Answered step by step

Verified Expert Solution

Question

1 Approved Answer

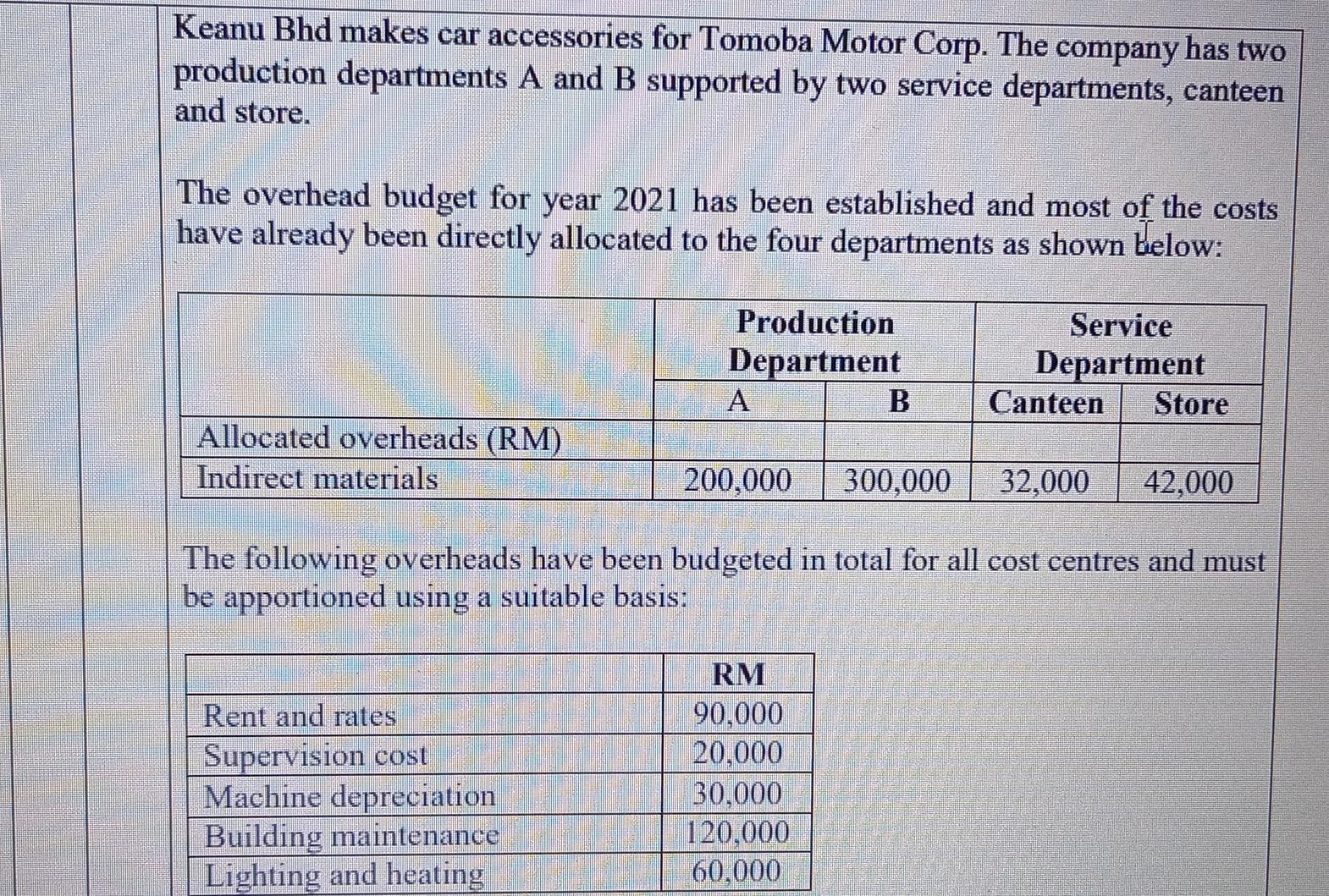

Keanu Bhd makes car accessories for Tomoba Motor Corp. The company has two production departments A and B supported by two service departments, canteen

