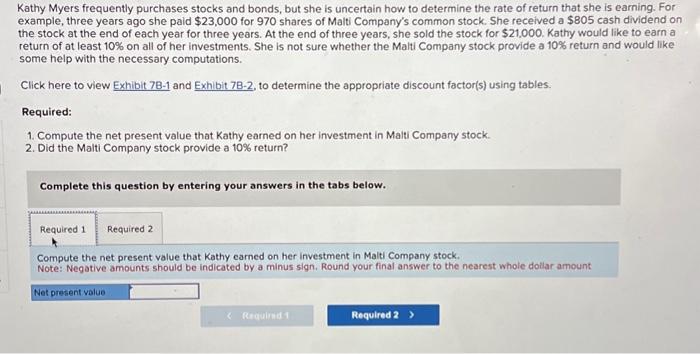

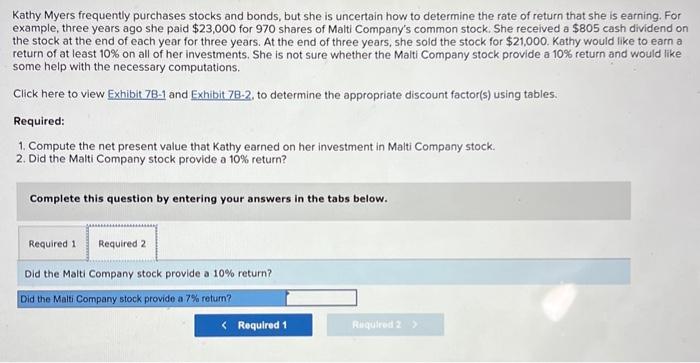

Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $23,000 for 970 shares of Malti Company's common stock. She received a $805 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $21,000. Kathy would like to earn a return of at least 10% on all of her investments. She is not sure whether the Malti Company stock provide a 10% return and would like some help with the necessary computations. Click here to view Exhibit 78-1 and Exhibit 78-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value that Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 10% return? Complete this question by entering your answers in the tabs below. Compute the net present value that Kathy earned on her investment in Malti Company stock. Note: Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount Kathy Myers frequently purchases stocks and bonds, but she is uncertain how to determine the rate of return that she is earning. For example, three years ago she paid $23,000 for 970 shares of Malti Company's common stock. She received a $805 cash dividend on the stock at the end of each year for three years. At the end of three years, she sold the stock for $21,000. Kathy would like to earn a return of at least 10% on all of her investments. She is not sure whether the Malti Company stock provide a 10% return and would like some help with the necessary computations. Click here to view Exhibit 78-1 and Exhibit 78-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value that Kathy earned on her investment in Malti Company stock. 2. Did the Malti Company stock provide a 10% return? Complete this question by entering your answers in the tabs below. Did the Malti Company stock provide a 10% return