Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Karsted Air Services is now in the final year of a project. The equipment originally cost $20 million, of which 85% has been depreciated. Karsted

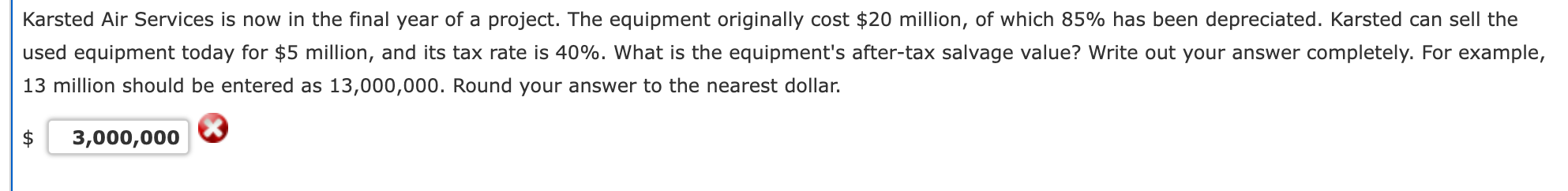

Karsted Air Services is now in the final year of a project. The equipment originally cost $20 million, of which 85% has been depreciated. Karsted can sell the used equipment today for $5 million, and its tax rate is 40%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar

Karsted Air Services is now in the final year of a project. The equipment originally cost $20 million, of which 85% has been depreciated. Karsted can sell the used equipment today for $5 million, and its tax rate is 40%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started