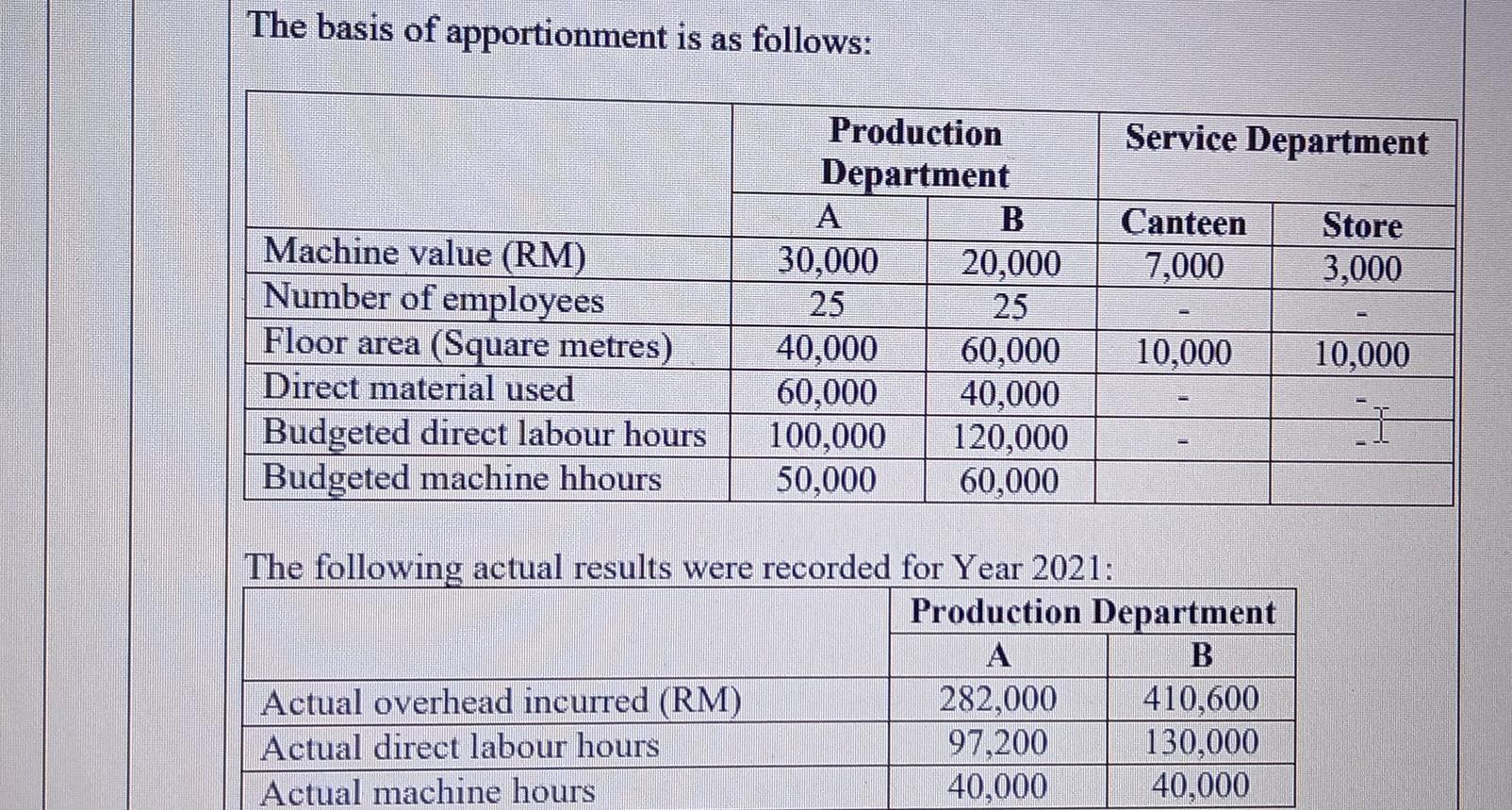

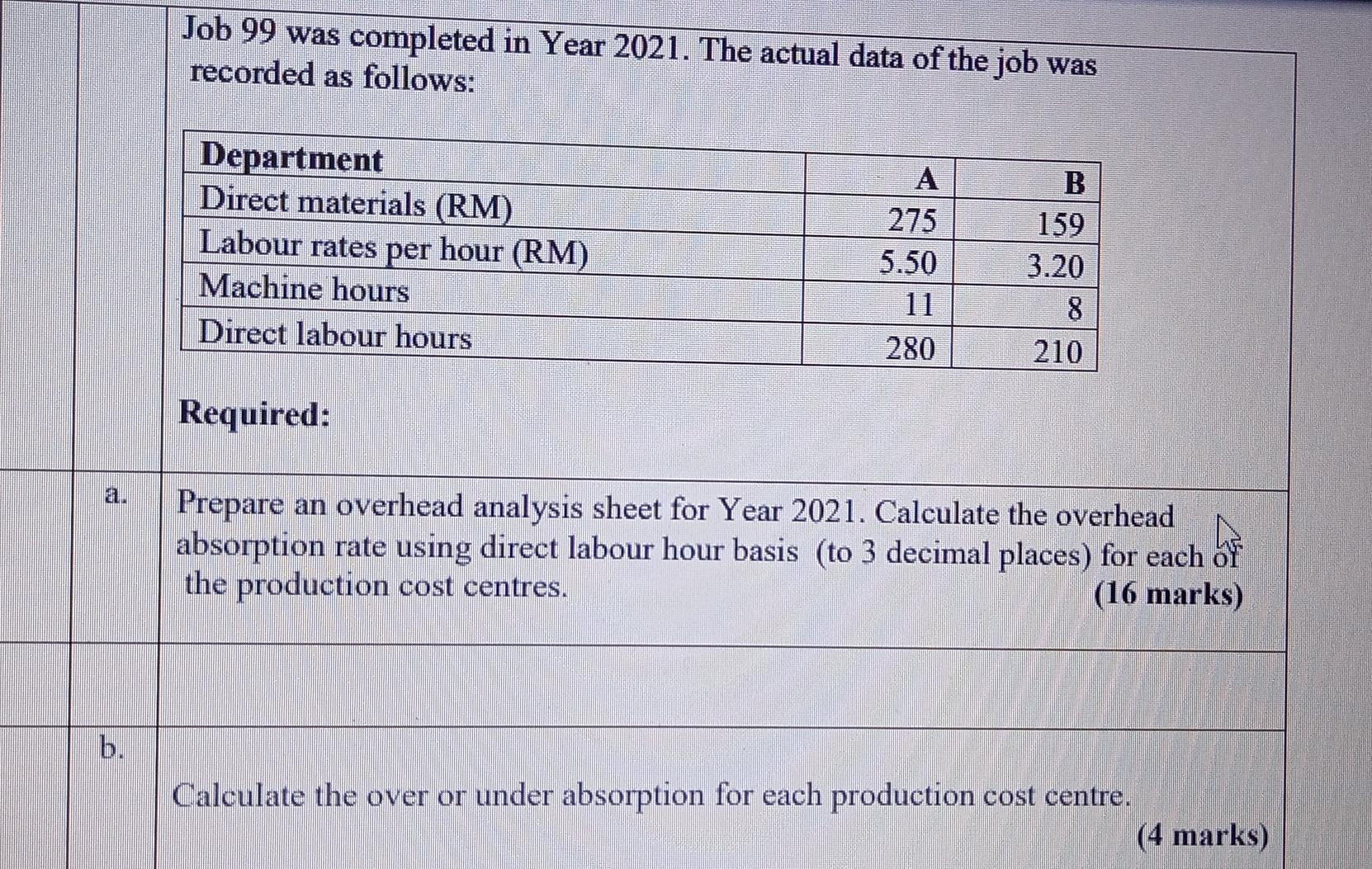

Keanu Bhd makes car accessories for Tomoba Motor Corp. The company has two production departments A and B supported by two service departments, canteen and store. The overhead budget for year 2021 has been established and most of the costs have already been directly allocated to the four departments as shown below: Allocated overheads (RM) Indirect materials Production Department Rent and rates Supervision cost Machine depreciation Building maintenance Lighting and heating A 200,000 300,000 32,000 42,000 The following overheads have been budgeted in total for all cost centres and must be apportioned using a suitable basis: RM 90,000 20,000 Service Department 30,000 120,000 60,000 Canteen Store The basis of apportionment is as follows: Machine value (RM) Number of employees Floor area (Square metres) Direct material used Budgeted direct labour hours Budgeted machine hhours Production Department Actual overhead incurred (RM) Actual direct labour hours Actual machine hours A 30.000 25 40,000 60,000 100,000 50,000 B 20,000 25 60,000 40,000 120,000 60,000 The following actual results were recorded for Year 2021: Service Department 282,000 97,200 40,000 Canteen 7,000 10,000 Production Department A B 410,600 130,000 40,000 Store 3,000 10,000 1 a b. Job 99 was completed in Year 2021. The actual data of the job was recorded as follows: Department Direct materials (RM) Labour rates per hour (RM) Machine hours Direct labour hours Required: A 275 5.50 11 280 B 159 3.20 8 210 Prepare an overhead analysis sheet for Year 2021. Calculate the overhead absorption rate using direct labour hour basis (to 3 decimal places) for each of the production cost centres. (16 marks) Calculate the over or under absorption for each production cost centre. (4 marks) b. Prepare an overhead analysis sheet for Year 2021. Calculate the overhead absorption rate using direct labour hour basis (to 3 decimal places) for each of the production cost centres. (16 marks) Calculate the over or under absorption for each production cost centre. Calculate the total cost for Job 99. (4 marks (5 marks)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Overhead Analysis Sheet 2021 Cost Centre Allocated Overheads Budgeted Overheads Actual Overheads Overhead Absorption Rate Production Department A 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started