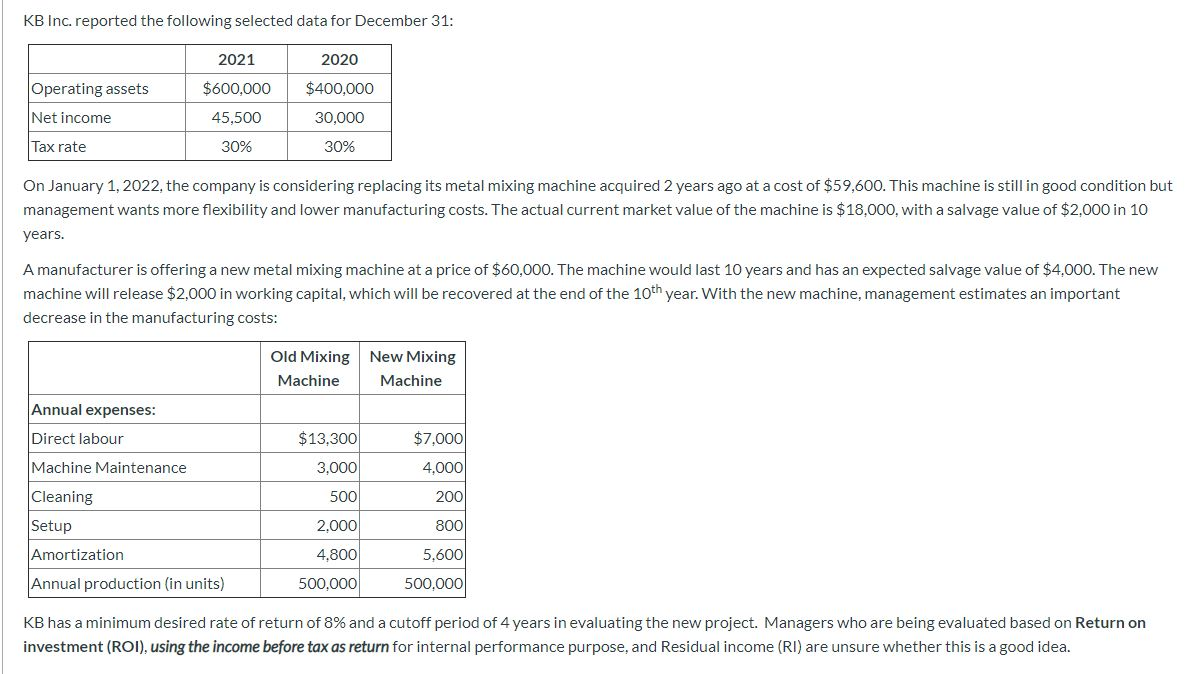

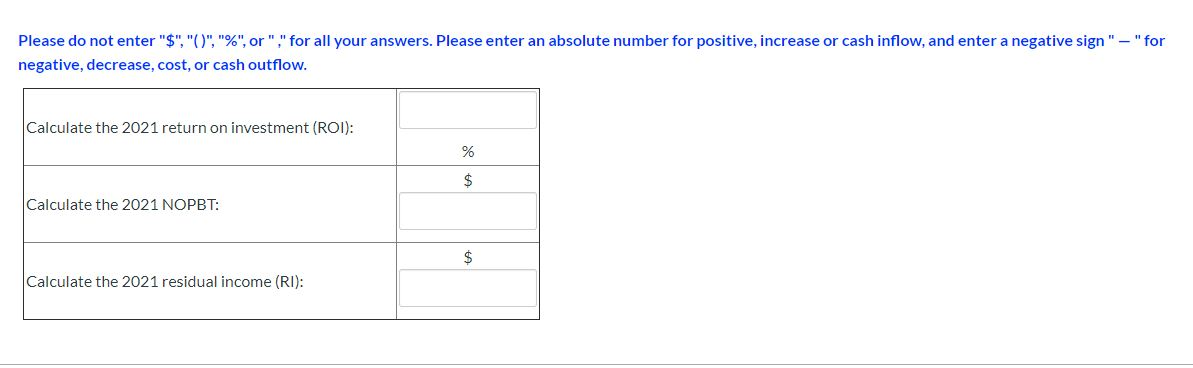

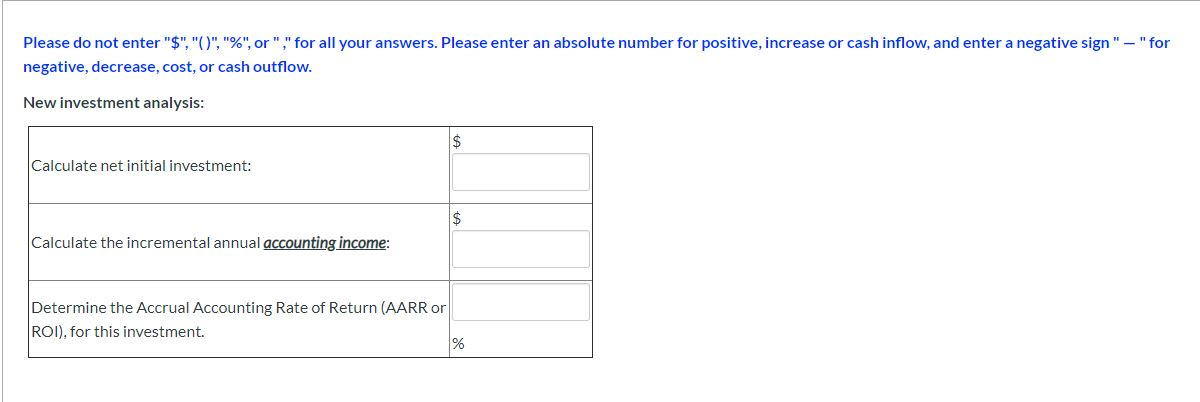

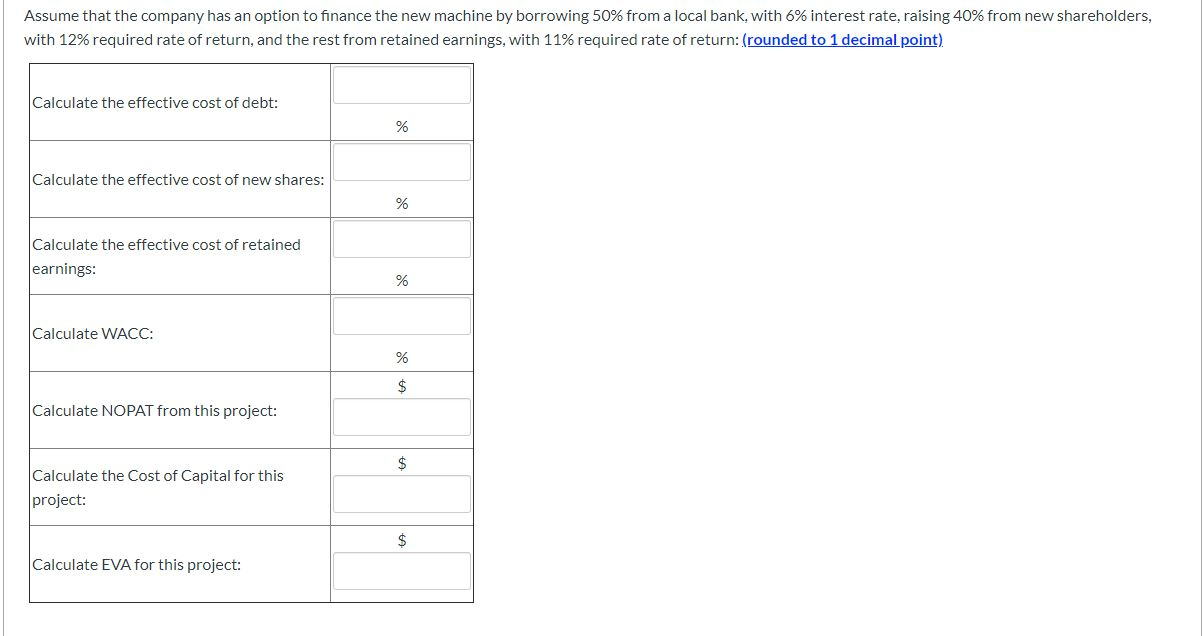

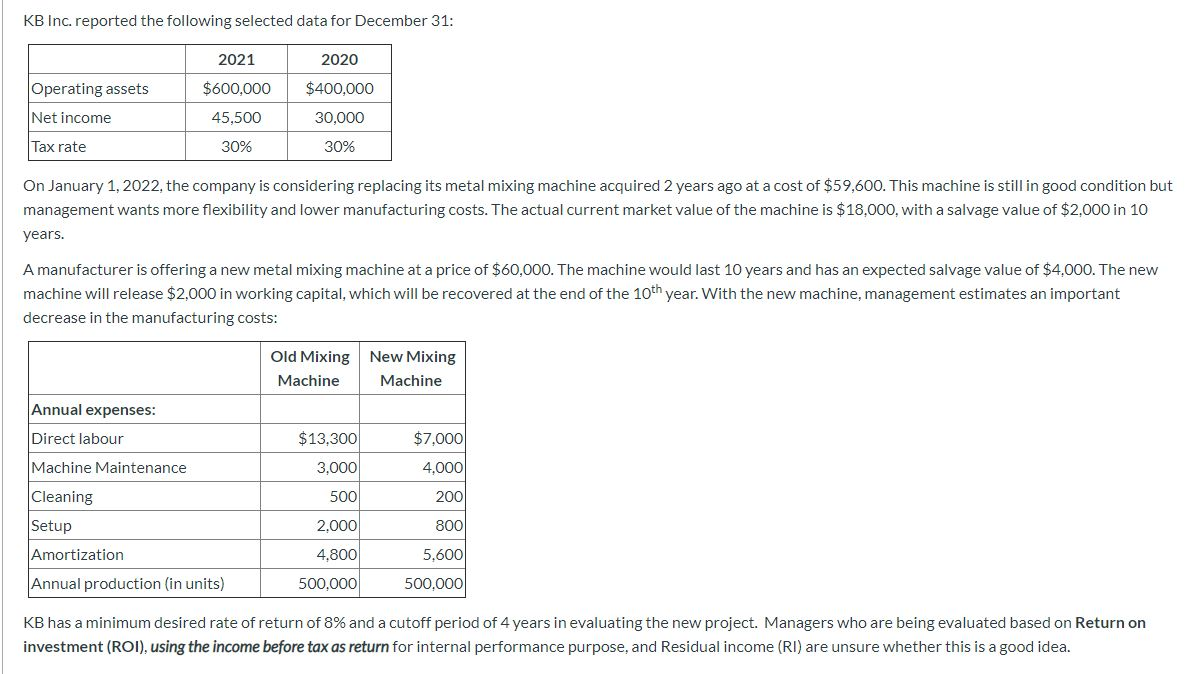

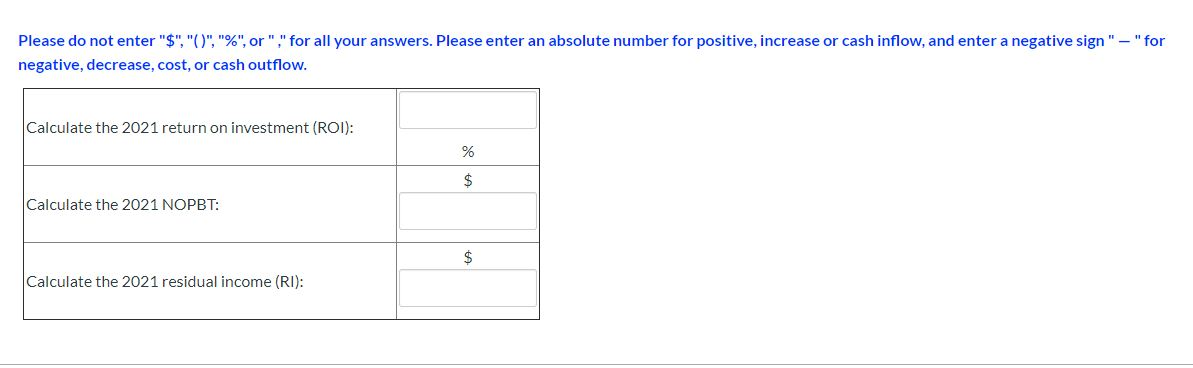

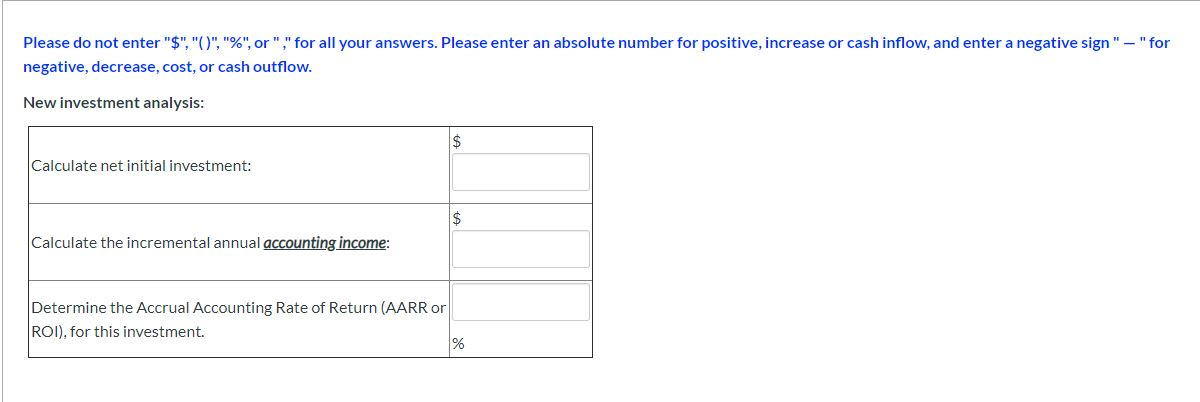

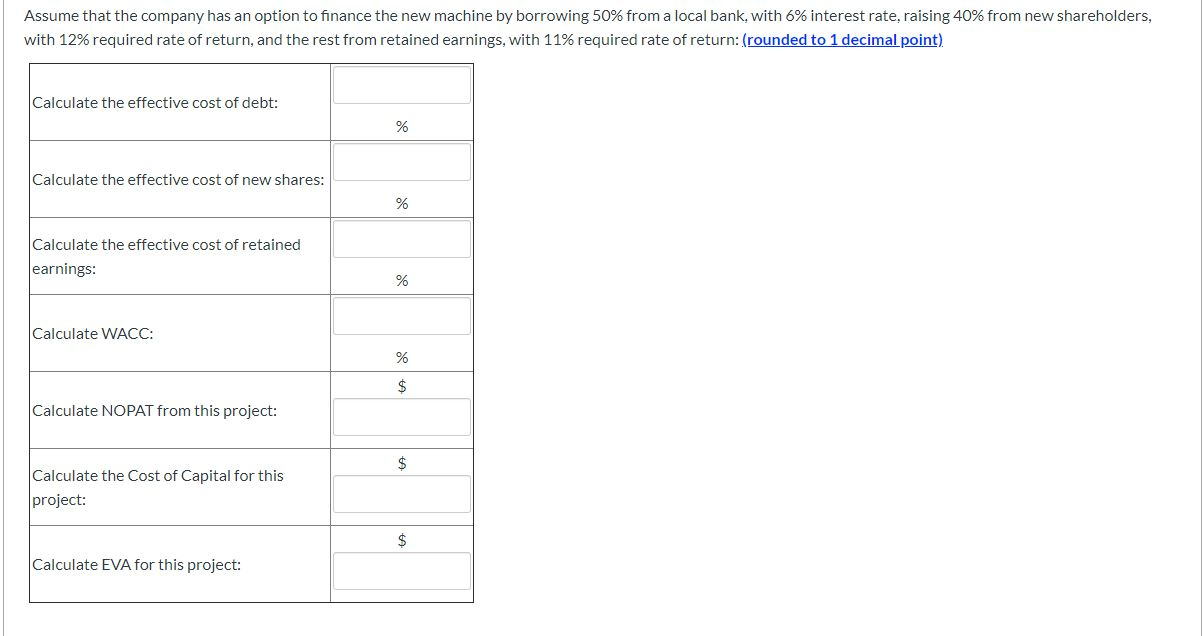

KB Inc. reported the following selected data for December 31: 2021 2020 Operating assets $600.000 $400,000 Net income 45,500 30,000 Tax rate 30% 30% On January 1, 2022, the company is considering replacing its metal mixing machine acquired 2 years ago at a cost of $59,600. This machine is still in good condition but management wants more flexibility and lower manufacturing costs. The actual current market value of the machine is $18,000, with a salvage value of $2,000 in 10 years. A manufacturer is offering a new metal mixing machine at a price of $60,000. The machine would last 10 years and has an expected salvage value of $4,000. The new machine will release $2,000 in working capital, which will be recovered at the end of the 10th year. With the new machine, management estimates an important