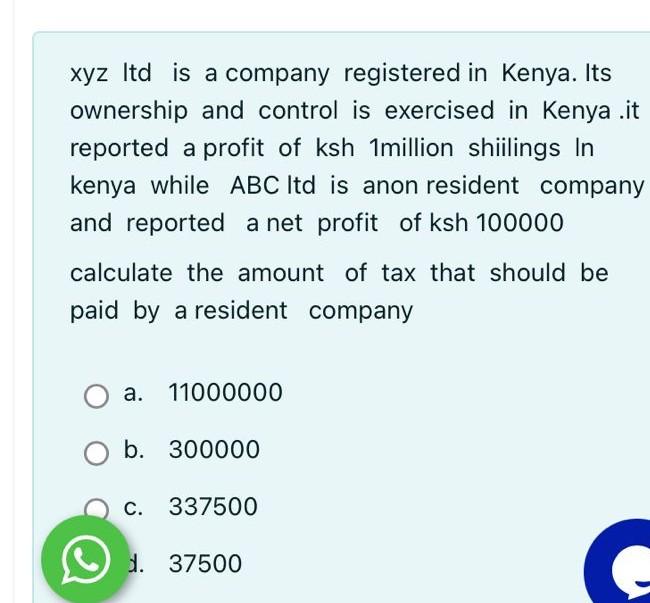

xyz Itd is a company registered in Kenya. Its ownership and control is exercised in Kenya it reported a profit of ksh 1milion shiilings In kenya while ABC ltd is anon resident company and reported a net profit of ksh 100000 calculate the amount of tax that should be paid by a resident company a. 11000000 b. 300000 c. 337500 d. 37500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started