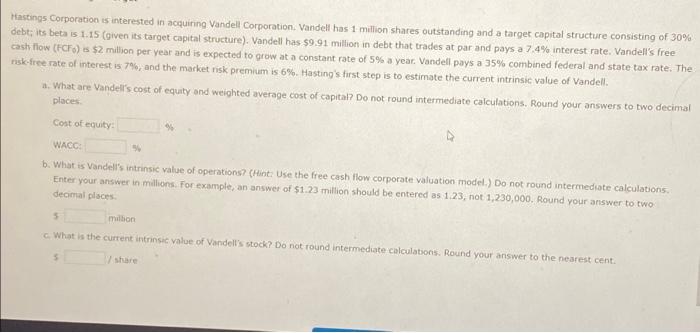

Keep the 2. Problem 26 01 (Variation of Merger Target HP Walk The Valuation of Merger Targe at Corporation de portion of short structure cottsbetes 1.15 foiventare ope) de 9.01 - det that des standay te detech (C) o per year and expected to protect vandul pays a combined federal and there on the premises the contem More Www Victory and we called and your swers to the death Creat cover WACC Wheels of the there for det rundt mede calcio Enter your writo 1 hd be 250,000 to two decimal places million What the current and do not und Round your answer to the nearest cent share Hastings Corporation is interested in acquiring Vandell Corporation. Vandell has 1 milion shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.15 (given its target capital structure). Vandell has $9.91 million in debt that trades at par and pays a 7.4% interest rate. Vandell's free cash flow (FCF) is $2 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 35% combined federal and state tax rate. The riske-free rate of interest is 7%, and the market risk premium is 6%. Hasting's first step is to estimate the current intrinsic value of Vandell, 1. What are Vandell's cost of equity and weighted average cost of capital? Do not round intermediate calculations. Round your answers to two decimal places Cost of equity a WACC: b. What is Vandell's intrinsic value of operations? (Hint: Use the free cash flow corporate valuation model.) Do not round intermediate calculations Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places million What is the current intrinsic value of Vandell's stock? Do not found intermediate calculations. Round your answer to the nearest cent. 5 Share Keep the 2. Problem 26 01 (Variation of Merger Target HP Walk The Valuation of Merger Targe at Corporation de portion of short structure cottsbetes 1.15 foiventare ope) de 9.01 - det that des standay te detech (C) o per year and expected to protect vandul pays a combined federal and there on the premises the contem More Www Victory and we called and your swers to the death Creat cover WACC Wheels of the there for det rundt mede calcio Enter your writo 1 hd be 250,000 to two decimal places million What the current and do not und Round your answer to the nearest cent share Hastings Corporation is interested in acquiring Vandell Corporation. Vandell has 1 milion shares outstanding and a target capital structure consisting of 30% debt; its beta is 1.15 (given its target capital structure). Vandell has $9.91 million in debt that trades at par and pays a 7.4% interest rate. Vandell's free cash flow (FCF) is $2 million per year and is expected to grow at a constant rate of 5% a year. Vandell pays a 35% combined federal and state tax rate. The riske-free rate of interest is 7%, and the market risk premium is 6%. Hasting's first step is to estimate the current intrinsic value of Vandell, 1. What are Vandell's cost of equity and weighted average cost of capital? Do not round intermediate calculations. Round your answers to two decimal places Cost of equity a WACC: b. What is Vandell's intrinsic value of operations? (Hint: Use the free cash flow corporate valuation model.) Do not round intermediate calculations Enter your answer in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Round your answer to two decimal places million What is the current intrinsic value of Vandell's stock? Do not found intermediate calculations. Round your answer to the nearest cent. 5 Share