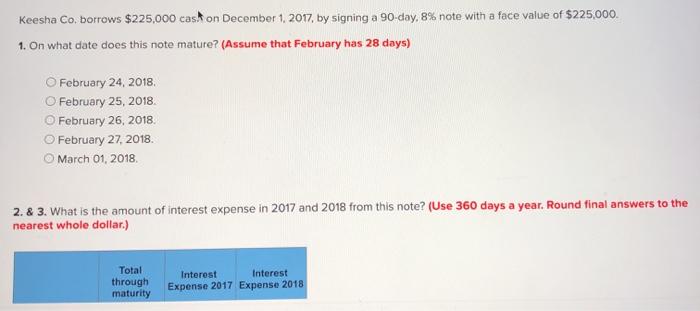

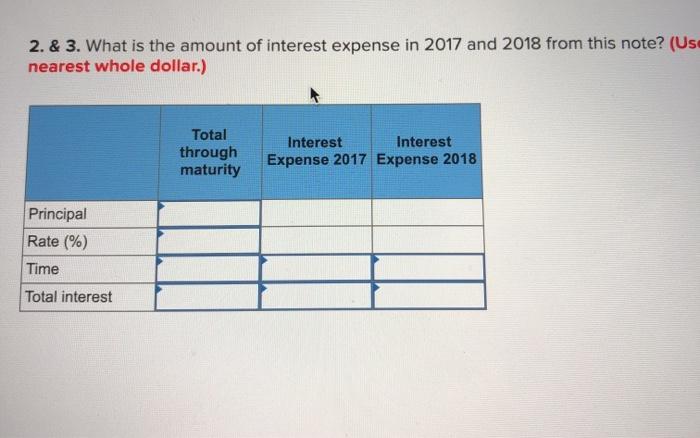

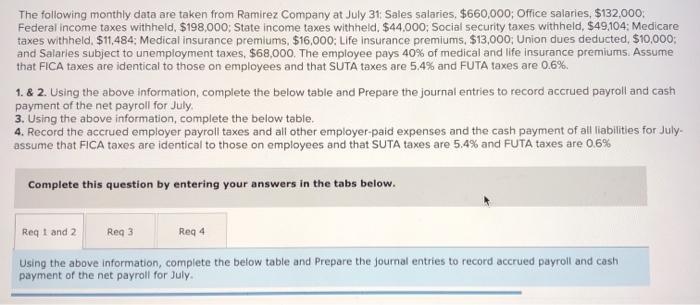

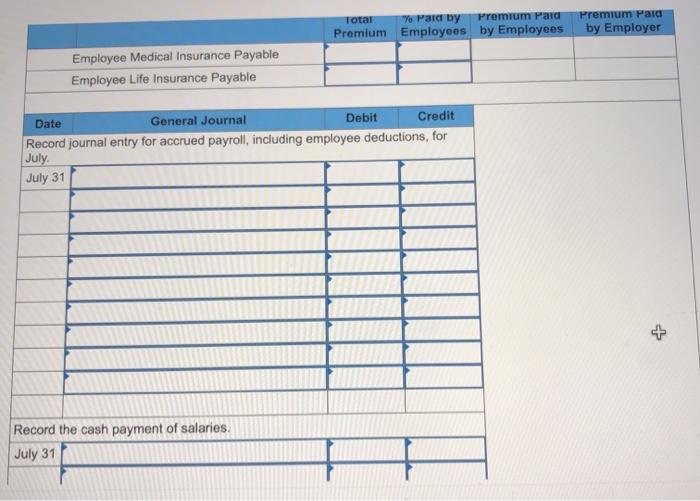

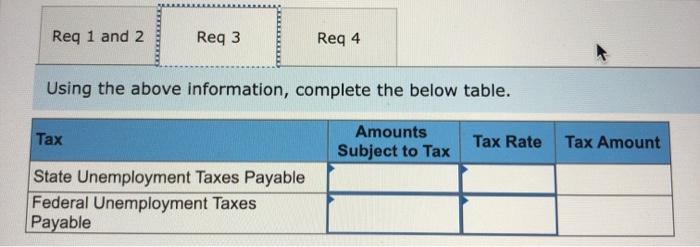

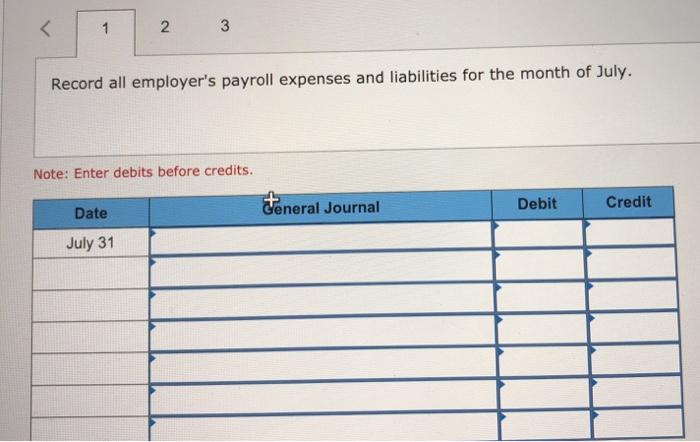

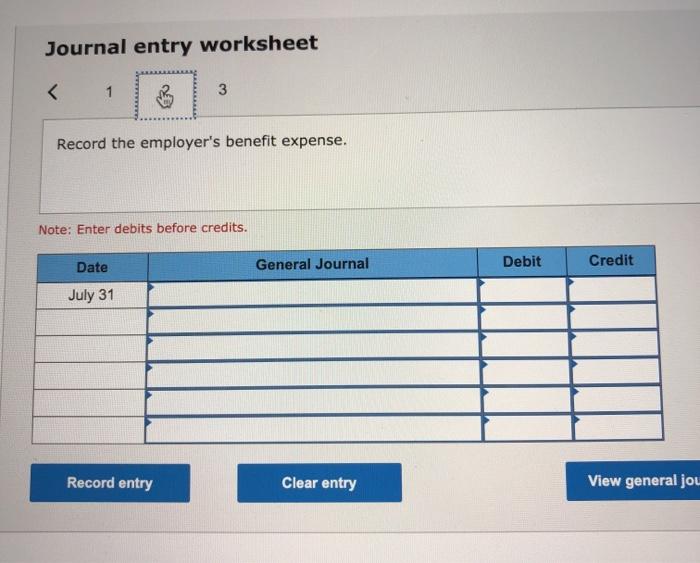

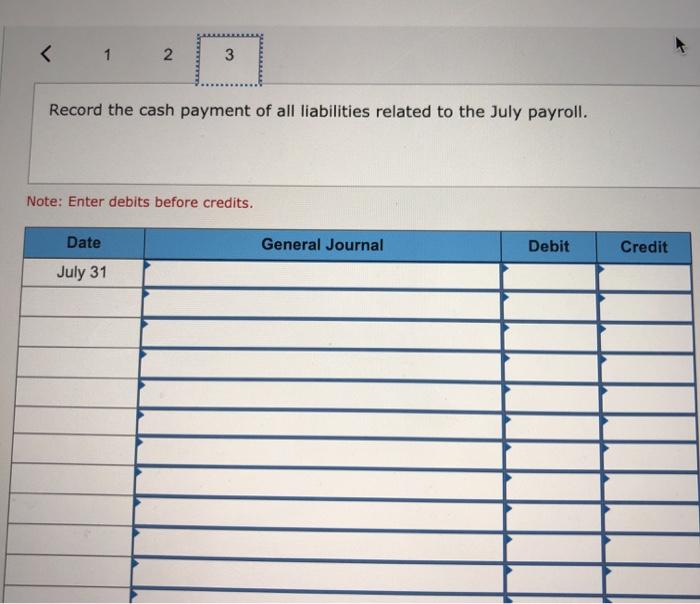

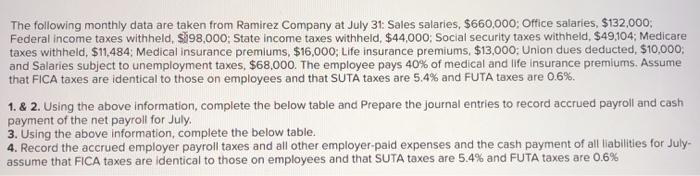

Keesha Co, borrows $225,000 cash on December 1, 2017 by signing a 90-day, 8% note with a face value of $225,000 1. On what date does this note mature? (Assume that February has 28 days) February 24, 2018 O February 25, 2018 February 26, 2018 February 27, 2018 March 01, 2018 2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Use 360 days a year. Round final answers to the nearest whole dollar.) Total through maturity Interest Interest Expense 2017 Expense 2018 2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Us nearest whole dollar.) Total through maturity Interest Interest Expense 2017 Expense 2018 Principal Rate (%) Time Total interest The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $660,000; Office salaries, $132,000 Federal income taxes withheld, $198,000; State income taxes withheld. $44.000; Social security taxes withheld, 549,104: Medicare taxes withheld. $11.484: Medical insurance premiums, $16,000: Life Insurance premiums. $13,000 Union dues deducted, $10,000: and Salaries subject to unemployment taxes, $68,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5,4% and FUTA taxes are 0.6% 1. & 2. Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July- assume that FICA taxes are identical to those on employees and that SUTA taxes are 5,4% and FUTA taxes are 0.6% Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Using the above information, complete the below table and Prepare the journal entries to record accrued payroll and cash payment of the net payroll for July Total % Pard by Premium Paid Premium Employees by Employees Premium Paid by Employer Employee Medical Insurance Payable Employee Life Insurance Payable Date General Journal Debit Credit Record journal entry for accrued payroll, including employee deductions, for July July 31 Record the cash payment of salaries. July 31 Req 1 and 2 Req 3 Reg 4 Using the above information, complete the below table. Tax Amounts Subject to Tax Tax Rate Tax Amount State Unemployment Taxes Payable Federal Unemployment Taxes Payable