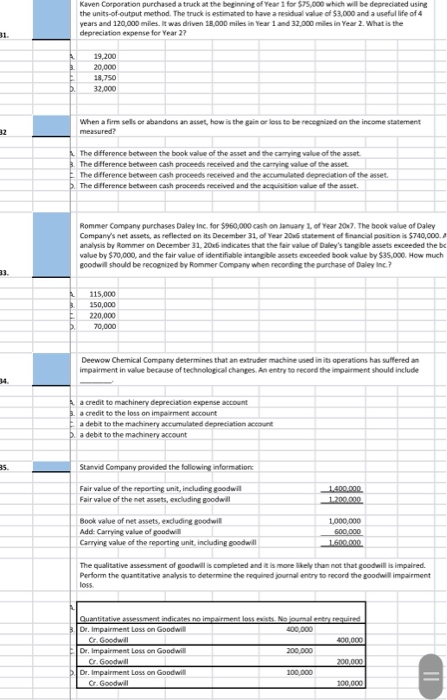

Kaven Corporation purchased a truck at the beginning of Year 1 for $75.which will be depreciated using the units of output method. The truck is estimated to have a residual of $2.000 and a selfie of 4 years and 120.000 miles. It was driven 1 000 miles in urd 12000 Year What is the depreciation expense for Year 27 19,200 20 000 1.750 or abandonanthesis the girls to be read on the income statement When a firm measured The difference between the book value of these and the camping of the The difference between cash proceeds received and the carrying Value of the The difference between cash proceeds received and the counted depreciation of the The difference between cash proceeds received and the acquisition value of the asset set Rommer Company purchases Daley inc. for 960.000 cash onl y of Year 2017. The book value of Daley Company's net assets, as reflected on its December 31. of Year 2016 mentofacial position is $740,000 analysis by Rommer on December 31 20 indicates that the wall of Duty's tangible w ewceeded the be value by $70,000, and the fair value of identifiable anbeste ded book value by S5 000. How much goodwill should be recognized by Rommer Company when recording the purchase of Daleyinc.? 115,000 150,000 220,000 70,000 Deewow Chemical Company determines that an extruder machine wed in its operations has suffered an impairment in value because of technolopical changes. An entry to record the impairment should include a credit to machinery depreciation expense account a credit to the loss on impairment account a debit to the machinery accumulated depreciation account Da debit to the machinery account Stanvid Company provided the following information Fair value of the reporting unit, including goodwill Fair value of the new s, excluding goodwill LARRA 12 1.000.000 Book value of net assets, excluding goodwill Add: Carrying value of goodwill Carrying value of the reporting unit including soda The qualitative assessment of goods come and more than not that go e d Perform the quantitative analysis to determine the required journal entry to record the goodwill impairment o required Louitative indicati Demparent Loss on Goodwil O Goodwill Dr. Impairment loss on Goodwil 600 l 200.00 De Impairment Loss on Goodwill O Goodal 900.000