Answered step by step

Verified Expert Solution

Question

1 Approved Answer

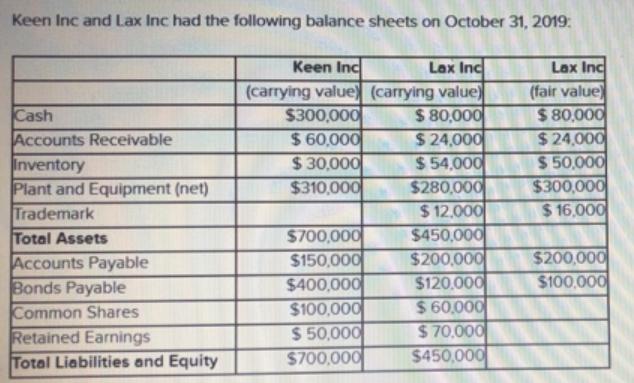

Keen Inc and Lax Inc had the following balance sheets on October 31, 2019: Keen Inc Lax Inc (carrying value) (carrying value) $ 80,000

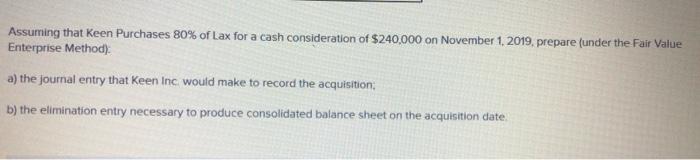

Keen Inc and Lax Inc had the following balance sheets on October 31, 2019: Keen Inc Lax Inc (carrying value) (carrying value) $ 80,000 $24,000 $ 54,000 $280,000 $12.000 $450,000 $200,000 $120.000 $ 60,000 $70,000 $450,000 Lax Inc (fair value) $ 80,000 $ 24,000 $ 50,000 $300,000 $16,000 Cash Accounts Receivable Inventory Plant and Equipment (net) Trademark $300,000 $ 60,000 $30,000 $310,000 $700,000 $150,000 $400,000 $100,000 $ 50,000 $700,000 Total Assets Accounts Payable Bonds Payable $200,000 $100,000 Common Shares Retained Earnings Total Liabilities and Equity Assuming that Keen Purchases 80% of Lax for a cash consideration of $240,000 on November 1, 2019, prepare (under the Fair Value Enterprise Method): a) the journal entry that Keen Inc. would make to record the acquisition; b) the elimination entry necessary to produce consolidated balance sheet on the acquisition date.

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution a D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started