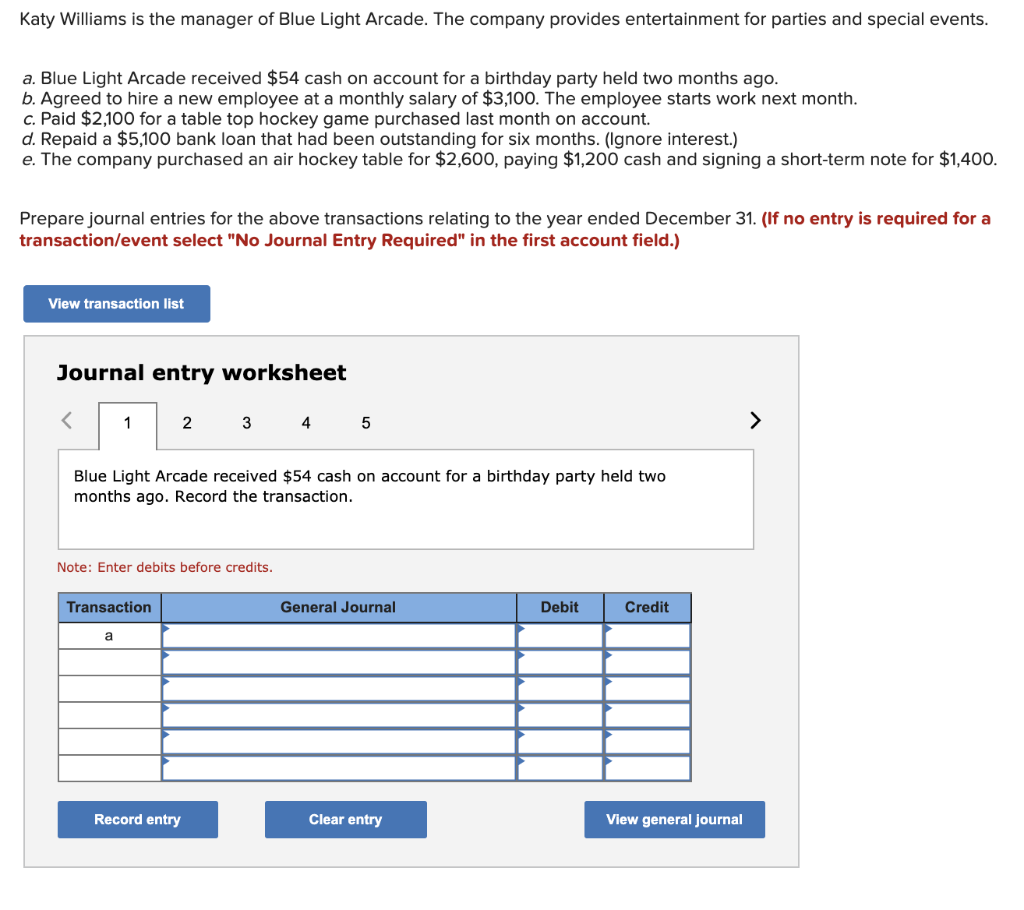

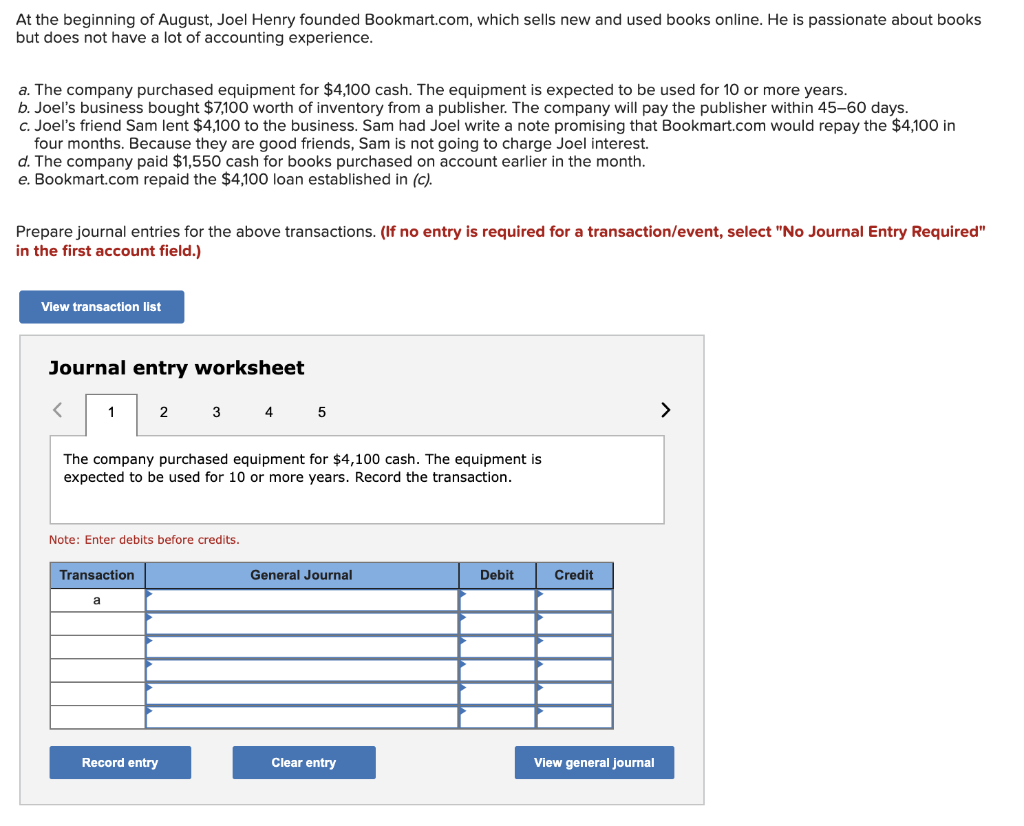

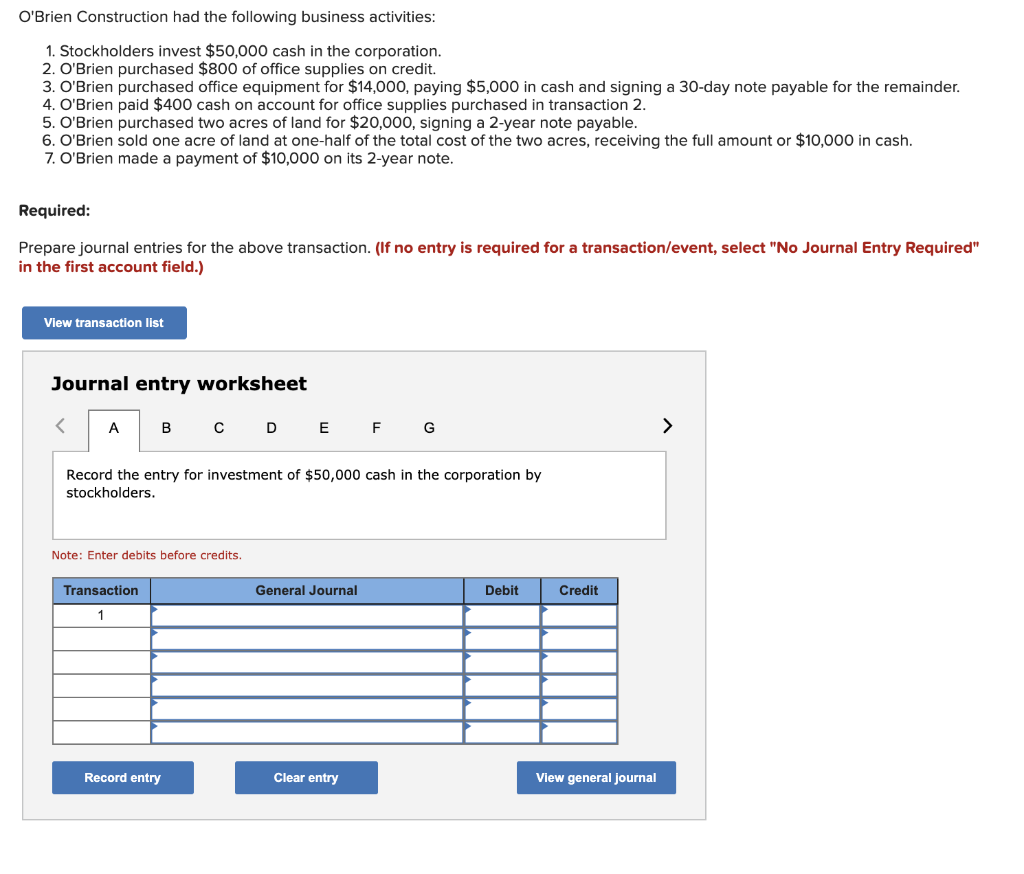

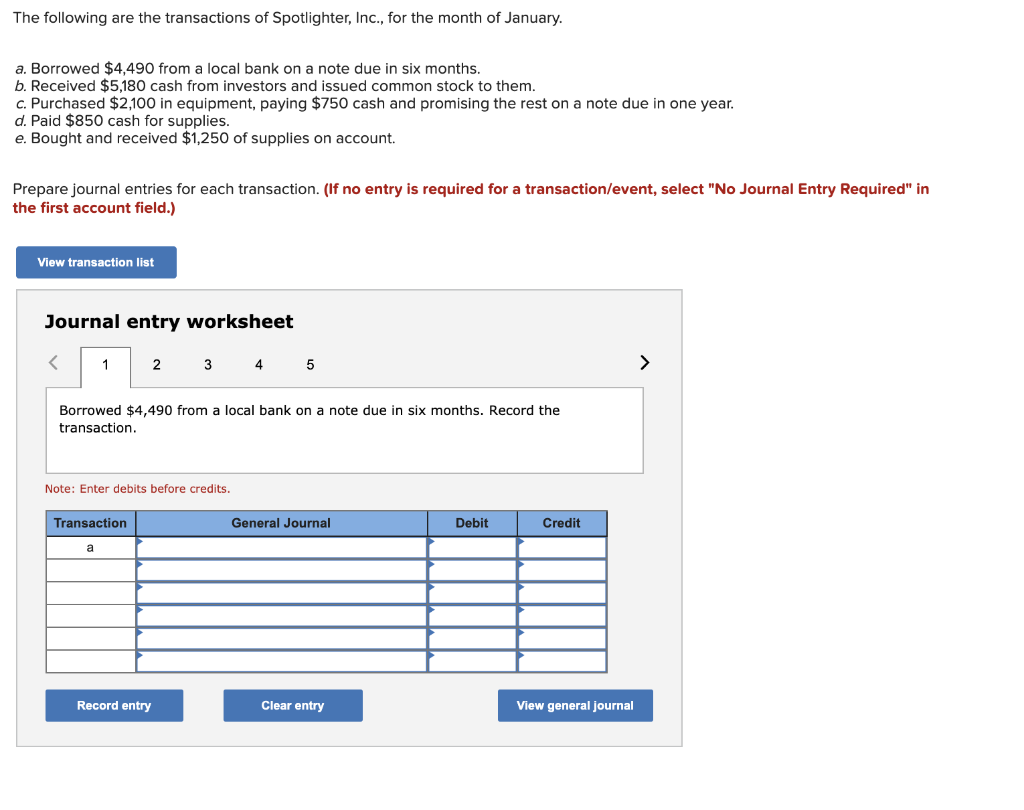

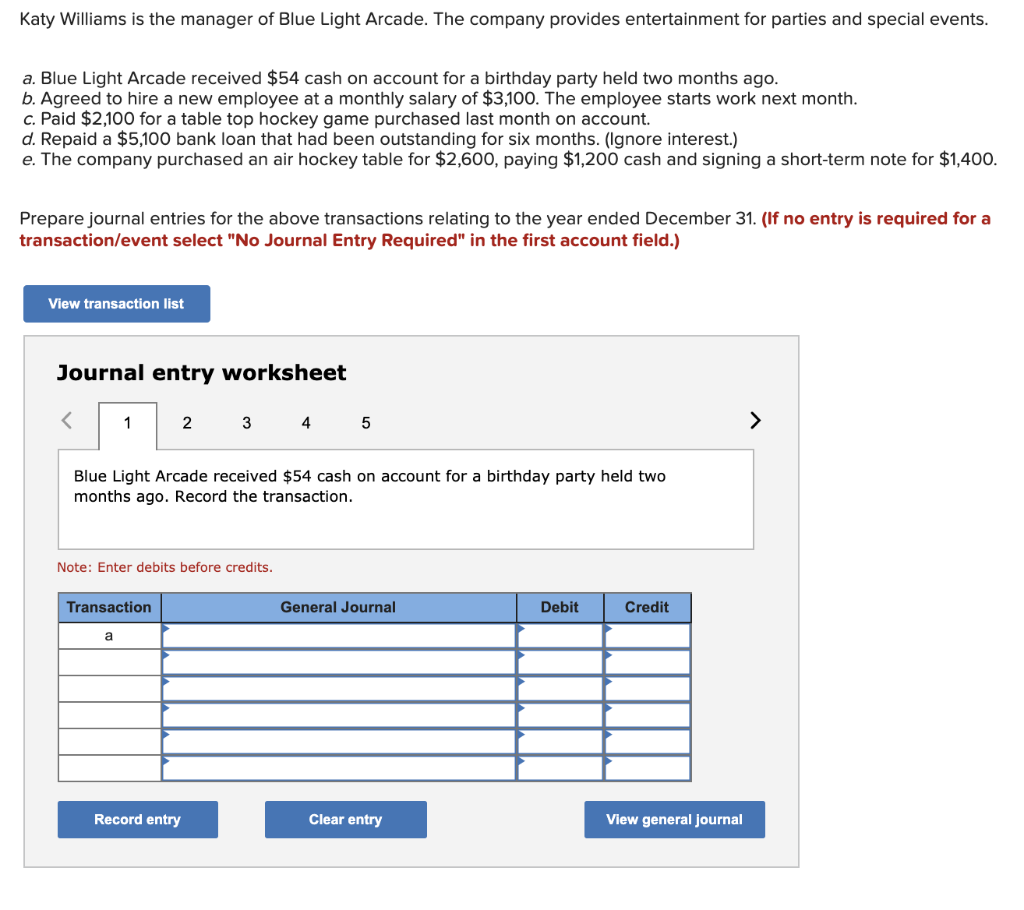

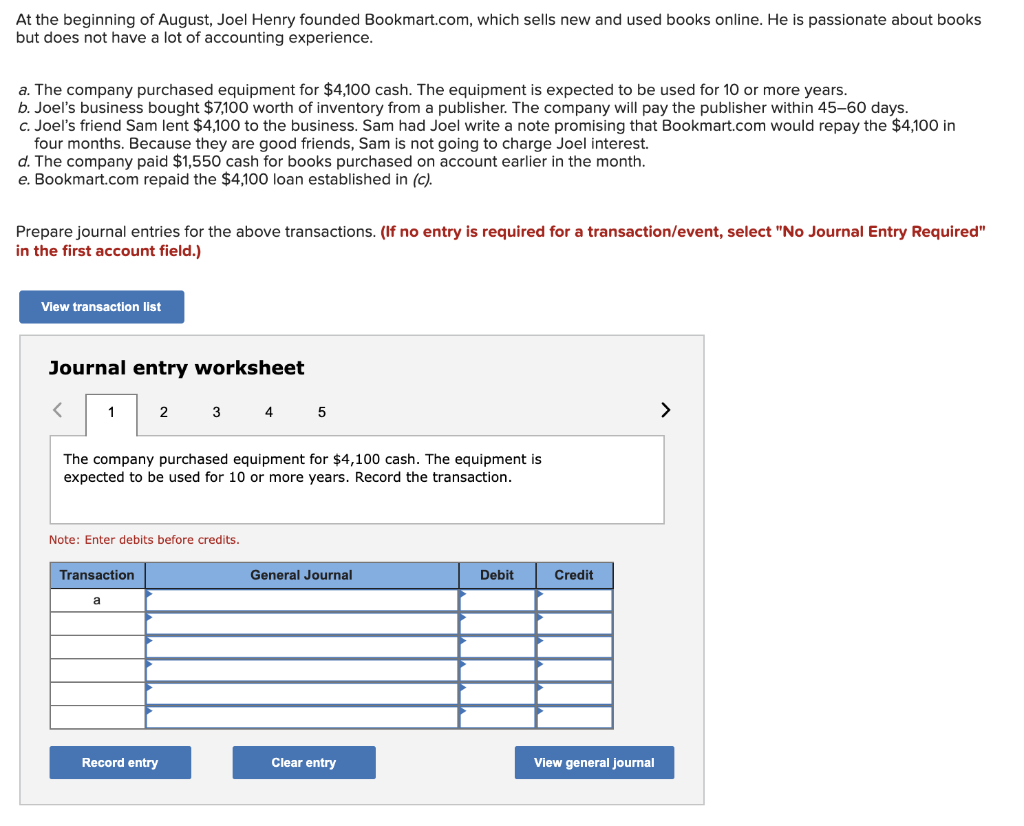

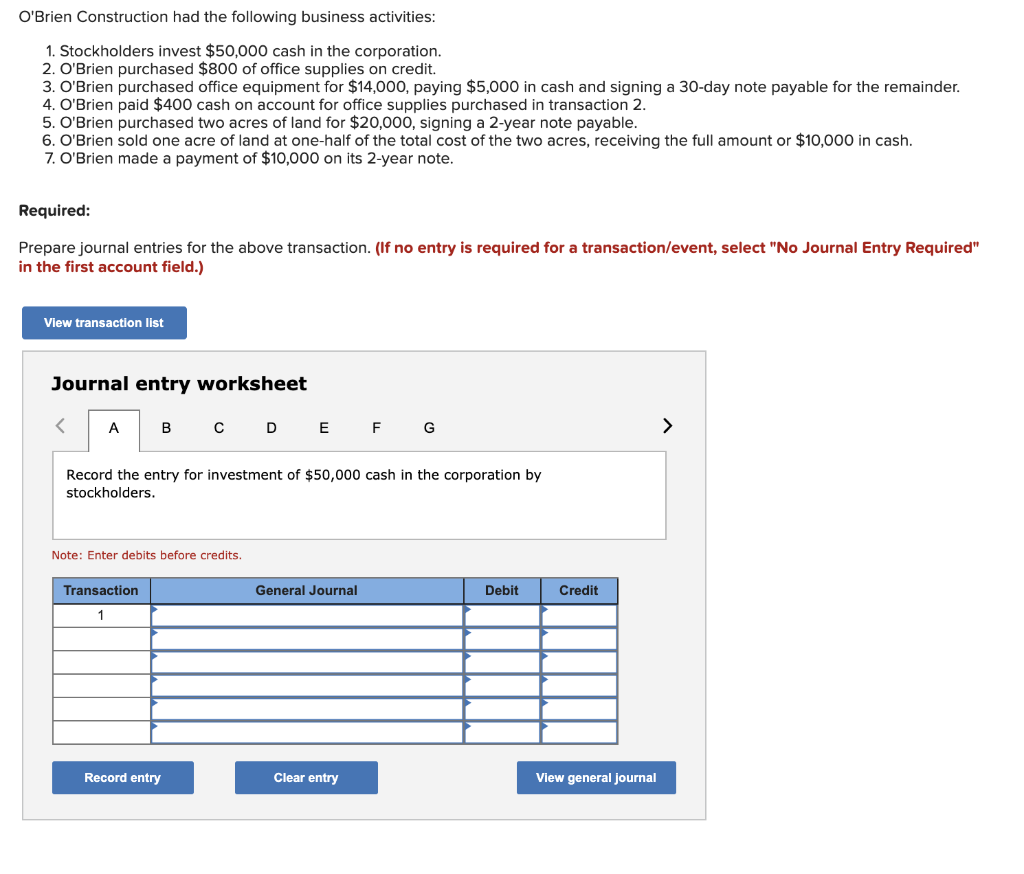

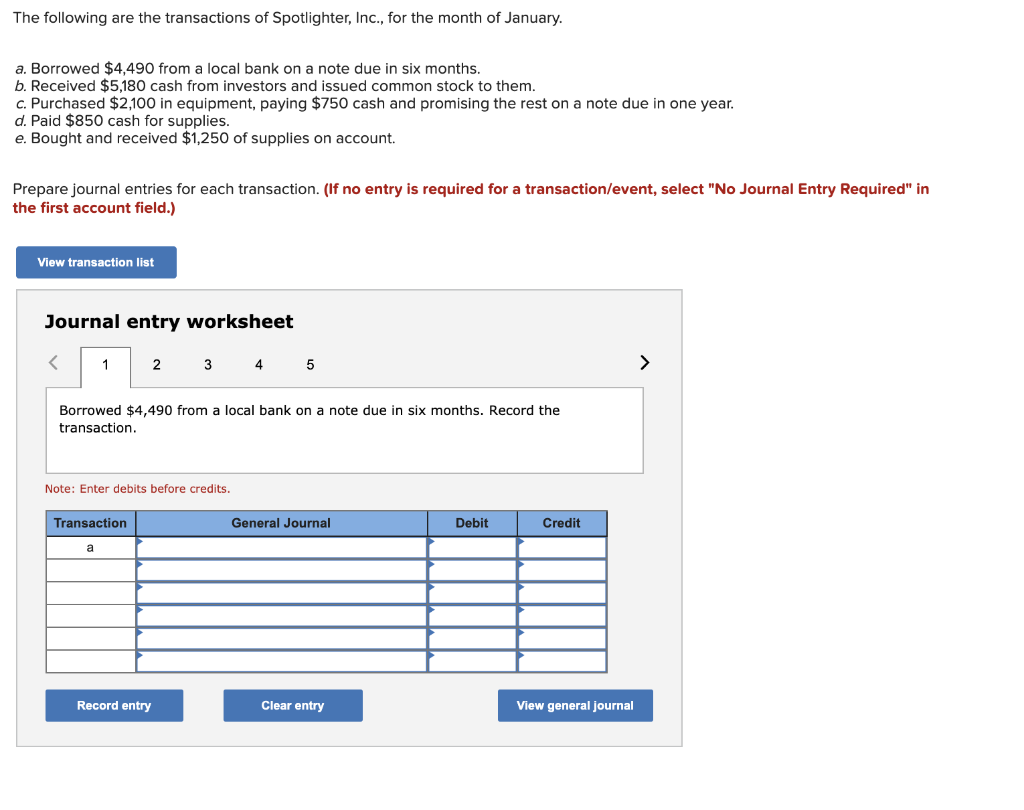

Katy Williams is the manager of Blue Light Arcade. The company provides entertainment for parties and special events. a. Blue Light Arcade received $54 cash on account for a birthday party held two months ago. b. Agreed to hire a new employee at a monthly salary of $3,100. The employee starts work next month. c. Paid $2,100 for a table top hockey game purchased last month on account. d. Repaid a $5,100 bank loan that had been outstanding for six months. (Ignore interest.) e. The company purchased an air hockey table for $2,600, paying $1,200 cash and signing a short-term note for $1,400. Prepare journal entries for the above transactions relating to the year ended December 31. (If no entry is required for a transaction/event select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Blue Light Arcade received $54 cash on account for a birthday party held two months ago. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal At the beginning of August, Joel Henry founded Bookmart.com, which sells new and used books online. He is passionate about books but does not have a lot of accounting experience. a. The company purchased equipment for $4,100 cash. The equipment is expected to be used for 10 or more years. b. Joel's business bought $7,100 worth of inventory from a publisher. The company will pay the publisher within 45-60 days. c. Joel's friend Sam lent $4,100 to the business. Sam had Joel write a note promising that Bookmart.com would repay the $4,100 in four months. Because they are good friends, Sam is not going to charge Joel interest. d. The company paid $1,550 cash for books purchased on account earlier in the month. e. Bookmart.com repaid the $4,100 loan established in (c). Prepare journal entries for the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet The company purchased equipment for $4,100 cash. The equipment is expected to be used for 10 or more years. Record the transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general journal O'Brien Construction had the following business activities: 1. Stockholders invest $50,000 cash in the corporation. 2. O'Brien purchased $800 of office supplies on credit. 3. O'Brien purchased office equipment for $14,000, paying $5,000 in cash and signing a 30-day note payable for the remainder. 4. O'Brien paid $400 cash on account for office supplies purchased in transaction 2. 5. O'Brien purchased two acres of land for $20,000, signing a 2-year note payable. 6. O'Brien sold one acre of land at one-half of the total cost of the two acres, receiving the full amount or $10,000 in cash. 7. O'Brien made a payment of $10,000 on its 2-year note. Required: Prepare journal entries for the above transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the entry for investment of $50,000 cash in the corporation by stockholders. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journal The following are the transactions of Spotlighter, Inc., for the month of January. a. Borrowed $4,490 from a local bank on a note due in six months. b. Received $5,180 cash from investors and issued common stock to them. C. Purchased $2,100 in equipment, paying $750 cash and promising the rest on a note due in one year. d. Paid $850 cash for supplies. e. Bought and received $1,250 of supplies on account. Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet local bank on a note due in six months. Record the Borrowed $4,490 from transaction. Note: Enter debits before credits. Transaction General Journal Debit Credit a Record entry Clear entry View general Journal