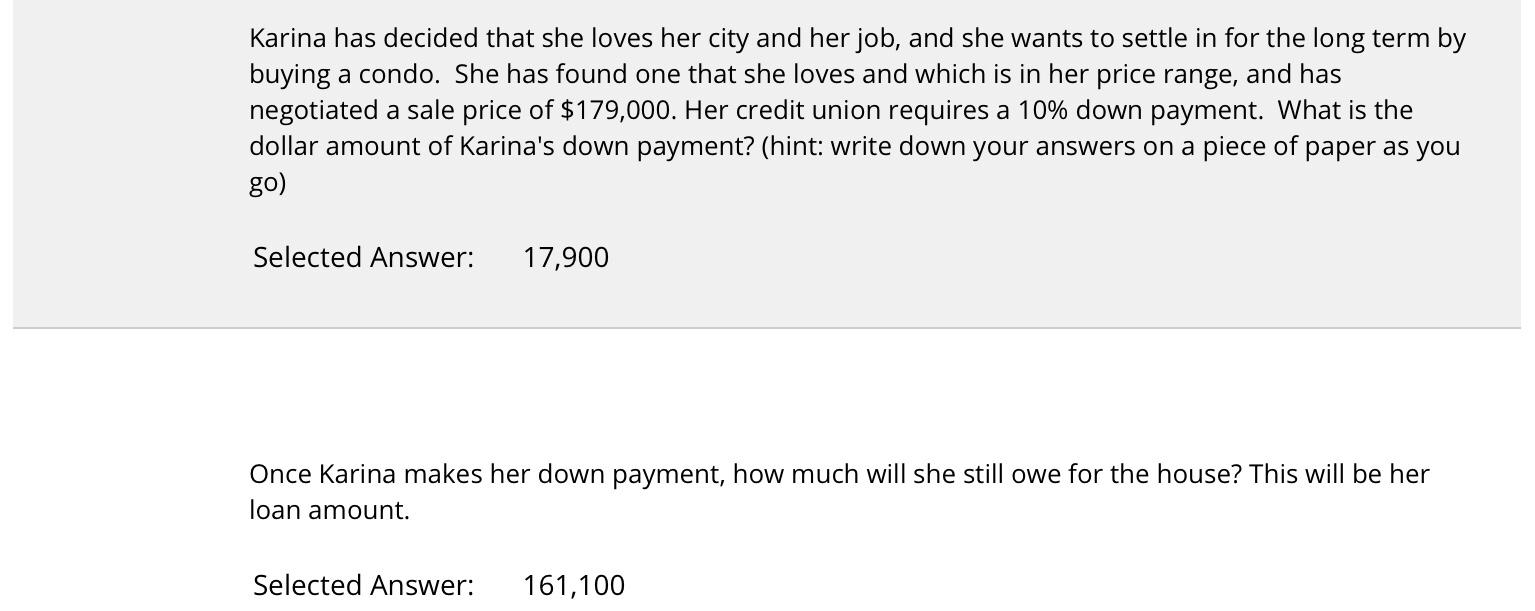

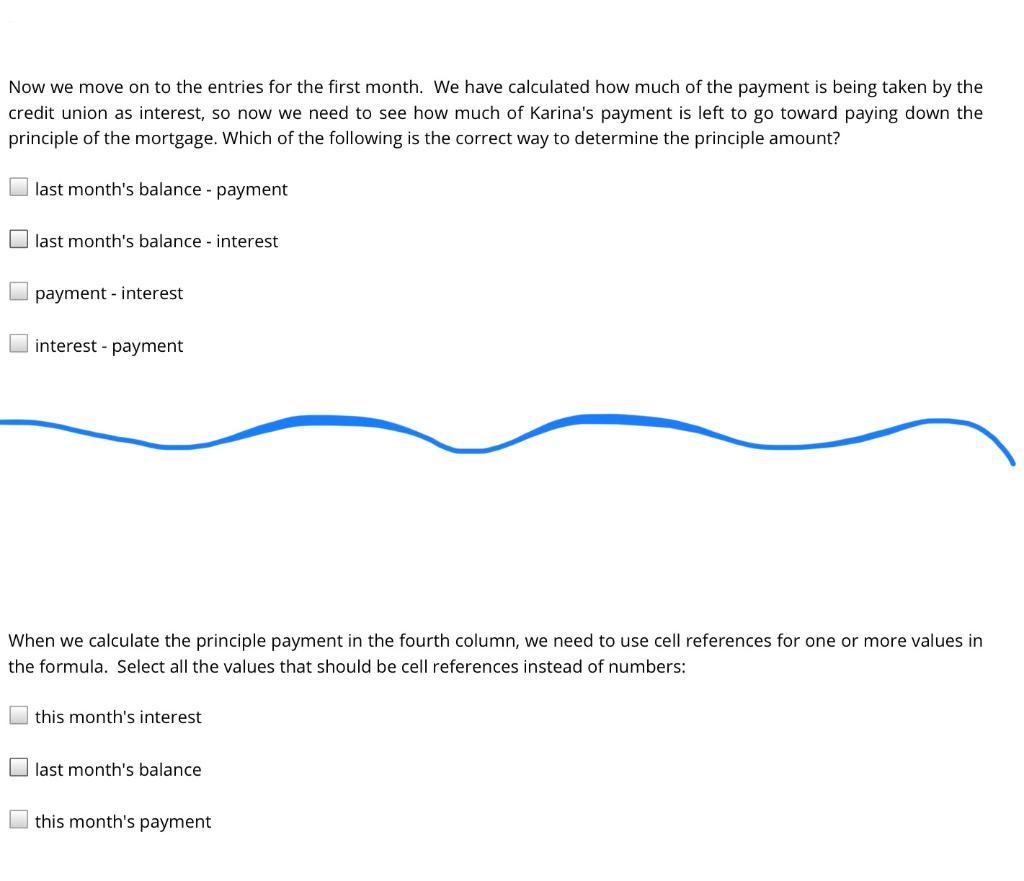

Karina has decided that she loves her city and her job, and she wants to settle in for the long term by buying a condo. She has found one that she loves and which is in her price range, and has negotiated a sale price of $179,000. Her credit union requires a 10% down payment. What is the dollar amount of Karina's down payment? (hint: write down your answers on a piece of paper as you go) Selected Answer: 17,900 Once Karina makes her down payment, how much will she still owe for the house? This will be her loan amount. Selected Answer: 161,100 Karina's credit union offers a 30 year fixed rate mortgage with a 5.75% APR and monthly payments. Use the PMT formula and the loan amount you calculated in the last problem to determine how much Karina's monthly payment will be. Set up your amortization table with the headings Month, Payment, Interest, Principle, and Balance. Now we will enter the items on the first row. Remember the first 4 columns are all o, but what will be your first entry in the balance column? Now we move on to the entries for the first month. We have calculated how much of the payment is being taken by the credit union as interest, so now we need to see how much of Karina's payment is left to go toward paying down the principle of the mortgage. Which of the following is the correct way to determine the principle amount? last month's balance - payment last month's balance - interest payment - interest interest - payment When we calculate the principle payment in the fourth column, we need to use cell references for one or more values in the formula. Select all the values that should be cell references instead of numbers: this month's interest U last month's balance this month's payment Now we move on to the entries for the first month. We have calculated how much of the payment is being taken by the credit union as interest, so now we need to see how much of Karina's payment is left to go toward paying down