Answered step by step

Verified Expert Solution

Question

1 Approved Answer

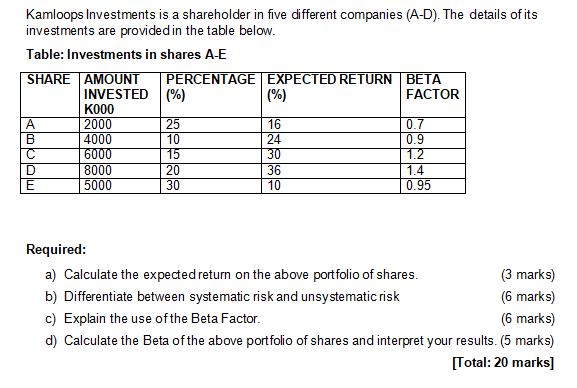

Kamloops Investments is a shareholder in five different companies (A-D). The details of its investments are provided in the table below. Table: Investments in

Kamloops Investments is a shareholder in five different companies (A-D). The details of its investments are provided in the table below. Table: Investments in shares A-E SHARE AMOUNT INVESTED K000 2000 ABCDE 4000 6000 8000 5000 PERCENTAGE (%) 25 10 15 20 30 EXPECTED RETURN BETA (%) FACTOR 16 24 30 36 10 0.7 0.9 1.2 1.4 0.95 Required: a) Calculate the expected return on the above portfolio of shares. b) Differentiate between systematic risk and unsystematic risk c) Explain the use of the Beta Factor. d) Calculate the Beta of the above portfolio of shares and interpret your results. (5 marks) [Total: 20 marks] (3 marks) (6 marks) (6 marks)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return on the portfolio of shares we need to calculate the weighted average of the expected returns of each share where th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started