Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kapuskasing Limited is trying to determine the amount of its ending inventory as at August 31, the company's year end. The accountant counted everything

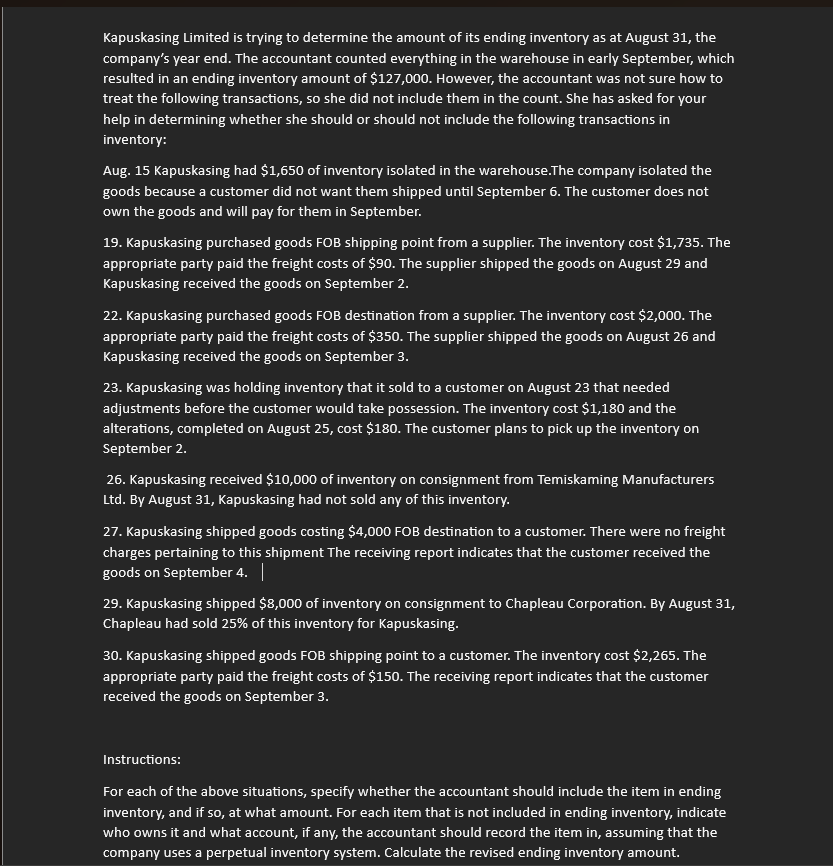

Kapuskasing Limited is trying to determine the amount of its ending inventory as at August 31, the company's year end. The accountant counted everything in the warehouse in early September, which resulted in an ending inventory amount of $127,000. However, the accountant was not sure how to treat the following transactions, so she did not include them in the count. She has asked for your help in determining whether she should or should not include the following transactions in inventory: Aug. 15 Kapuskasing had $1,650 of inventory isolated in the warehouse.The company isolated the goods because a customer did not want them shipped until September 6. The customer does not own the goods and will pay for them in September. 19. Kapuskasing purchased goods FOB shipping point from a supplier. The inventory cost $1,735. The appropriate party paid the freight costs of $90. The supplier shipped the goods on August 29 and Kapuskasing received the goods on September 2. 22. Kapuskasing purchased goods FOB destination from a supplier. The inventory cost $2,000. The appropriate party paid the freight costs of $350. The supplier shipped the goods on August 26 and Kapuskasing received the goods on September 3. 23. Kapuskasing was holding inventory that it sold to a customer on August 23 that needed adjustments before the customer would take possession. The inventory cost $1,180 and the alterations, completed on August 25, cost $180. The customer plans to pick up the inventory on September 2. 26. Kapuskasing received $10,000 of inventory on consignment from Temiskaming Manufacturers Ltd. By August 31, Kapuskasing had not sold any of this inventory. 27. Kapuskasing shipped goods costing $4,000 FOB destination to a customer. There were no freight charges pertaining to this shipment The receiving report indicates that the customer received the goods on September 4. | 29. Kapuskasing shipped $8,000 of inventory on consignment to Chapleau Corporation. By August 31, Chapleau had sold 25% of this inventory for Kapuskasing. 30. Kapuskasing shipped goods FOB shipping point to a customer. The inventory cost $2,265. The appropriate party paid the freight costs of $150. The receiving report indicates that the customer received the goods on September 3. Instructions: For each of the above situations, specify whether the accountant should include the item in ending inventory, and if so, at what amount. For each item that is not included in ending inventory, indicate who owns it and what account, if any, the accountant should record the item in, assuming that the company uses a perpetual inventory system. Calculate the revised ending inventory amount.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started