Answered step by step

Verified Expert Solution

Question

1 Approved Answer

keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps. As investor purchased a fixed-coupon

keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps.

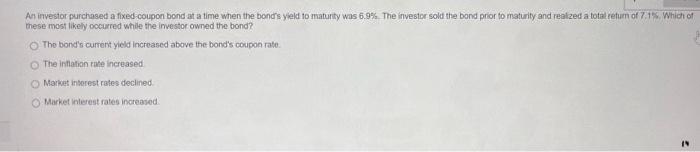

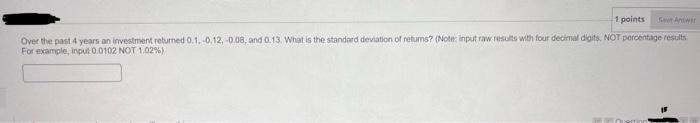

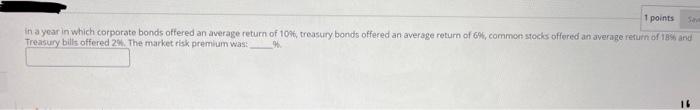

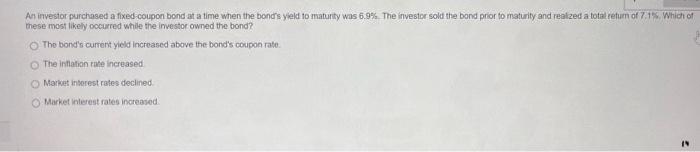

As investor purchased a fixed-coupon bond at a time when the bond's yield to maturity was 6.9%. The investor sold the bond prior to maturity and realized a total retum of 7.15 . Which of these most likely occurred while the imvestor owred the bond? The bond's current yield increased above the bond's coupon rate. The inflation rate increased Market intorest rates declined. Market inlerest rates increasiod. Over the past 4 years an investment reburned 0.1,0,12,0.08, and 0.13 . What is the standard deviation of retums? (Noler input raw results with four decimal digits, NOT percentige restults For example, input 0.0102 NOT 1,02% ) in ayear in which corporate bonds offered an average return of 1094 , treasury bonds offered an average return of 695 , common stocks offered an average refurn of 18% and Treasurv billt afferad 20 . The market risk premium wast \%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started