decrease in the manufacturing costs: Old Mixing New Mixing Machine Machine Annual expenses: Direct labour $13,300 $7,000 Machine Maintenance 4,000 3,000 500 200 Cleaning Setup 2.000 800 Amortization 4.800 5,600 Annual production (in units) 500,000 500,000 KB has a minimum desired rate of return of 8% and a cutoff period of 4 years in evaluating the new project. Managers who are being evaluated based on Return on investment (ROI), using the income before tax as return for internal performance purpose, and Residual income (RI) are unsure whether this is a good idea. Please do not enter "$", "0", "%", or ","for all your answers. Please enter an absolute number for positive, increase or cash inflow, and enter a negative sign" - "for negative, decrease, cost, or cash outflow. Calculate the 2021 return on investment (ROI): % $ Calculate the 2021 NOPBT: $ Calculate the 2021 residual income (RI): Please do not enter "$", "O", "%", or ","for all your answers. Please enter an absolute number for positive, increase or cash inflow, and enter a negative sign" - "for negative, decrease, cost, or cash outflow. New investment analysis: $ Calculate net initial investment: $ Calculate the incremental annual accounting income: Determine the Accrual Accounting Rate of Return (AARR or ROI), for this investment. % Assume that the company has an option to finance the new machine by borrowing 50% from a local bank, with 6% interest rate, raising 40% from new shareholders, with 12% required rate of return, and the rest from retained earnings, with 11% required rate of return: (rounded to 1 decimal point) Calculate the effective cost of debt: % Calculate the effective cost of new shares: % Calculate the effective cost of retained earnings: % Calculate WACC: % $ Calculate NOPAT from this project: $ Calculate the cost of Capital for this project: $ Calculate EVA for this project: KB Inc. reported the following selected data for December 31: 2021 2020 Operating assets $600.000 $400,000 Net income 45,500 30,000 Tax rate 30% 30% On January 1, 2022, the company is considering replacing its metal mixing machine acquired 2 years ago at a cost of $59,600. This machine is still in good condition but management wants more flexibility and lower manufacturing costs. The actual current