Answered step by step

Verified Expert Solution

Question

1 Approved Answer

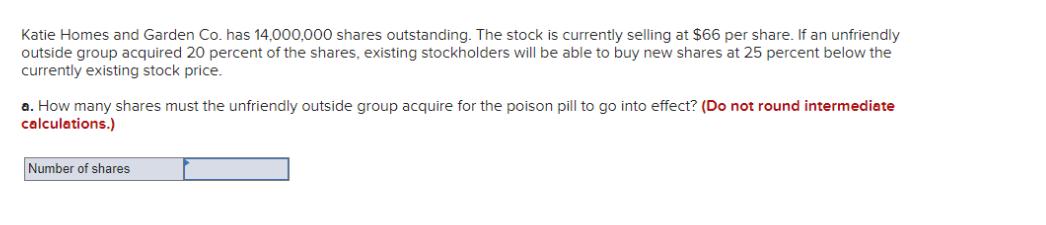

Katie Homes and Garden Co. has 14,000,000 shares outstanding. The stock is currently selling at $66 per share. If an unfriendly outside group acquired

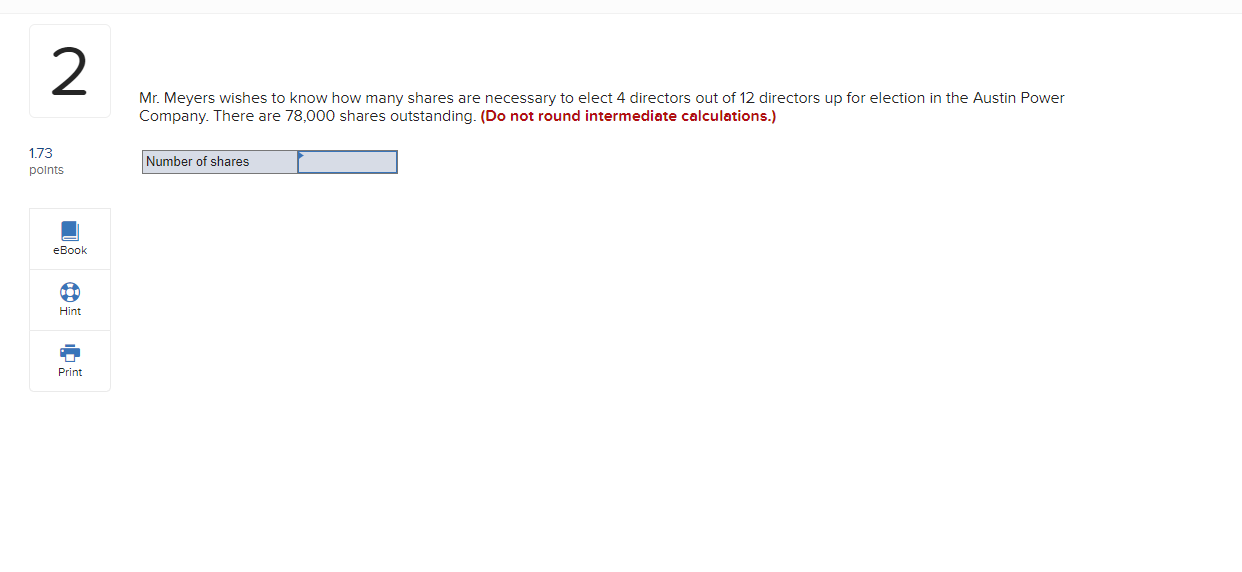

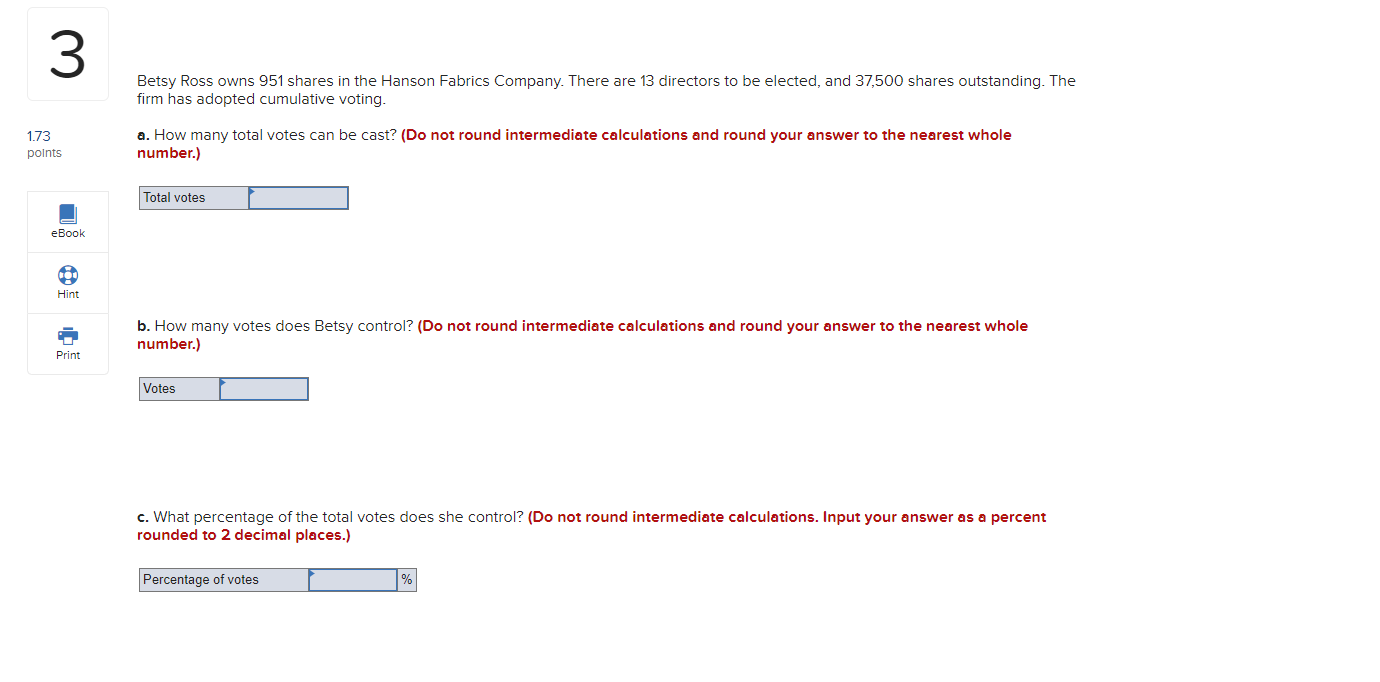

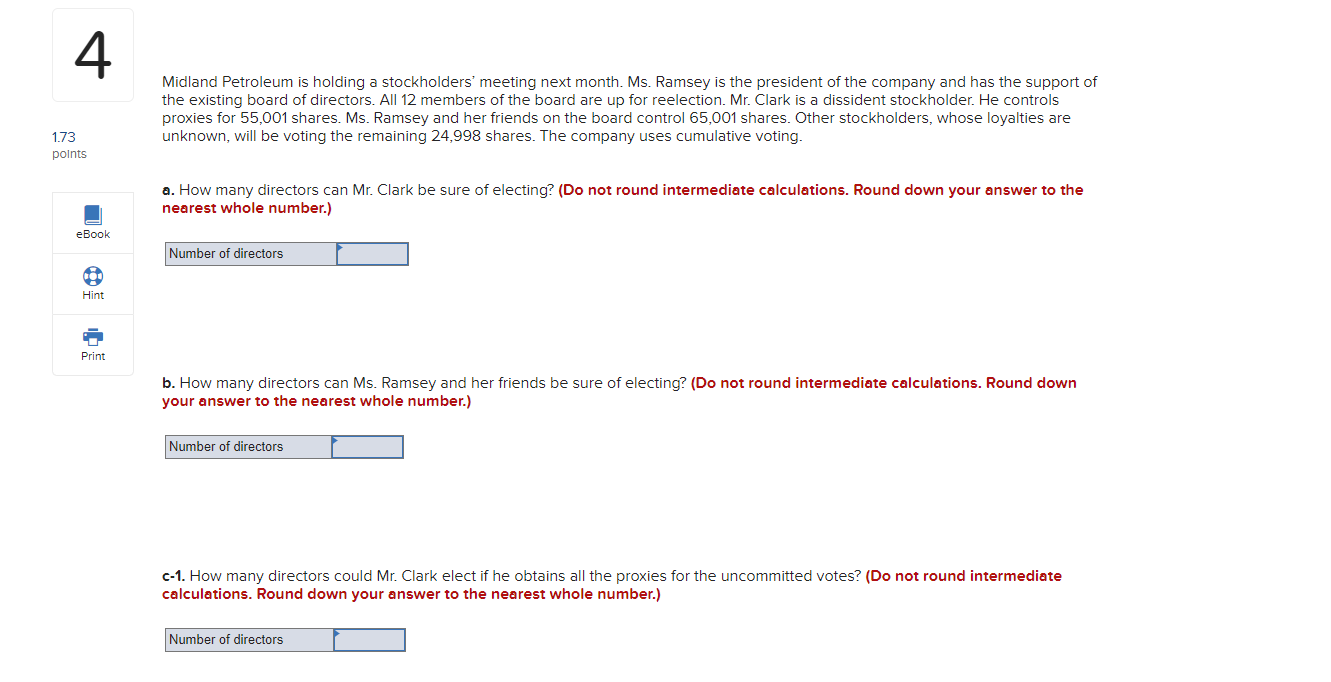

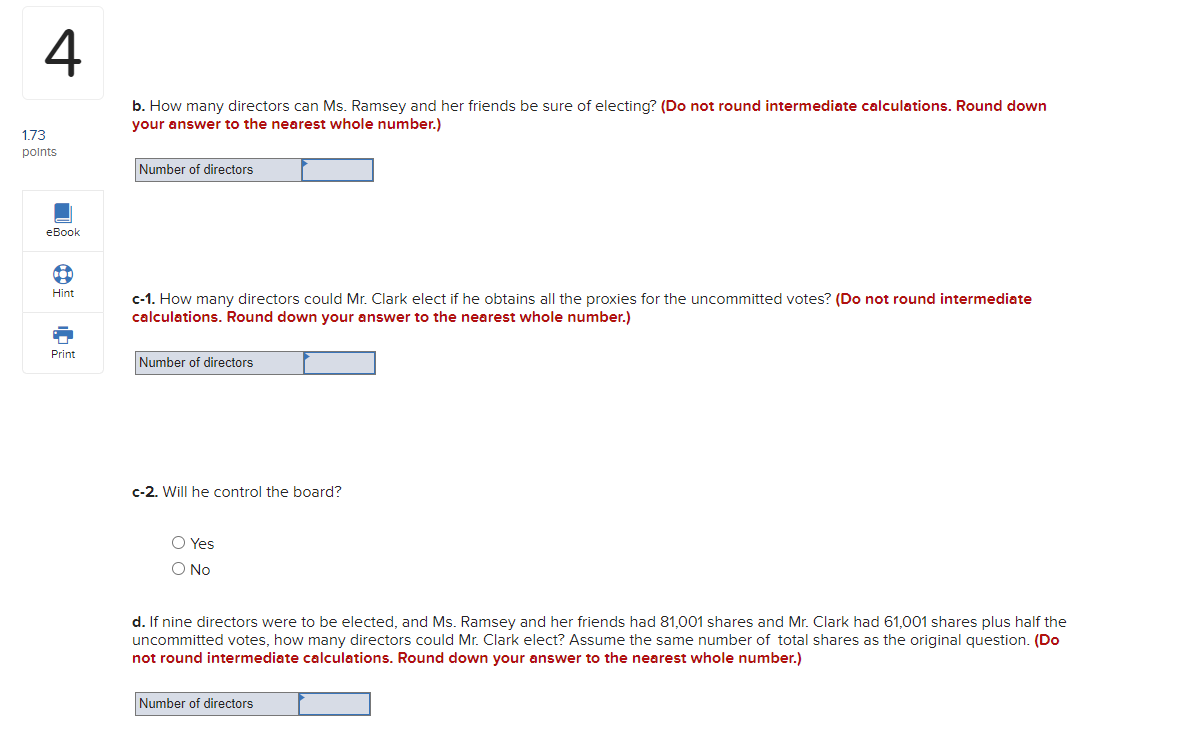

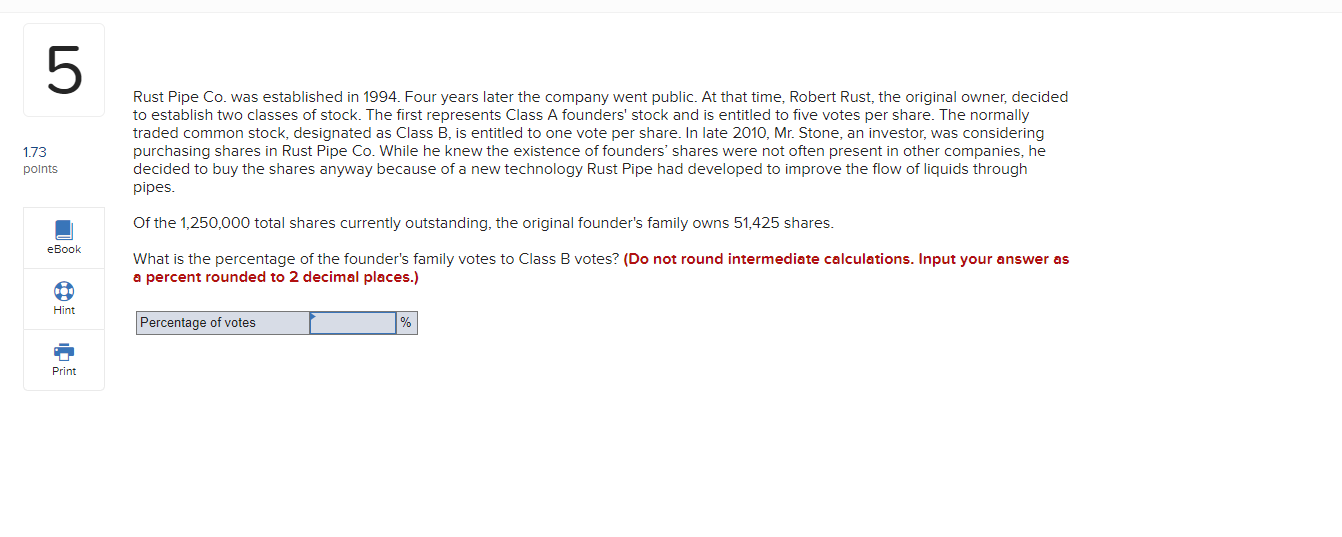

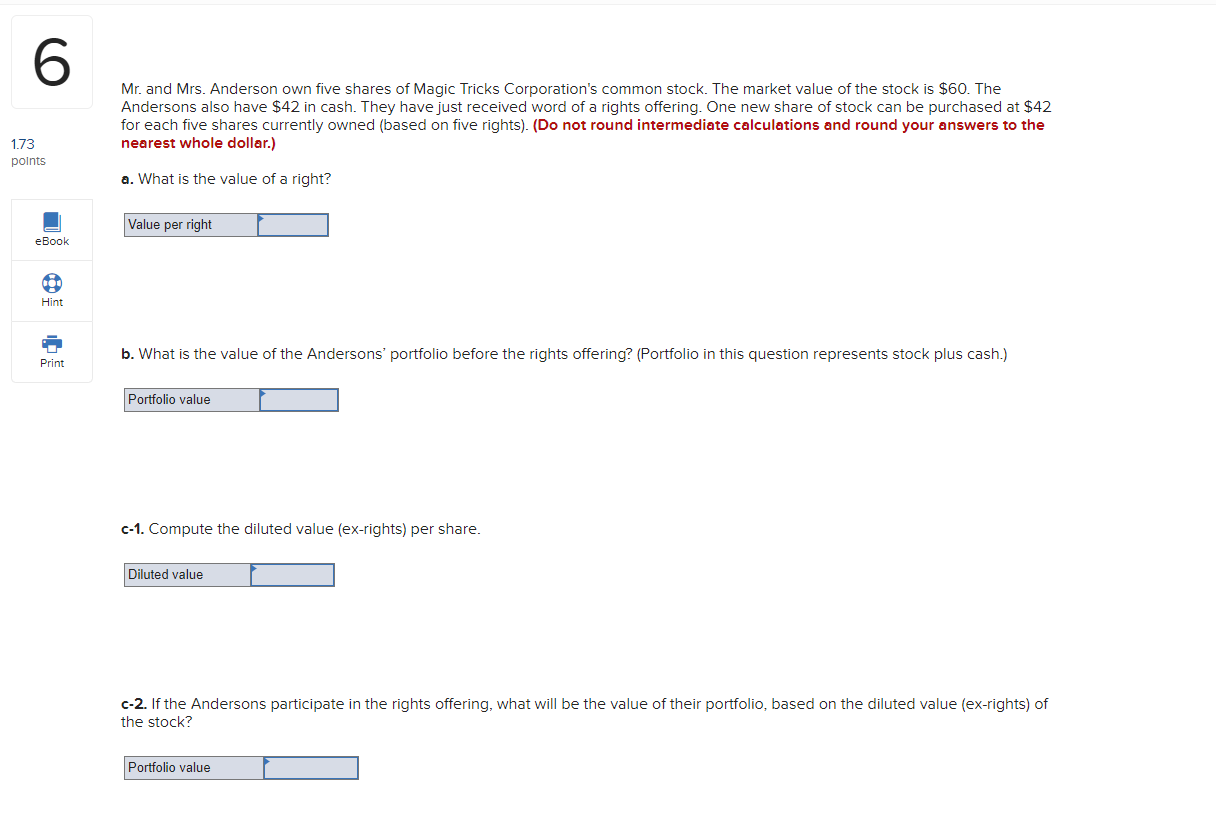

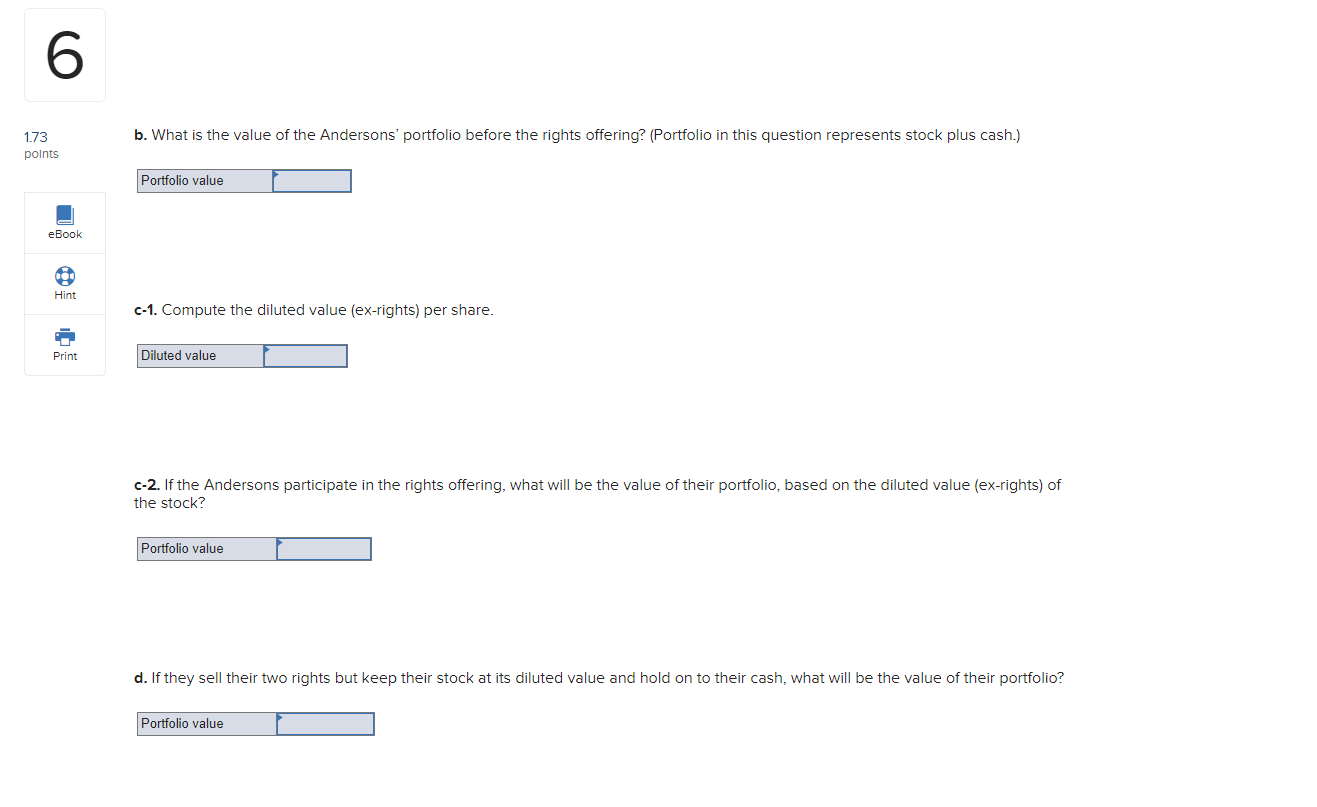

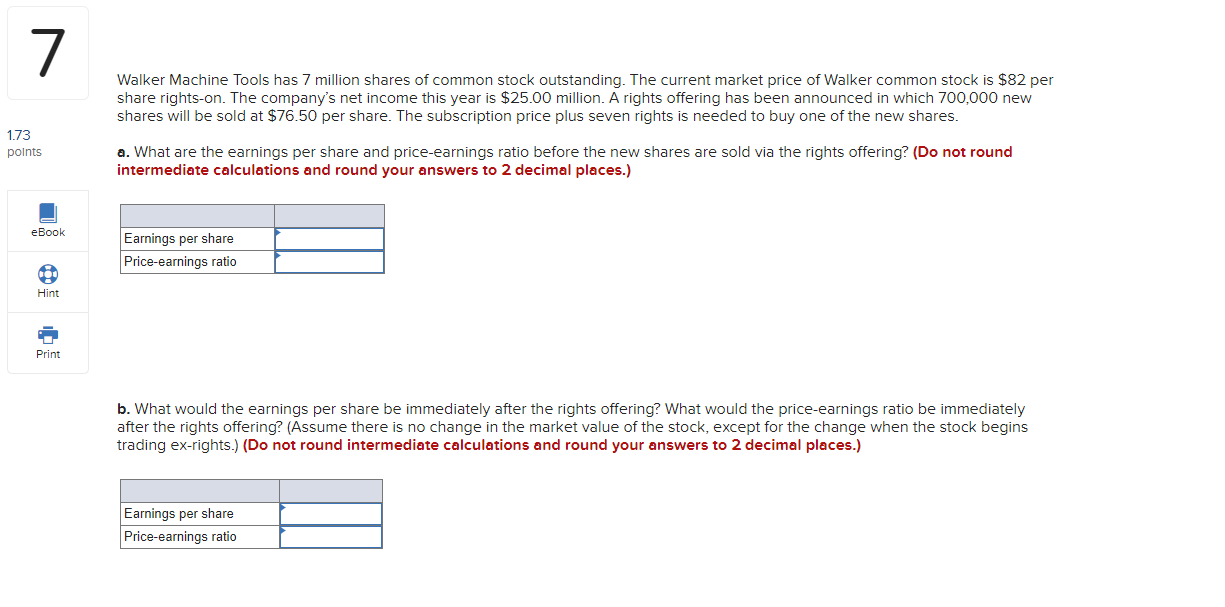

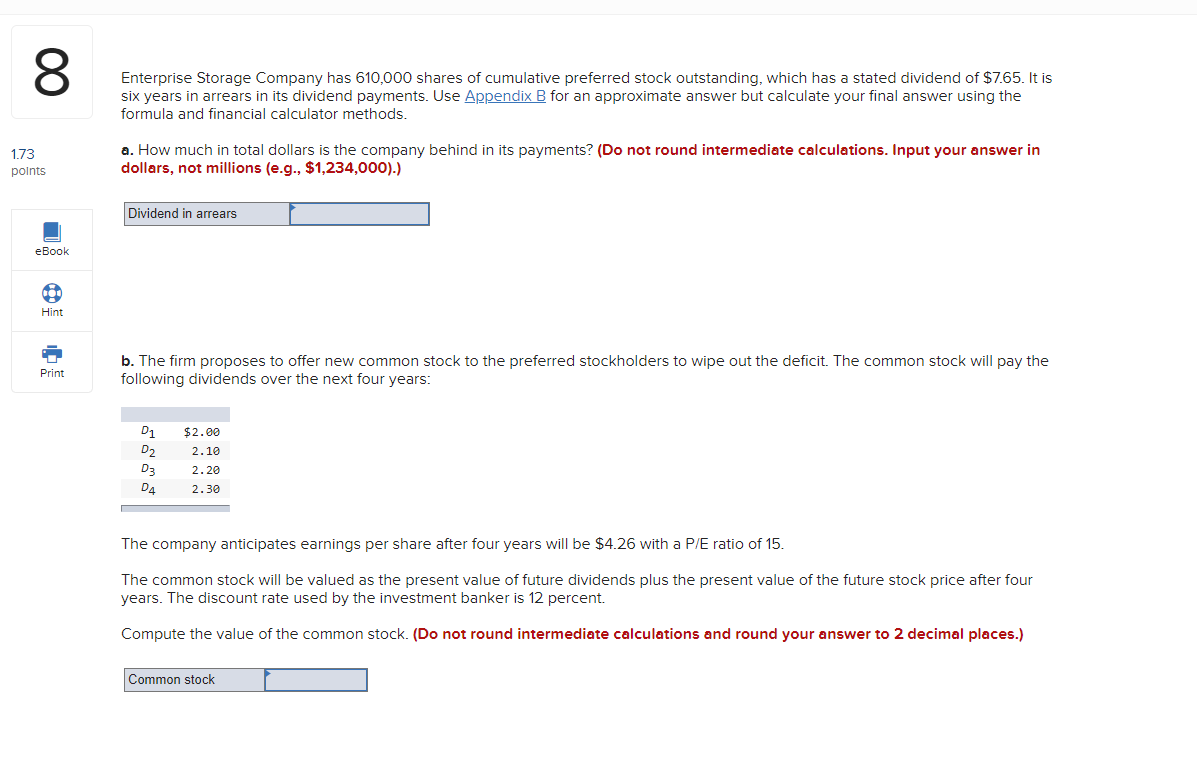

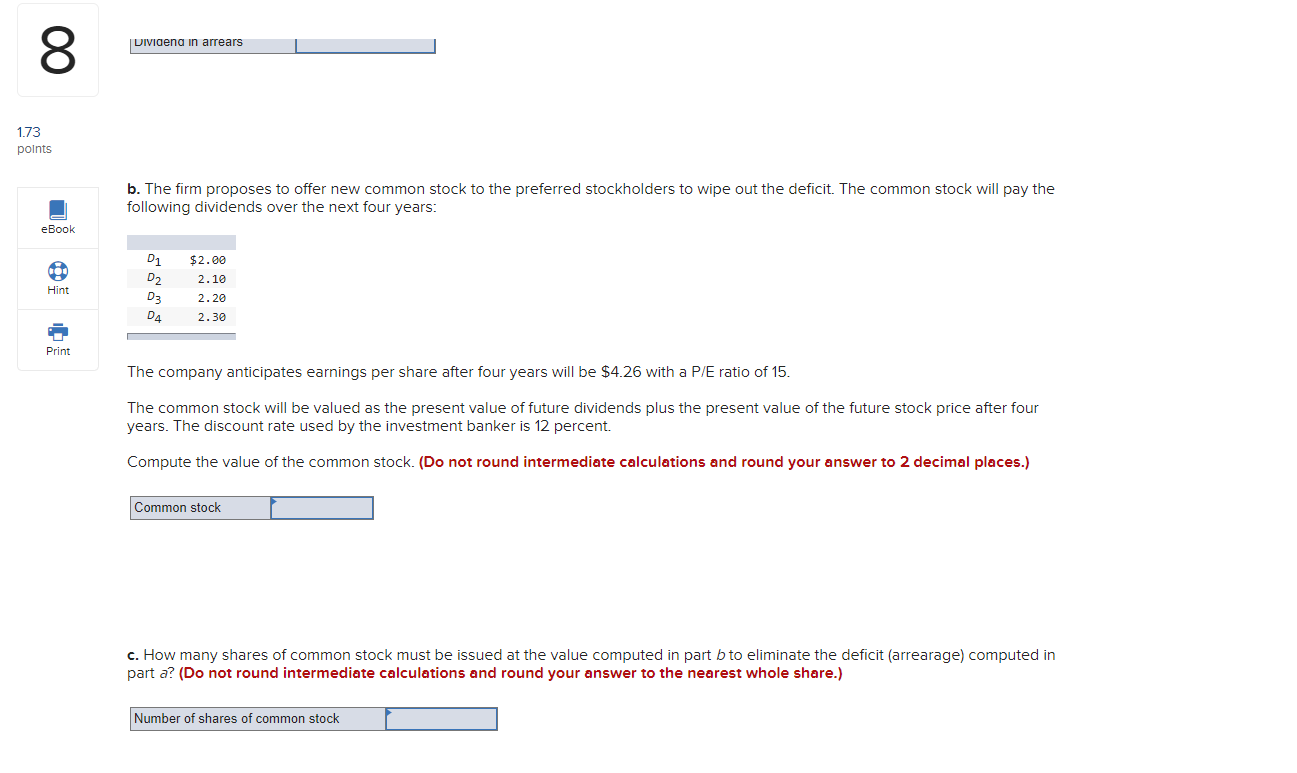

Katie Homes and Garden Co. has 14,000,000 shares outstanding. The stock is currently selling at $66 per share. If an unfriendly outside group acquired 20 percent of the shares, existing stockholders will be able to buy new shares at 25 percent below the currently existing stock price. a. How many shares must the unfriendly outside group acquire for the poison pill to go into effect? (Do not round intermediate calculations.) Number of shares 2 1.73 points eBook fo