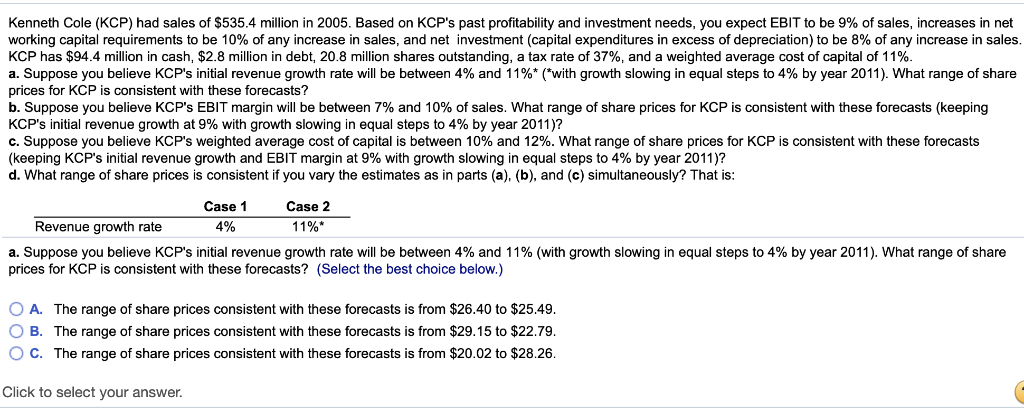

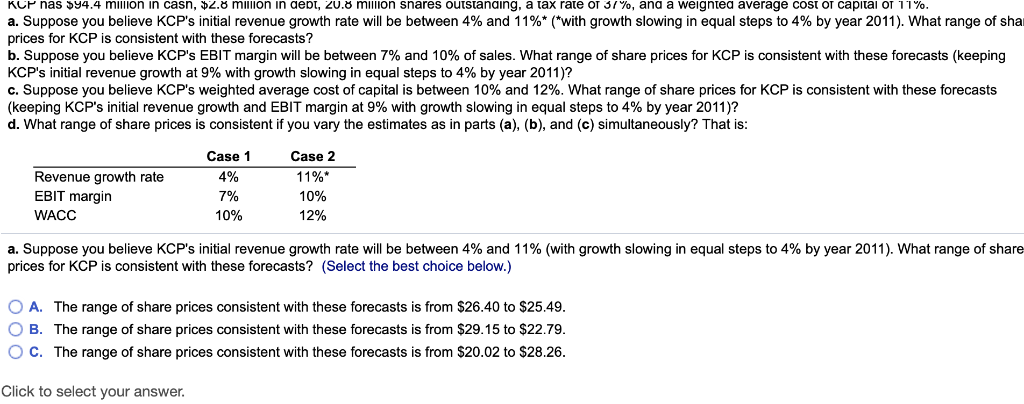

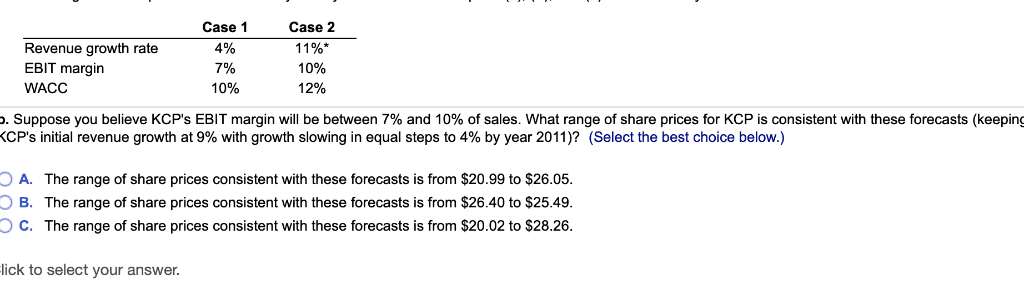

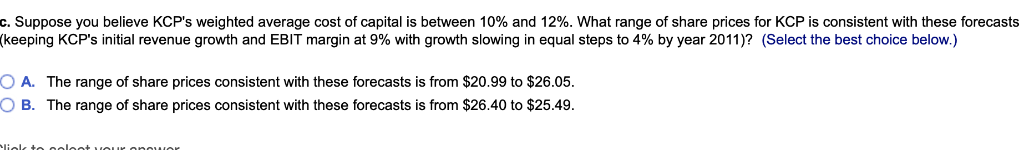

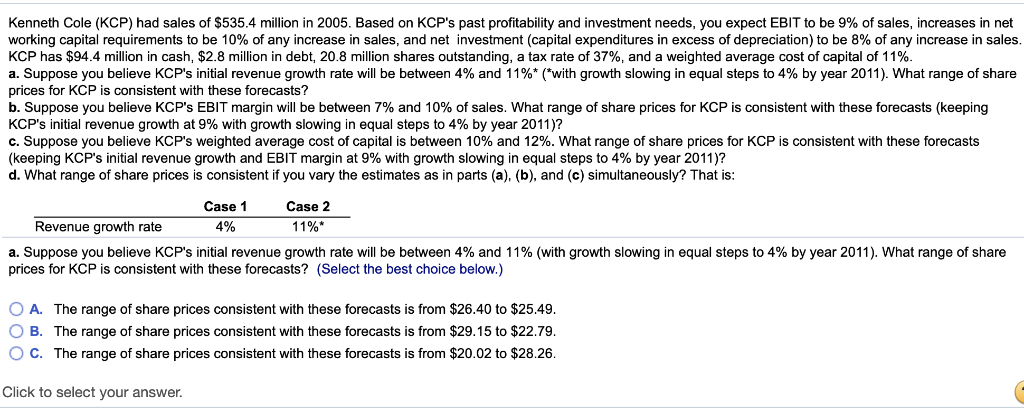

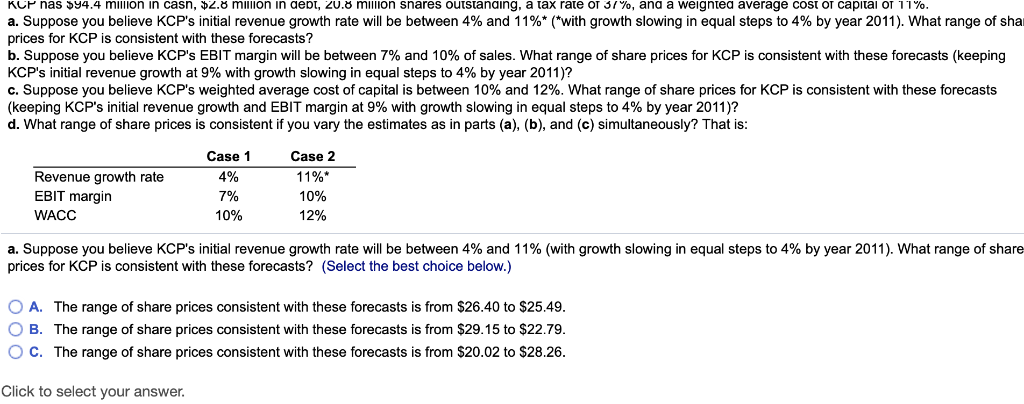

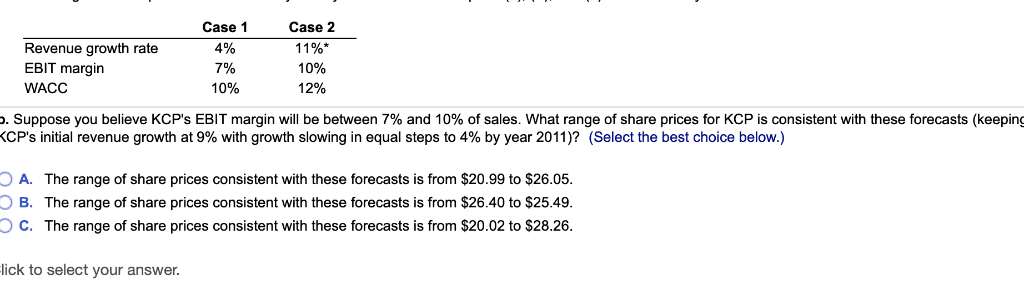

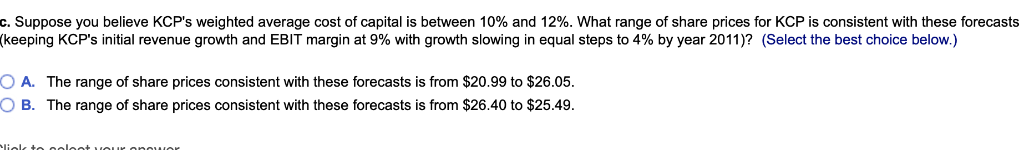

Kcr nas 14.4 million in casn, 2. million in aeDI, 2U. mlillon snares outstanding, a ax rate OTSTYo, ana a weig ntea average costcapital %. a. Suppose you believe KCP's initial revenue growth rate will be between 4% and 11%" with growth slowing in equal steps to 49 by year 2011 What range of sha prices for KCP is consistent with these forecasts? b. Suppose you believe KCP's EBIT margin will be between 7% and 10% of sales. What range of share prices for KCP is consistent with these forecasts (keeping KCP's initial revenue growth at 9% with growth slowing in equal steps to 4% by year 2011)? C. Suppose you believe KCP's weighted average cost of capital is between 10% and 12%. What range of share prices for KCP is consistent with these forecasts keeping KCP's initial revenue growth and EBIT margin at 9% with growth slowing in equal steps to 4% by year2011 d. What range of share prices is consistent if you vary the estimates as in parts (a), (b), and (c) simultaneously? That is: Case 1 4% 7% 10% Case 2 1196" 10% 12% Revenue growth rate EBIT margin WACC a. Suppose you believe KCP's initial revenue growth rate will be between 4% and 11% (with growth