Answered step by step

Verified Expert Solution

Question

1 Approved Answer

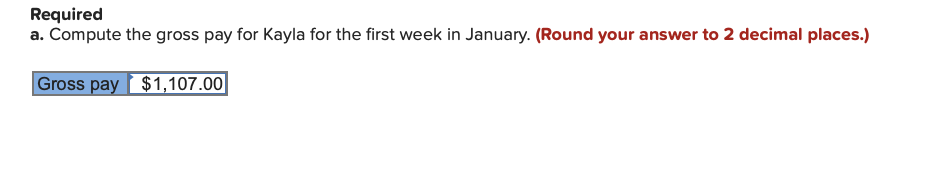

Kayla earns $26 per hour and 1 times her regular rate for hours over 40 per week. Kayla worked 49 hours the first week in

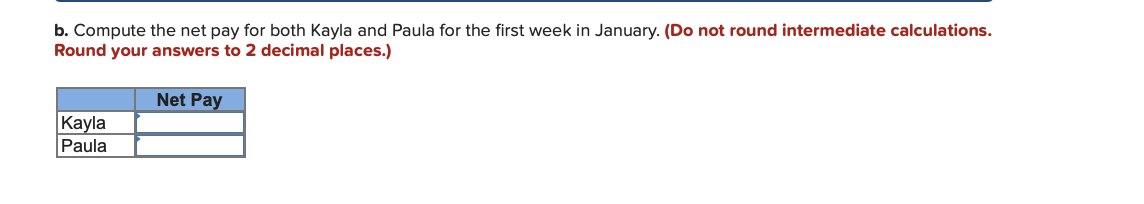

- Kayla earns $26 per hour and 1 times her regular rate for hours over 40 per week. Kayla worked 49 hours the first week in January. Kaylas federal income tax withholding is equal to 10 percent of her gross pay. Webber pays medical insurance of $95 per week for Kayla and contributes $50 per week to a retirement plan for her.

- Paula earns a weekly salary of $1,450. Paulas federal income tax withholding is 15 percent of her gross pay. Webber pays medical insurance of $105 per week for Paula and contributes $120 per week to a retirement plan for her.

- Vacation pay is accrued at the rate of 2 hours per week (based on the regular pay rate) for Kayla and $85 per week for Paula.

