Question

Sterling Co. changed from average cost to FIFO on January 1, 2021. Inventory balances under both methods follow. Sterling Co. has a December 31 year-end.

Sterling Co. changed from average cost to FIFO on January 1, 2021. Inventory balances under both methods follow. Sterling Co. has a December 31 year-end.

| Inventory Balances, Dec. 31 | 2020 | 2019 |

|---|---|---|

| Ending inventory, average cost | $ 15,000 | $ 10,000 |

| Ending inventory, FIFO | 9,000 | 7,000 |

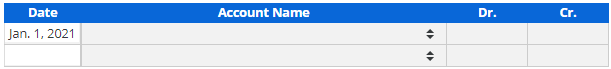

a. Prepare the entry in the company's accounting system on January 1, 2021, to record the accounting change. Ignore taxes

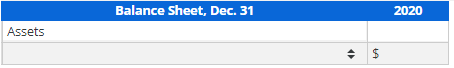

b. For external reporting purposes on December 31, 2021, the company reports comparative balance sheets for 2021 and 2020. What amount of inventory is reported on the December 31, 2020, balance sheet?

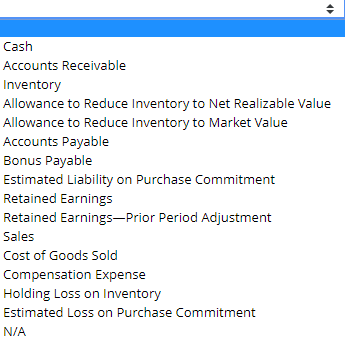

choose from these

choose from these

c. What cumulative effect of change in accounting principle is reported as an adjustment to retained earnings in 2021? in 2020? Assume comparative financial statement presentation of years ended December 31, 2021, and 2020. Ignore taxes.

Note: Indicate a decrease with a negative sign.

| Cumulative effect of change in accounting principle reported in beginning retained earnings in 2020: | |

| Cumulative effect of change in accounting principle reported in beginning retained earnings in 2021: |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started