Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kardon Enterprises, Inc. has two operating divisions, one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined

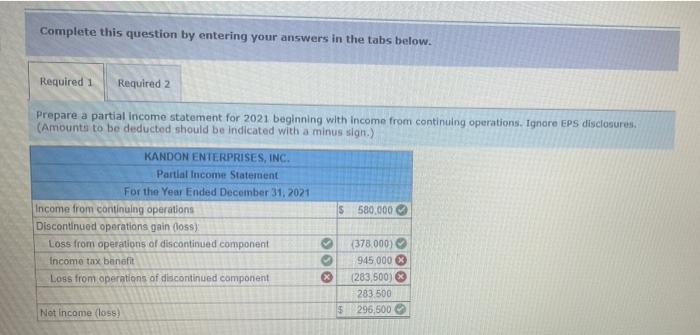

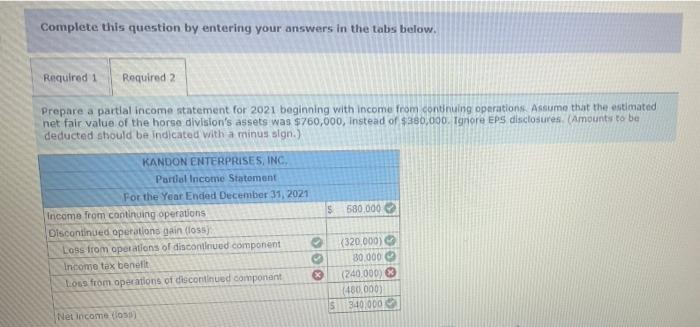

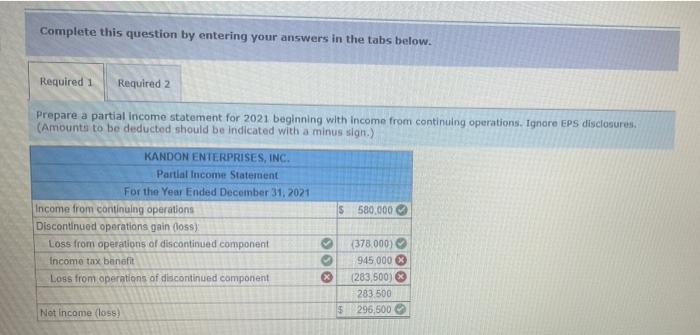

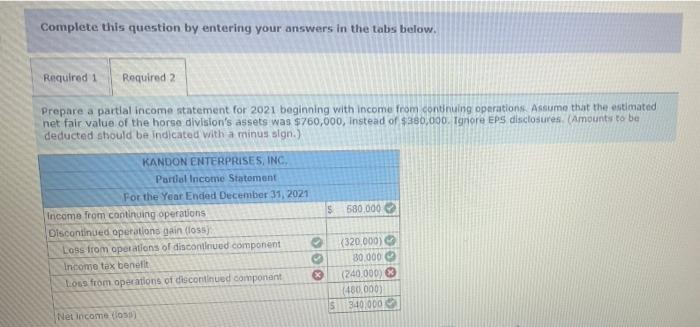

Kardon Enterprises, Inc. has two operating divisions, one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been unprofitable, and, on November 15, 2021, Kandon adopted a formal plan to sell the division. The sale was completed on April 30, 2022 At December 31, 2021, the component was considered held for sale On December 31, 2021, the company's fiscal year end, the book value of the assets of the horse division was $438,000. On that date the fair value of the assets, less costs to sell was $380,000. The before tax loss from operations of the division for the year was $320.000. The company's effective tax rate 1 25%. The alter-tax income from continuing operations for 2021 was $580,000 Required: 1. Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures 2. Prepare partial income statement for 2021 beginning with income from continuing operations. Assume that the estimated netfak value of the horse division's assets was $780.000, instead of $380 000. Ignore EPS disclosures by Answer is not complete Complete this question by entering your answers in the tabs below Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures (Amounts to be deducted should be indicated with a minus sign.) KANDON ENTERPRISES, INC. Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations IS 580.000 Discontinued operations gain (lossy Loss from operations of discontinued component (378.000) Income tax benefit 945,000 Loss from operations of discontinued component 283,500) 283 500 Net Income (loss) $ 296,500 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a partial income statement for 2021 beginning with income from connuing operations. Assume that the estimated net fair value of the horse division's assets was $760,000, instead of $380,000. Ignore EPS disclosures (Amounts to be deducted should be indicated with a minus sign.) KANDON ENTERPRISES, INC Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations $ 580 000 Discontinued operations gain (los) Loss from operations of discontinued component (320,000) Income tax benet 80.000 Loss from operations of discontinued component 83 (240,000) 480,000) 1S Net income on) 340.000 00

Kardon Enterprises, Inc. has two operating divisions, one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been unprofitable, and, on November 15, 2021, Kandon adopted a formal plan to sell the division. The sale was completed on April 30, 2022 At December 31, 2021, the component was considered held for sale On December 31, 2021, the company's fiscal year end, the book value of the assets of the horse division was $438,000. On that date the fair value of the assets, less costs to sell was $380,000. The before tax loss from operations of the division for the year was $320.000. The company's effective tax rate 1 25%. The alter-tax income from continuing operations for 2021 was $580,000 Required: 1. Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures 2. Prepare partial income statement for 2021 beginning with income from continuing operations. Assume that the estimated netfak value of the horse division's assets was $780.000, instead of $380 000. Ignore EPS disclosures by Answer is not complete Complete this question by entering your answers in the tabs below Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures (Amounts to be deducted should be indicated with a minus sign.) KANDON ENTERPRISES, INC. Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations IS 580.000 Discontinued operations gain (lossy Loss from operations of discontinued component (378.000) Income tax benefit 945,000 Loss from operations of discontinued component 283,500) 283 500 Net Income (loss) $ 296,500 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a partial income statement for 2021 beginning with income from connuing operations. Assume that the estimated net fair value of the horse division's assets was $760,000, instead of $380,000. Ignore EPS disclosures (Amounts to be deducted should be indicated with a minus sign.) KANDON ENTERPRISES, INC Partial Income Statement For the Year Ended December 31, 2021 Income from continuing operations $ 580 000 Discontinued operations gain (los) Loss from operations of discontinued component (320,000) Income tax benet 80.000 Loss from operations of discontinued component 83 (240,000) 480,000) 1S Net income on) 340.000 00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started