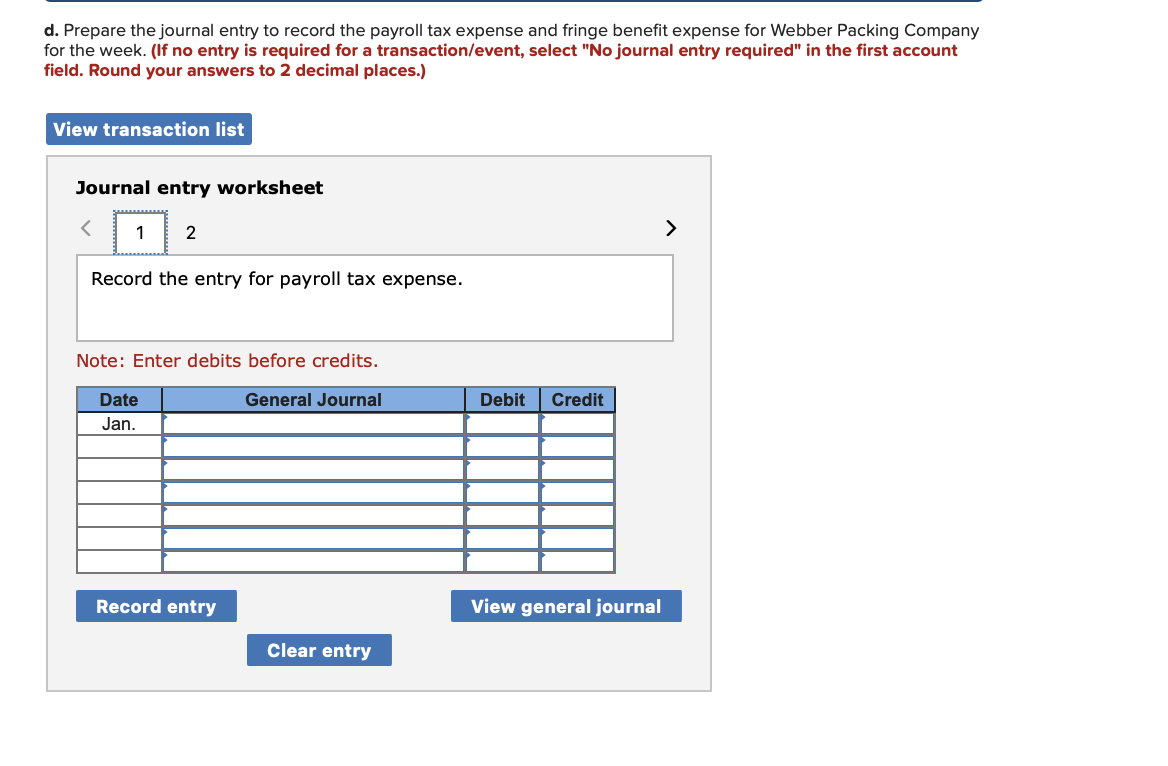

Assume the Social Security tax rate is 6.0 percent on the first $110,000 of salaries and the Medicare tax rate is 1.5 percent of total salaries. The state unemployment tax rate is 5.4 percent and the federal unemployment tax rate is 0.6 percent of the first $7,000 of salary for each employee.