slowing in equal steps to 4% by year 2011). what range of share prices for KCP is consistent with these forecasts? (Select the best choice below.) O A. The range of share prices consistent with these forecasts is from $26.40 to $25.49. O B. The range of share prices consistent with these forecasts is from $29.15 to $22.79. C. The range of share prices consistent with these forecasts is from $20.02 to $28.26. Click to select your answer. C. Suppose you believe KCP's weighted average cost of capital is between 10% and 12%. What range of share prices for KCP is consistent with these forecasts Keeping KCP's initial revenue growth and EBIT margin at 9% with growth slowing in equal steps to 4% by year 2011)? (Select the best choice below) OA. O B. The range of share prices consistent with these forecasts is from $20.99 to $26.05. The range of share prices consistent with these forecasts is from $26.40 to $25.49. Kcr nas 14.4 million in casn, 2. million in aeDI, 2U. mlillon snares outstanding, a ax rate OTSTYo, ana a weig ntea average costcapital %. a. Suppose you believe KCP's initial revenue growth rate will be between 4% and 11%" with growth slowing in equal steps to 49 by year 2011 What range of sha prices for KCP is consistent with these forecasts? b. Suppose you believe KCP's EBIT margin will be between 7% and 10% of sales. What range of share prices for KCP is consistent with these forecasts (keeping KCP's initial revenue growth at 9% with growth slowing in equal steps to 