Answered step by step

Verified Expert Solution

Question

1 Approved Answer

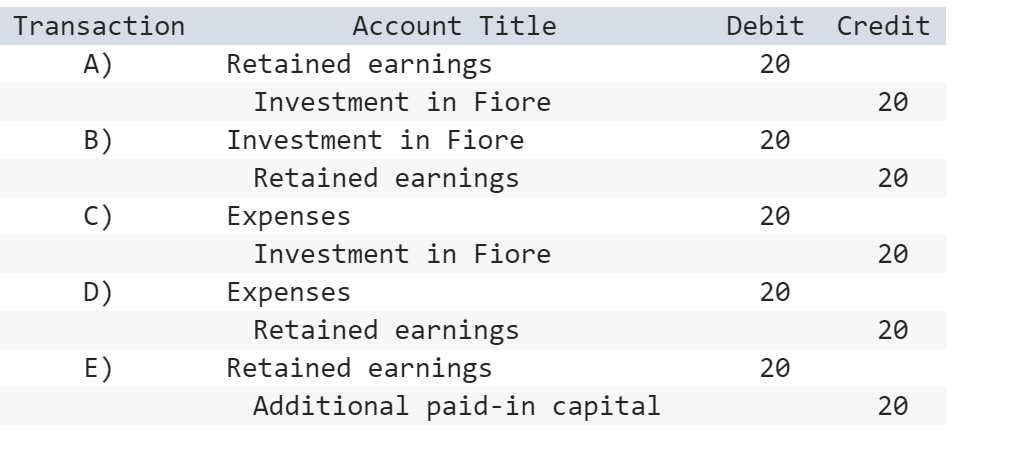

Kaye Company acquired 100% of Fiore Company on January 1, 2024. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20

Kaye Company acquired 100% of Fiore Company on January 1, 2024. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2024 and paid dividends of $100.

Assume the partial equity method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes, but is not required for the equity method?

TransactionA)ExpensesInvestmentinFioreC)D)E)AccountTitleRetainedearningsInvestmentinFioreInvestmentinFioreRetainedearnings2020ExpensesRetainedearningsRetainedearningsAdditionalpaid-incapitalDebit20202020Credit202020

TransactionA)ExpensesInvestmentinFioreC)D)E)AccountTitleRetainedearningsInvestmentinFioreInvestmentinFioreRetainedearnings2020ExpensesRetainedearningsRetainedearningsAdditionalpaid-incapitalDebit20202020Credit202020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started