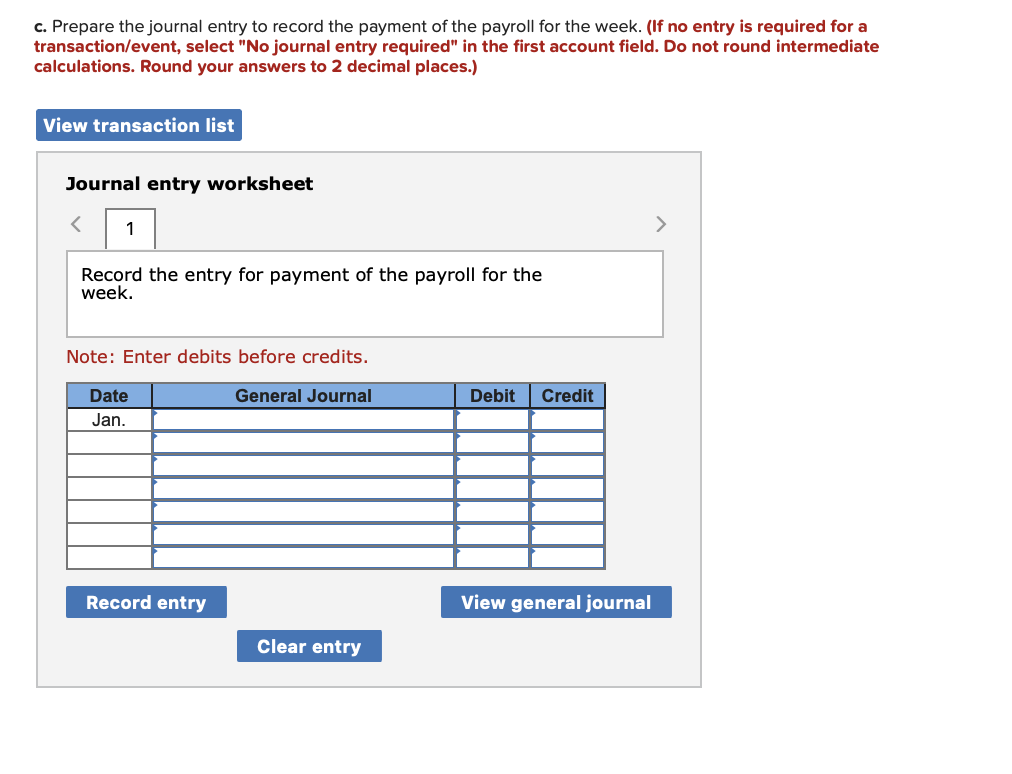

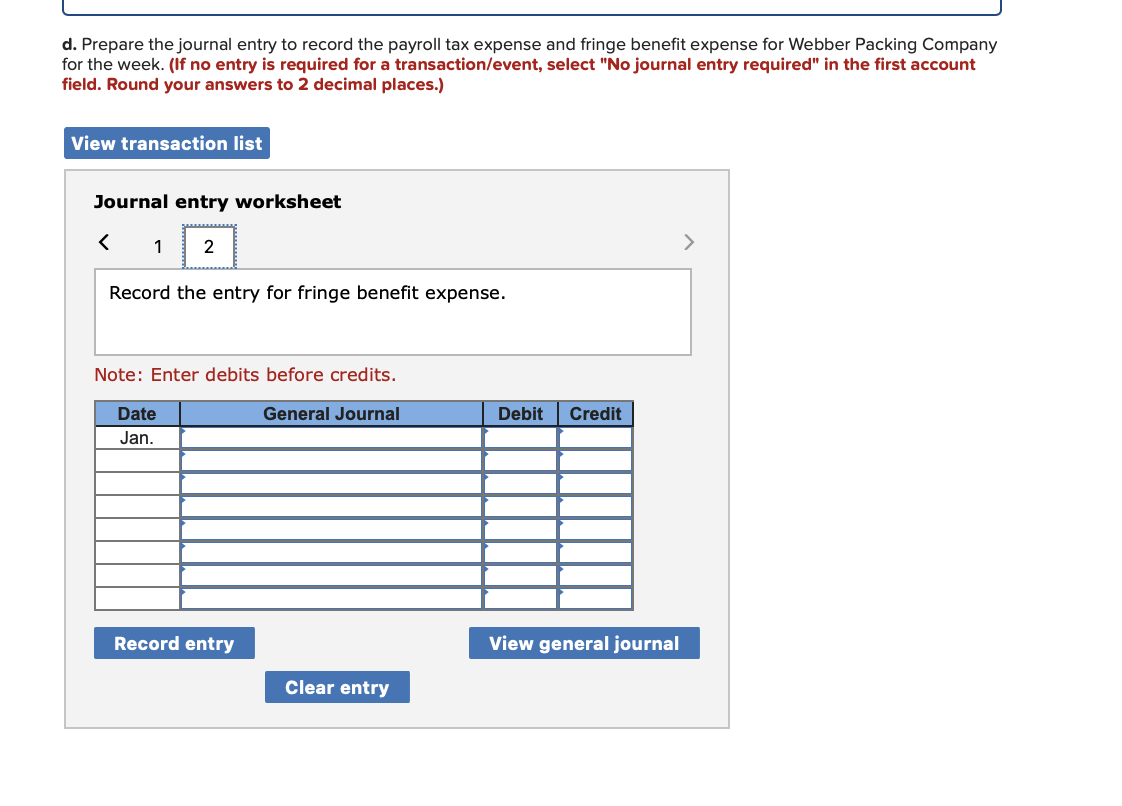

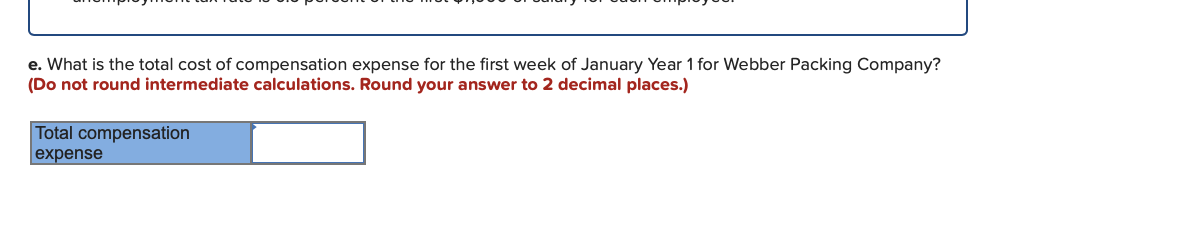

Required a. Compute the gross pay for Kayla for the first week in January. (Round your answer to 2 decimal places.) b. Compute the net pay for both Kayla and Paula for the first week in January. (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Prepare the journal entry to record the payment of the payroll for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payment of the payroll for the week. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for fringe benefit expense. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payroll tax expense. Note: Enter debits before credits. e. What is the total cost of compensation expense for the first week of January Year 1 for Webber Packing Company? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Required a. Compute the gross pay for Kayla for the first week in January. (Round your answer to 2 decimal places.) b. Compute the net pay for both Kayla and Paula for the first week in January. (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Prepare the journal entry to record the payment of the payroll for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payment of the payroll for the week. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for fringe benefit expense. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payroll tax expense. Note: Enter debits before credits. e. What is the total cost of compensation expense for the first week of January Year 1 for Webber Packing Company? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Required a. Compute the gross pay for Kayla for the first week in January. (Round your answer to 2 decimal places.) b. Compute the net pay for both Kayla and Paula for the first week in January. (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Prepare the journal entry to record the payment of the payroll for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payment of the payroll for the week. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for fringe benefit expense. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payroll tax expense. Note: Enter debits before credits. e. What is the total cost of compensation expense for the first week of January Year 1 for Webber Packing Company? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Required a. Compute the gross pay for Kayla for the first week in January. (Round your answer to 2 decimal places.) b. Compute the net pay for both Kayla and Paula for the first week in January. (Do not round intermediate calculations. Round your answers to 2 decimal places.) c. Prepare the journal entry to record the payment of the payroll for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payment of the payroll for the week. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for fringe benefit expense. Note: Enter debits before credits. d. Prepare the journal entry to record the payroll tax expense and fringe benefit expense for Webber Packing Company for the week. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) Journal entry worksheet Record the entry for payroll tax expense. Note: Enter debits before credits. e. What is the total cost of compensation expense for the first week of January Year 1 for Webber Packing Company? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started