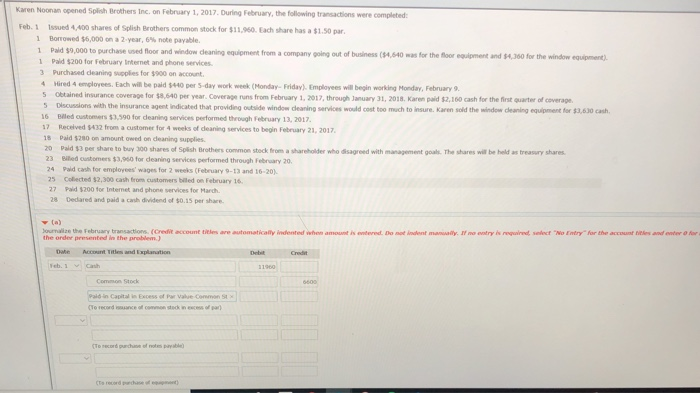

Karen Noonan opened Splish Brothers Inc. on February 1, 2017. During February, the following transactions were Feb. 1 Issued 4,400 shares of Splish Brothers common stock for $11,960 Each share has a $1.50 par 1 Bonowed $6,000 on a 2-year, 6% note payable 1 Pald $9,000 to purchase used floor and window deaning equipment from a company oing out of business(94,640 was for the f foor equipment and $4,360 for the window equipment). Pald $200 for February Iinternet and phone services 3 Purchased cleaning supplies for $900 on account. Hired 4 employees. Each will be paid $440 per S-day work week (Monday-Friday) Employees will begin working Monday, February 9 s Obtained insurance coverage for $8,640 per year. Coverage runs from February 1, 2017, through January 31, 2018. Karn paid $2,160 cash for the first quarter of coverage wilth the insurance agent indicated that providing outside window cleaning services would cost too much to insure. Karen sold the window cleaning equipment for $3,630 cash 6 Billed oustomers $3,590 for deaning services performed through February 13,2017 7 Received $432 from a customer for 4 weeks of deaning services to begin February 21, 2017 18 Paid $280 on amount owed on deaning supplies 20 Pald $3 per share to buy 300 shares of Splish Brothers common stock from a shareholder who disagreed with management goals The shares will be held as treasury shares 23 Bilied oustomers $3,960 for deaning services performed through February 20 24 Paid cash for employees' wages for 2 weeks (Febeuary 9-13 and 16-20), 25 Collected $2,300 cash from customers biled on February 16 27 Paid $200 for Internet and phone services for March 28 Dedared and paid a cash dividend of $0.15 per share. ourralize tho February transactions (Oedit account tiem ave automaticamy the onder presented in the problem) ented when amount is eweer d Do not ANI nt manwaar ry mo entry .yul d self No rnt y forthe a numr neean/andro Date Account Titles and Explanation Pa in Casitalin Excess of Par Vabue Common St