Hint Print Mr. Meyers wishes to know how many shares are necessary to elect 4 directors out of 12 directors up for election in the Austin Power Company. There are 78,000 shares outstanding. (Do not round intermediate calculations.) Number of shares 3 Betsy Ross owns 951 shares in the Hanson Fabrics Company. There are 13 directors to be elected, and 37,500 shares outstanding. The firm has adopted cumulative voting. 1.73 points eBook f Hint Print a. How many total votes can be cast? (Do not round intermediate calculations and round your answer to the nearest whole number.) Total votes b. How many votes does Betsy control? (Do not round intermediate calculations and round your answer to the nearest whole number.) Votes c. What percentage of the total votes does she control? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Percentage of votes 4 1.73 points eBook 18 Hint Print Midland Petroleum is holding a stockholders' meeting next month. Ms. Ramsey is the president of the company and has the support of the existing board of directors. All 12 members of the board are up for reelection. Mr. Clark is a dissident stockholder. He controls proxies for 55,001 shares. Ms. Ramsey and her friends on the board control 65,001 shares. Other stockholders, whose loyalties are unknown, will be voting the remaining 24,998 shares. The company uses cumulative voting. a. How many directors can Mr. Clark be sure of electing? (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors b. How many directors can Ms. Ramsey and her friends be sure of electing? (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors c-1. How many directors could Mr. Clark elect if he obtains all the proxies for the uncommitted votes? (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors 4 1.73 points eBook f Hint C Print b. How many directors can Ms. Ramsey and her friends be sure of electing? (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors c-1. How many directors could Mr. Clark elect if he obtains all the proxies for the uncommitted votes? (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors c-2. Will he control the board? O Yes O No d. If nine directors were to be elected, and Ms. Ramsey and her friends had 81,001 shares and Mr. Clark had 61,001 shares plus half the uncommitted votes, how many directors