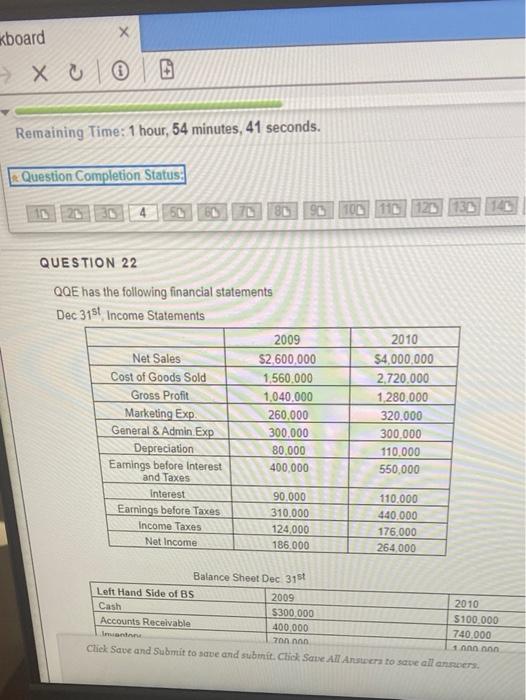

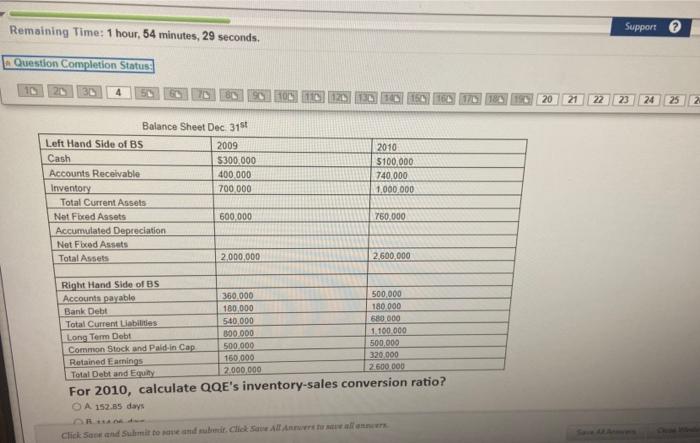

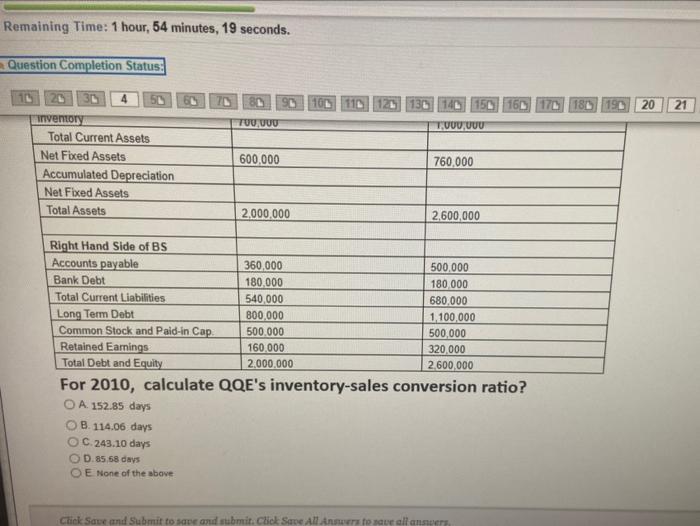

kboard > X X 0 0 Remaining Time: 1 hour, 54 minutes, 41 seconds. Question Completion Status: 90 100 110 120 130 TL QUESTION 22 QQE has the following financial statements Dec 31st Income Statements 2009 Net Sales $2,600,000 Cost of Goods Sold 1,560.000 Gross Profit 1,040.000 Marketing Exp. 260,000 General & Admin Exp 300.000 Depreciation 80.000 Earnings before Interest 400,000 and Taxes Interest 90.000 Earnings before Taxes 310.000 Income Taxes 124,000 Net Income 186 000 2010 $4,000,000 2.720.000 1.280,000 320.000 300.000 110.000 550.000 110.000 440.000 176.000 264.000 Balance Sheet Dec 315 Left Hand Side of BS 2009 2010 Cash $300.000 $100.000 Accounts Receivable 400.000 740.000 Invente 70 1 on na Click Save and submit to save and submit. Chok Save All Anse to our aller Remaining Time: 1 hour, 54 minutes, 29 seconds. Support @ Question Completion Status: 20 21 22 23 24 25 Balance Sheet Dec 315! Left Hand Side of BS 2009 Cash 5300.000 Accounts Receivable 400 000 Inventory 700 000 Total Current Assets Net Fored Assets 600,000 Accumulated Depreciation Net Fbced Assets Total Assets 2,000,000 2010 5100 000 740,000 1.000.000 750,000 2600,000 Right Hand Side of BS Accounts payable 360.000 500.000 Bank Debt 180 000 180.000 Total Current Liabilities 540 000 680 000 Long Term Debt B00 000 1.100.000 Common Stock and Pald-in Cap 500 000 500.000 Retained Eminos 150 000 320 000 Total Debt and Equity 2.000.000 2.600 000 For 2010, calculate QQE's inventory-sales conversion ratio? O A 152.55 days Click on and Submit to me and be. Click Save Antal Remaining Time: 1 hour, 54 minutes, 19 seconds. Question Completion Status: 4 50 140 20 21 TUUUUU TUUUUUU inventory Total Current Assets Net Fixed Assets Accumulated Depreciation Net Fixed Assets Total Assets 600,000 760,000 2.000.000 2.600,000 Right Hand Side of BS Accounts payable 360.000 500,000 Bank Debt 180,000 180 000 Total Current Liabilities 540,000 680.000 Long Term Debt 800,000 1,100,000 Common Stock and Paid-in Cap 500.000 500,000 Retained Earnings 160,000 320,000 Total Debt and Equity 2.000.000 2,600,000 For 2010, calculate QQE's inventory-sales conversion ratio? O A. 152.85 days OB 114.06 days OC.243.10 days O D.85 58 days O E None of the above Click Save and Submit to save and submit. Click Save All Answer to save all answers