4% by year 2011)? C. Suppose you believe KCP's weighted average cost of capital is between 10% and 12%. What range of share prices for KCP is consistent with these forecasts keeping KCP's initial revenue growth and EBIT margin at 9% with growth slowing in equal steps to 4% by year2011 d. What range of share prices is consistent if you vary the estimates as in parts (a), (b), and (c) simultaneously? That is: Case 1 4% 7% 10% Case 2 1196" 10% 12% Revenue growth rate EBIT margin WACC a. Suppose you believe KCP's initial revenue growth rate will be between 4% and 11% (with growth slowing in equal steps to 4% by year 2011). what range of share prices for KCP is consistent with these forecasts? (Select the best choice below.) O A. The range of share prices consistent with these forecasts is from $26.40 to $25.49. O B. The range of share prices consistent with these forecasts is from $29.15 to $22.79. C. The range of share prices consistent with these forecasts is from $20.02 to $28.26. Click to select your answer. C. Suppose you believe KCP's weighted average cost of capital is between 10% and 12%. What range of share prices for KCP is consistent with these forecasts Keeping KCP's initial revenue growth and EBIT margin at 9% with growth slowing in equal steps to 4% by year 2011)? (Select the best choice below) OA. O B. The range of share prices consistent with these forecasts is from $20.99 to $26.05. The range of share prices consistent with these forecasts is from $26.40 to $25.49