could Mr. Clark elect? Assume the same number of total shares as the original question. (Do not round intermediate calculations. Round down your answer to the nearest whole number.) Number of directors LO 5 1.73 points eBook B Hint Print Rust Pipe Co. was established in 1994. Four years later the company went public. At that time, Robert Rust, the original owner, decided to establish two classes of stock. The first represents Class A founders' stock and is entitled to five votes per share. The normally traded common stock, designated as Class B, is entitled to one vote per share. In late 2010, Mr. Stone, an investor, was considering purchasing shares in Rust Pipe Co. While he knew the existence of founders' shares were not often present in other companies, he decided to buy the shares anyway because of a new technology Rust Pipe had developed to improve the flow of liquids through pipes. Of the 1,250,000 total shares currently outstanding, the original founder's family owns 51,425 shares. What is the percentage of the founder's family votes to Class B votes? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Percentage of votes 6 Mr. and Mrs. Anderson own five shares of Magic Tricks Corporation's common stock. The market value of the stock is $60. The Andersons also have $42 in cash. They have just received word of a rights offering. One new share of stock can be purchased at $42 for each five shares currently owned (based on five rights). (Do not round intermediate calculations and round your answers to the nearest whole dollar.) a. What is the value of a right? 1.73 points eBook 101 Hint Print Value per right b. What is the value of the Andersons' portfolio before the rights offering? (Portfolio in this question represents stock plus cash.) Portfolio value c-1. Compute the diluted value (ex-rights) per share. Diluted value c-2. If the Andersons participate in the rights offering, what will be the value of their portfolio, based on the diluted value (ex-rights) of the stock? Portfolio value 6 1.73 points eBook fot Hint Print b. What is the value of the Andersons' portfolio before the rights offering? (Portfolio in this question represents stock plus cash.) Portfolio value c-1. Compute the diluted value (ex-rights) per share. Diluted value c-2. If the Andersons participate in the rights