the principle of the mortgage. Which of the following is the correct way to determine the principle amount? last month's balance - payment last month's balance - interest payment - interest interest - payment When we calculate the principle payment in the fourth column, we need to use cell references for one or more values in the formula. Select all the values that should be cell references instead of numbers: this month's interest U last month's balance this month's payment Calculating the new balance at the end of the month is a common place for students to make a mistake. So be careful with this one and make sure you know what to do for the test. Which of the following is the correct way to calculate the new balance at the end of month one? After you answer the question type the formula into the cell. Remember to use cell references for both values. Selected Answers: last month's balance - principle QUESTION 10 You should have your month 1 values calculated. Enter them here: month payment interest principle balance Now use the fill feature of Excel to drag the formulas and values from month 1 down to later months. Remember to drag the columns one at a time, and don't panic if you get a column of zeros partway through the process - just keep going. When the loan term is halfway over where does the loan stand? Enter the values for month 180 in the row below: month payment interest principle balance 180 Use the fill feature to continue dragging the columns all the way down to month 360 (NOT row 360 of the spreadsheet). If the final balance at the end of month 360 is more than $5.00 away from $0 then you have made a mistake somewhere and should check over your work and look to make corrections. If the ending balance is within $5.00 of zero, then you have a minor rounding error due to rounding your monthly payment to the nearest cent. This is what actually happens with mortgages in real life. Simply adjust your final payment by a few dollars until the ending balance is zero. What is your final payment