Answered step by step

Verified Expert Solution

Question

1 Approved Answer

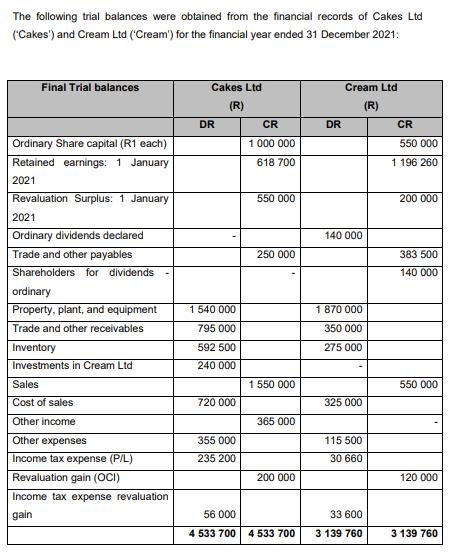

The following trial balances were obtained from the financial records of Cakes Ltd ('Cakes') and Cream Ltd ('Cream') for the financial year ended 31

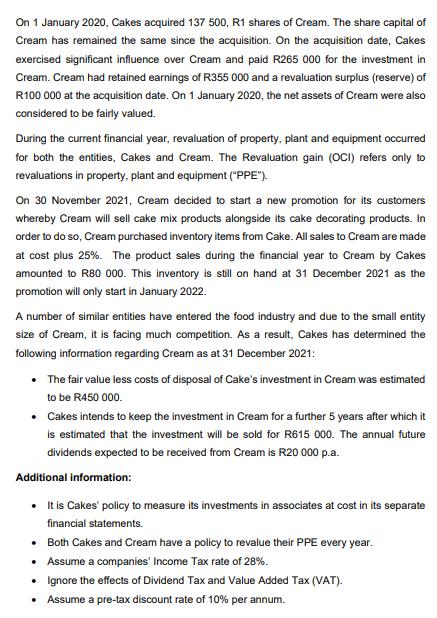

The following trial balances were obtained from the financial records of Cakes Ltd ('Cakes') and Cream Ltd ('Cream') for the financial year ended 31 December 2021: Final Trial balances Ordinary Share capital (R1 each) Retained earnings: 1 January 2021 Revaluation Surplus: 1 January 2021 Ordinary dividends declared Trade and other payables Shareholders for dividends ordinary Property, plant, and equipment Trade and other receivables Inventory Investments in Cream Ltd Sales Cost of sales Other income Other expenses Income tax expense (P/L) Revaluation gain (OCI) Income tax expense revaluation gain Cakes Ltd (R) DR 1 540 000 795 000 592 500 240 000 720 000 355 000 235 200 CR 1 000 000 618 700 550 000 250 000 1 550 000 365 000 200 000 56 000 4 533 700 4 533 700 DR Cream Ltd (R) 140 000 1 870 000 350 000 275 000 325 000 115 500 30 660 33 600 3 139 760 CR 550 000 1 196 260 200 000 383 500 140 000 550 000 120 000 3 139 760 On 1 January 2020, Cakes acquired 137 500, R1 shares of Cream. The share capital of Cream has remained the same since the acquisition. On the acquisition date, Cakes exercised significant influence over Cream and paid R265 000 for the investment in Cream. Cream had retained earnings of R355 000 and a revaluation surplus (reserve) of R100 000 at the acquisition date. On 1 January 2020, the net assets of Cream were also considered to be fairly valued. During the current financial year, revaluation of property, plant and equipment occurred for both the entities, Cakes and Cream. The Revaluation gain (OCI) refers only to revaluations in property, plant and equipment ("PPE"). On 30 November 2021, Cream decided to start a new promotion for its customers whereby Cream will sell cake mix products alongside its cake decorating products. In order to do so, Cream purchased inventory items from Cake. All sales to Cream are made at cost plus 25%. The product sales during the financial year to Cream by Cakes amounted to R80 000. This inventory is still on hand at 31 December 2021 as the promotion will only start in January 2022. A number of similar entities have entered the food industry and due to the small entity size of Cream, it is facing much competition. As a result, Cakes has determined the following information regarding Cream as at 31 December 2021: The fair value less costs of disposal of Cake's investment in Cream was estimated to be R450 000. Cakes intends to keep the investment in Cream for a further 5 years after which it is estimated that the investment will be sold for R615 000. The annual future dividends expected to be received from Cream is R20 000 p.a. Additional information: It is Cakes' policy to measure its investments in associates at cost in its separate financial statements. . Both Cakes and Cream have a policy to revalue their PPE every year. Assume a companies' Income Tax rate of 28%. Ignore the effects of Dividend Tax and Value Added Tax (VAT). Assume a pre-tax discount rate of 10% per annum. REQUIRED: Prepare the pro forma journal entries to equity account for Cakes' investment in Cream for the financial year ended 31 December 2021. Dates and narrations are not required. (30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The question asks to prepare pro forma journal entries to equity account for Cakes Ltds investment in Cream Ltd for the financial year ended 31 Decemb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started