offering, what will be the value of their portfolio, based on the diluted value (ex-rights) of the stock? Portfolio value d. If they sell their two rights but keep their stock at its diluted value and hold on to their cash, what will be the value of their portfolio? Portfolio value 7 1.73 points eBook B Hint G Print Walker Machine Tools has 7 million shares of common stock outstanding. The current market price of Walker common stock is $82 per share rights-on. The company's net income this year is $25.00 million. A rights offering has been announced in which 700,000 new shares will be sold at $76.50 per share. The subscription price plus seven rights is needed to buy one of the new shares. a. What are the earnings per share and price-earnings ratio before the new shares are sold via the rights offering? (Do not round intermediate calculations and round your answers to 2 decimal places.) Earnings per share Price-earnings ratio b. What would the earnings per share be immediately after the rights offering? What would the price-earnings ratio be immediately after the rights offering? (Assume there is no change in the market value of the stock, except for the change when the stock begins trading ex-rights.) (Do not round intermediate calculations and round your answers to 2 decimal places.) Earnings per share Price-earnings ratio 8 Enterprise Storage Company has 610,000 shares of cumulative preferred stock outstanding, which has a stated dividend of $7.65. It is six years in arrears in its dividend payments. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. 1.73 points eBook ti Hint Print a. How much in total dollars is the company behind in its payments? (Do not round intermediate calculations. Input your answer in dollars, not millions (e.g., $1,234,000).) Dividend in arrears b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D D D3 D4 $2.00 2.10 2.20 2.30 The company anticipates earnings per share after four years will be $4.26 with a P/E ratio of 15. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment banker is 12 percent. Compute the value of the common stock. (Do not round intermediate calculations and round your answer to 2 decimal places.) Common stock 8 1.73 points eBook B Hint Print Dividena in arrears b. The firm proposes to offer new common stock to the preferred stockholders to wipe out the deficit. The common stock will pay the following dividends over the next four years: D1 D D3 D4 $2.00 2.10 2.20 2.30 The company anticipates earnings per share after four years will be $4.26 with a P/E ratio of 15. The common stock will be valued as the present value of future dividends plus the present value of the future stock price after four years. The discount rate used by the investment banker is 12 percent. Compute the value of the common stock. (Do not round intermediate calculations and round your answer to 2 decimal places.) Common stock c. How many shares of common stock must be issued at the value computed in part b to eliminate the deficit (arrearage) computed in part a? (Do not round intermediate calculations and round your answer to the nearest whole share.) Number of shares of common stock

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Katie Homes and Garden Co has 14000000 shares outstanding The unfriendly outside group needs to acquire 2800000 shares 20 of 14000000 for the poison pill to go into effect 2 Mr Meyers needs to acqui...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started