market value of the machine is $18,000, with a salvage value of $2,000 in 10 years. A manufacturer is offering a new metal mixing machine at a price of $60,000. The machine would last 10 years and has an expected salvage value of $4,000. The new machine will release $2,000 in working capital, which will be recovered at the end of the 10th year. With the new machine, management estimates an important decrease in the manufacturing costs: Old Mixing New Mixing Machine Machine Annual expenses: Direct labour $13,300 $7,000 Machine Maintenance 4,000 3,000 500 200 Cleaning Setup 2.000 800 Amortization 4.800 5,600 Annual production (in units) 500,000 500,000 KB has a minimum desired rate of return of 8% and a cutoff period of 4 years in evaluating the new project. Managers who are being evaluated based on Return on investment (ROI), using the income before tax as return for internal performance purpose, and Residual income (RI) are unsure whether this is a good idea. Please do not enter "$", "0", "%", or ","for all your answers. Please enter an absolute number for positive, increase or cash inflow, and enter a negative sign" - "for negative, decrease, cost, or cash outflow. Calculate the 2021 return on investment (ROI): % $ Calculate the 2021 NOPBT: $ Calculate the 2021 residual income (RI): Please do not enter "$", "O", "%", or ","for all your answers. Please enter an absolute number for positive, increase or cash inflow, and enter a negative sign" - "for negative, decrease, cost, or cash outflow. New investment analysis: $ Calculate net initial investment: $ Calculate the incremental annual accounting income: Determine the Accrual Accounting Rate of Return (AARR or ROI), for this investment. % Assume that the company has an option to finance the new machine by borrowing 50% from a local bank, with 6% interest rate, raising 40% from new shareholders, with 12% required rate of return, and the rest from retained earnings, with 11% required rate of return: (rounded to 1 decimal point) Calculate the effective cost of debt: % Calculate the effective cost of new shares: % Calculate the effective cost of retained earnings: % Calculate WACC: % $ Calculate NOPAT from this project: $ Calculate the cost of Capital for this project: $ Calculate EVA for this project