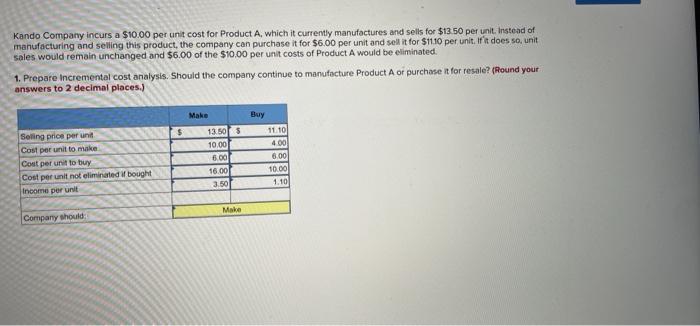

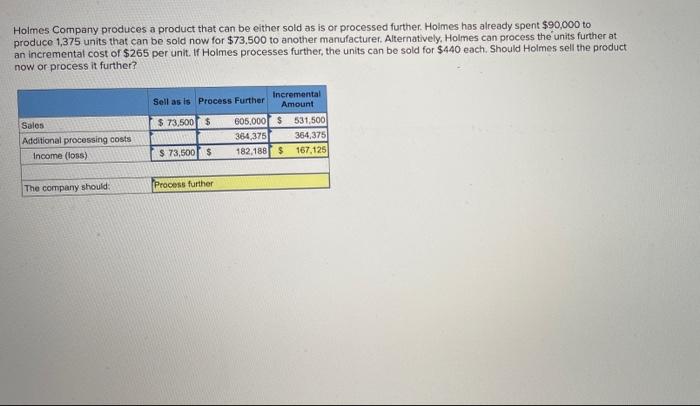

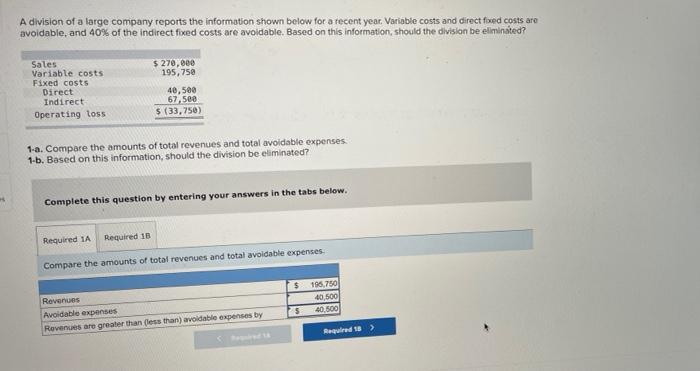

Kando Company incurs a $10.00 per unit cost for Product A, which it currently manufactures and sells for $13.50 per unit. Instead of manufacturing and selling this product, the company can purchase it for $6.00 per unit and sell it for $1110 per unit. If it does so unit sales would remain unchanged and $6.00 of the $10,00 per unit costs of Product A would be eliminated. 1. Prepare Incremental cost analysis. Should the company continue to manufacture Product A or purchase it for resale? (Round your answers to 2 decimal places.) Make Buy $ Selling price per una Cost per unit to make Cost per unit to buy Cost per unit not limited if bought Income per unit 13.50 $ 10.00 6.00 16.00 3.50 11.10 4.00 6.00 10.00 1.10 Make Company should Holmes Company produces a product that can be either sold as is or processed further. Holmes hos already spent $90,000 to produce 1,375 units that can be sold now for $73,500 to another manufacturer. Alternatively, Holmes can process the units further at an incremental cost of $265 per unit. If Holmes processes further, the units can be sold for $440 each. Should Holmes sell the product now or process it further? Sales Additional processing costs Income (los) Incremental Sell as is Process Further Amount $ 73,500 $ 605,000 $ 531,500 364 375 364,375 $ 73,500 $ 182.188 $ 167,125 The company should Process further A division of a large company reports the information shown below for a recent year. Variable costs and direct fixed costs are avoidable, and 40% of the indirect fixed costs are avoidable. Based on this information, should the division be eliminated? Sales Variable costs Fixed costs Direct Indirect Operating loss $ 270,000 195,750 40,500 67,500 $ (33,750) 1-a. Compare the amounts of total revenues and total avoidable expenses. 1-b. Based on this information, should the division be eliminated? Complete this question by entering your answers in the tabs below. Required 1A Required 18 Compare the amounts of total revenues and total avoidable expenses $195.750 40.500 5 40.500 Revenues Avoidable expenses Revenues are greater than (less than) avoidable expenses by Required 18 )