Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kansas Supplies is a manufacturer of plastic parts that uses the weighted average process costing method to account for costs of production. It produces parts

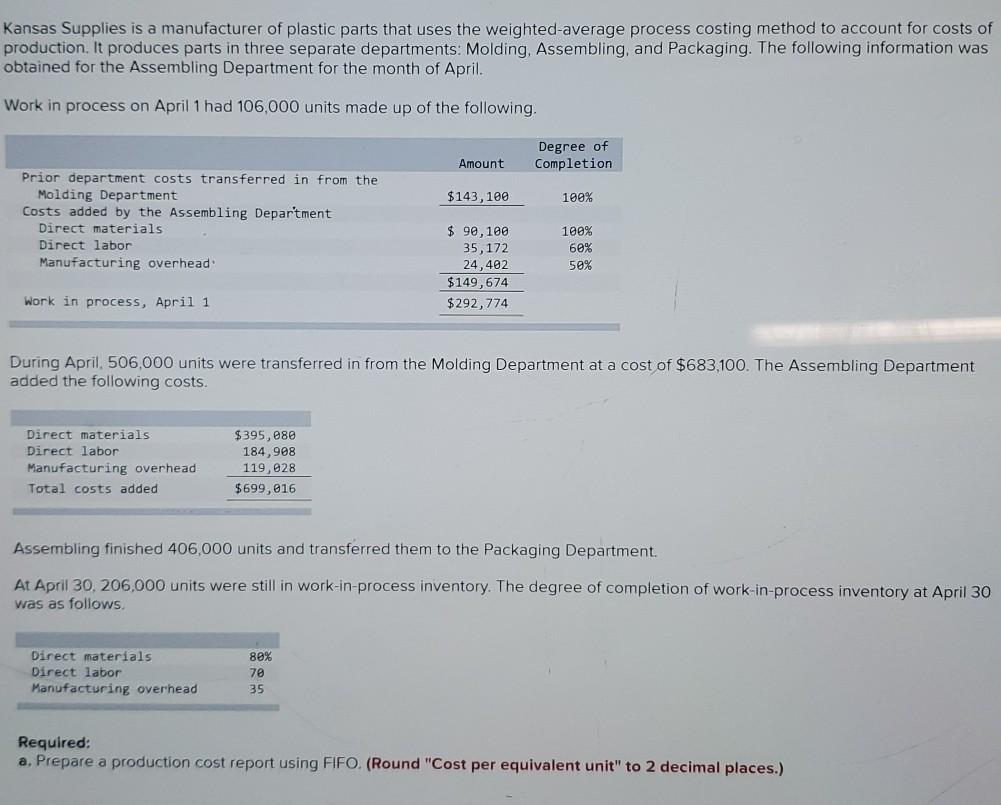

Kansas Supplies is a manufacturer of plastic parts that uses the weighted average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 106,000 units made up of the following. Degree of Completion Amount $143, 100 100% Prior department costs transferred in from the Molding Department Costs added by the Assembling Department Direct materials Direct labor Manufacturing overhead $ 90,100 35,172 24,402 $149,674 $292,774 100% 60% 50% Work in process, April 1 During April, 506,000 units were transferred in from the Molding Department at a cost of $683,100. The Assembling Department added the following costs. Direct materials Direct labor Manufacturing overhead Total costs added $395,080 184,908 119,028 $699,016 Assembling finished 406,000 units and transferred them to the Packaging Department At April 30, 206,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Manufacturing overhead 80% 70 35 Required: a. Prepare a production cost report using FIFO. (Round "Cost per equivalent unit" to 2 decimal places.) Kansas Supplies is a manufacturer of plastic parts that uses the weighted average process costing method to account for costs of production. It produces parts in three separate departments: Molding, Assembling, and Packaging. The following information was obtained for the Assembling Department for the month of April. Work in process on April 1 had 106,000 units made up of the following. Degree of Completion Amount $143, 100 100% Prior department costs transferred in from the Molding Department Costs added by the Assembling Department Direct materials Direct labor Manufacturing overhead $ 90,100 35,172 24,402 $149,674 $292,774 100% 60% 50% Work in process, April 1 During April, 506,000 units were transferred in from the Molding Department at a cost of $683,100. The Assembling Department added the following costs. Direct materials Direct labor Manufacturing overhead Total costs added $395,080 184,908 119,028 $699,016 Assembling finished 406,000 units and transferred them to the Packaging Department At April 30, 206,000 units were still in work-in-process inventory. The degree of completion of work-in-process inventory at April 30 was as follows. Direct materials Direct labor Manufacturing overhead 80% 70 35 Required: a. Prepare a production cost report using FIFO. (Round "Cost per equivalent unit" to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started