Question

Kari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at

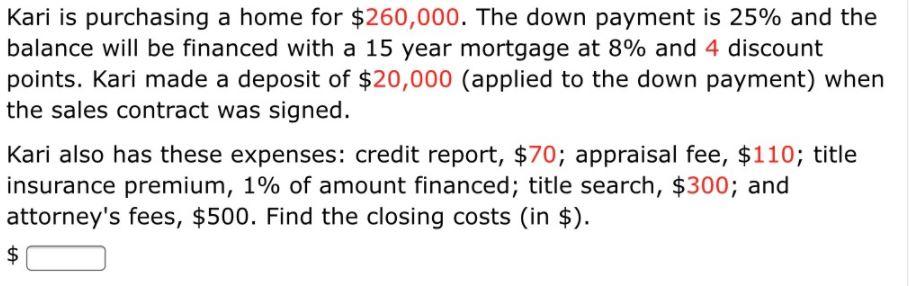

Kari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 4 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $300; and attorney's fees, $500. Find the closing costs (in $). %24

Step by Step Solution

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A B 1 2 Amount 3 Down payment 260000 25 260000025 4 Add 5 Finance...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and managerial accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

1st edition

111800423X, 9781118233443, 1118016114, 9781118004234, 1118233441, 978-1118016114

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App