Answered step by step

Verified Expert Solution

Question

1 Approved Answer

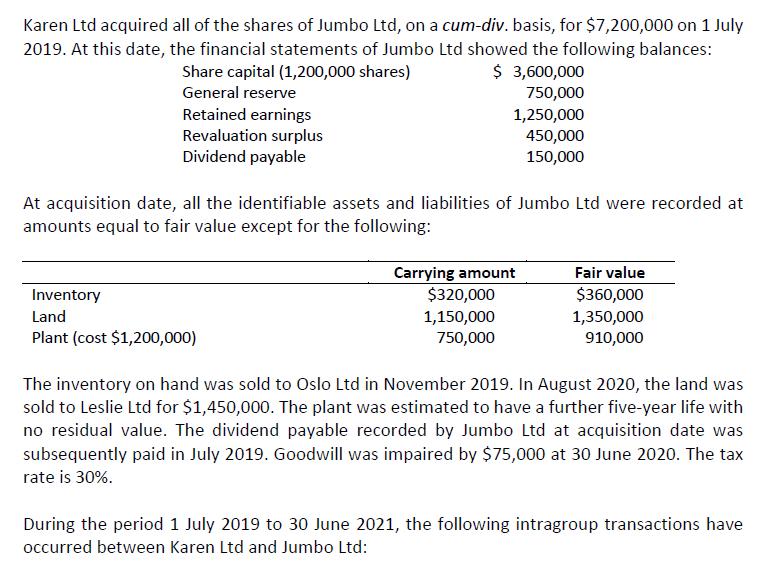

Karen Ltd acquired all of the shares of Jumbo Ltd, on a cum-div. basis, for $7,200,000 on 1 July 2019. At this date, the

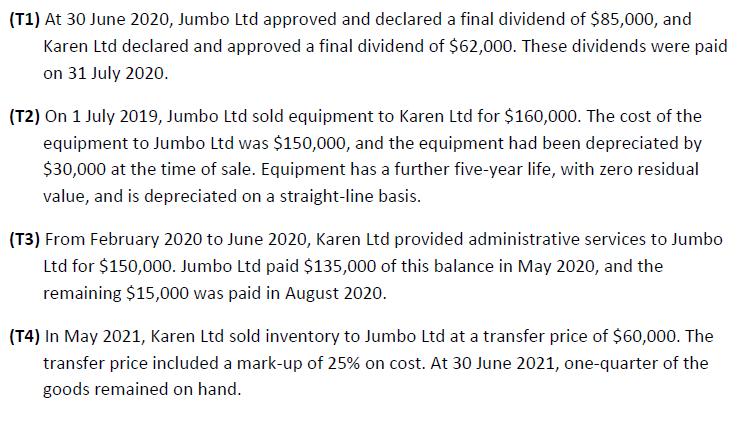

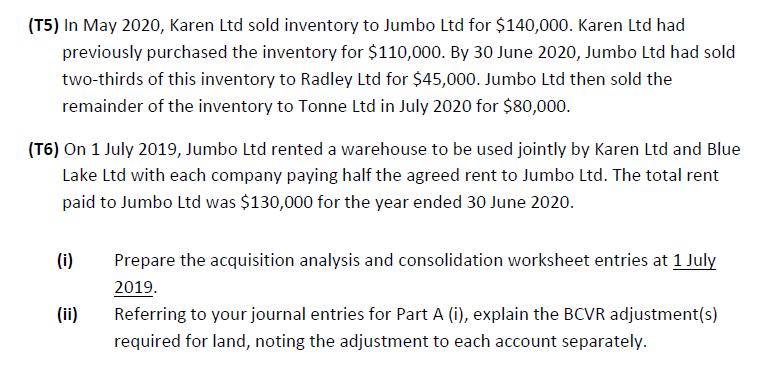

Karen Ltd acquired all of the shares of Jumbo Ltd, on a cum-div. basis, for $7,200,000 on 1 July 2019. At this date, the financial statements of Jumbo Ltd showed the following balances: Share capital (1,200,000 shares) $ 3,600,000 General reserve 750,000 Retained earnings Revaluation surplus Dividend payable 1,250,000 450,000 150,000 At acquisition date, all the identifiable assets and liabilities of Jumbo Ltd were recorded at amounts equal to fair value except for the following: Carrying amount $320,000 Fair value Inventory $360,000 Land 1,150,000 750,000 1,350,000 910,000 Plant (cost $1,200,000) The inventory on hand was sold to Oslo Ltd in November 2019. In August 2020, the land was sold to Leslie Ltd for $1,450,000. The plant was estimated to have a further five-year life with no residual value. The dividend payable recorded by Jumbo Ltd at acquisition date was subsequently paid in July 2019. Goodwill was impaired by $75,000 at 30 June 2020. The tax rate is 30%. During the period 1 July 2019 to 30 June 2021, the following intragroup transactions have occurred between Karen Ltd and Jumbo Ltd: (T1) At 30 June 2020, Jumbo Ltd approved and declared a final dividend of $85,000, and Karen Ltd declared and approved a final dividend of $62,000. These dividends were paid on 31 July 2020. (T2) On 1 July 2019, Jumbo Ltd sold equipment to Karen Ltd for $160,000. The cost of the equipment to Jumbo Ltd was $150,000, and the equipment had been depreciated by $30,000 at the time of sale. Equipment has a further five-year life, with zero residual value, and is depreciated on a straight-line basis. (T3) From February 2020 to June 2020, Karen Ltd provided administrative services to Jumbo Ltd for $150,000. Jumbo Ltd paid $135,000 of this balance in May 2020, and the remaining $15,000 was paid in August 2020. (T4) In May 2021, Karen Ltd sold inventory to Jumbo Ltd at a transfer price of $60,000. The transfer price included a mark-up of 25% on cost. At 30 June 2021, one-quarter of the goods remained on hand. (T5) In May 2020, Karen Ltd sold inventory to Jumbo Ltd for $140,000. Karen Ltd had previously purchased the inventory for $110,000. By 30 June 2020, Jumbo Ltd had sold two-thirds of this inventory to Radley Ltd for $45,000. Jumbo Ltd then sold the remainder of the inventory to Tonne Ltd in July 2020 for $80,000. (T6) On 1 July 2019, Jumbo Ltd rented a warehouse to be used jointly by Karen Ltd and Blue Lake Ltd with each company paying half the agreed rent to Jumbo Ltd. The total rent paid to Jumbo Ltd was $130,000 for the year ended 30 June 2020. (i) Prepare the acquisition analysis and consolidation worksheet entries at 1 July 2019. (ii) Referring to your journal entries for Part A (i), explain the BCVR adjustment(s) required for land, noting the adjustment to each account separately.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Showing Net ARcet em0Lluly 2014 Statement Amaunee launiculae sh...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started