Question

Below is a sample path of Brownian motion that will be useful in this problem. time t 0.0625 0.1250 0.1875 0.25 B(t) -0.4252 -0.0428

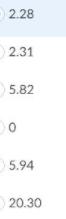

Below is a sample path of Brownian motion that will be useful in this problem. time t 0.0625 0.1250 0.1875 0.25 B(t) -0.4252 -0.0428 -0.0973 0.0542 Consider a stock whose price is modeled by a geometric Brownian motion. The price today is $50, the volatility is 50%, and the risk- free interest rate is 2% per year. The time frame is the next 3 months, and the strike price is $50. Compute the discounted European put option payoff to the nearest penny using the above sample path. 2.28 2.31 5.82 5.94 20.30

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

thus t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Analytics

Authors: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson, Dennis J. Sweeney, Thomas A. Williams

3rd Edition

1337406422, 9781337406420

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App