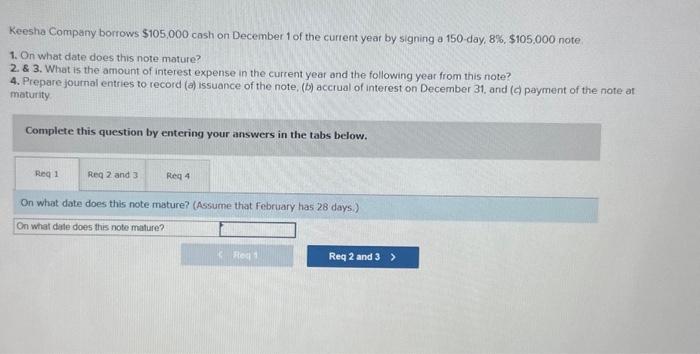

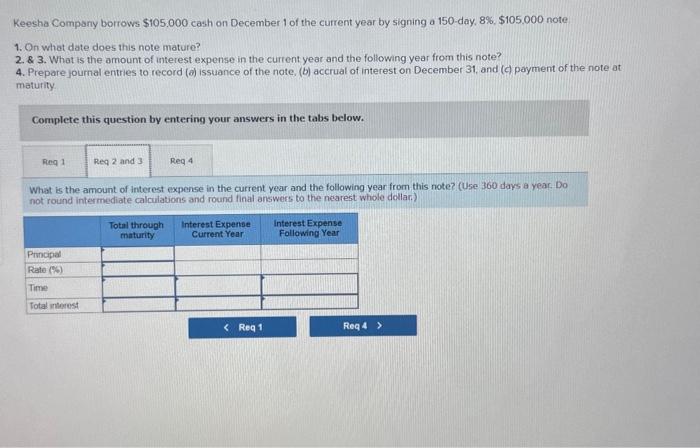

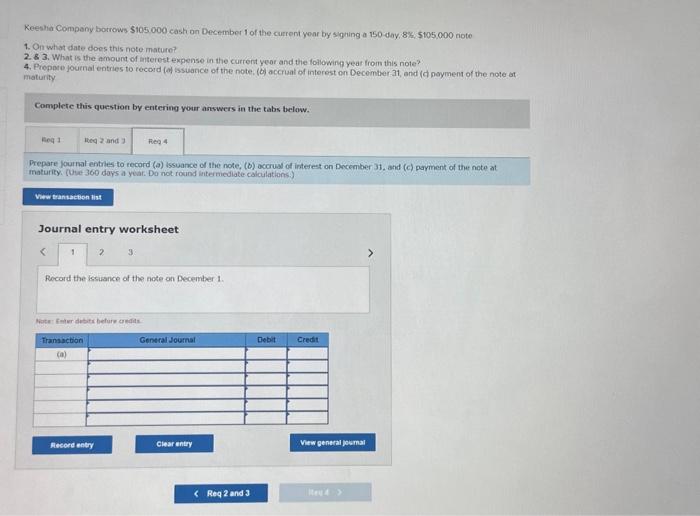

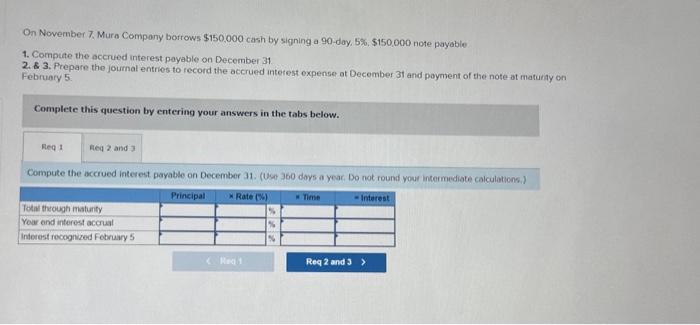

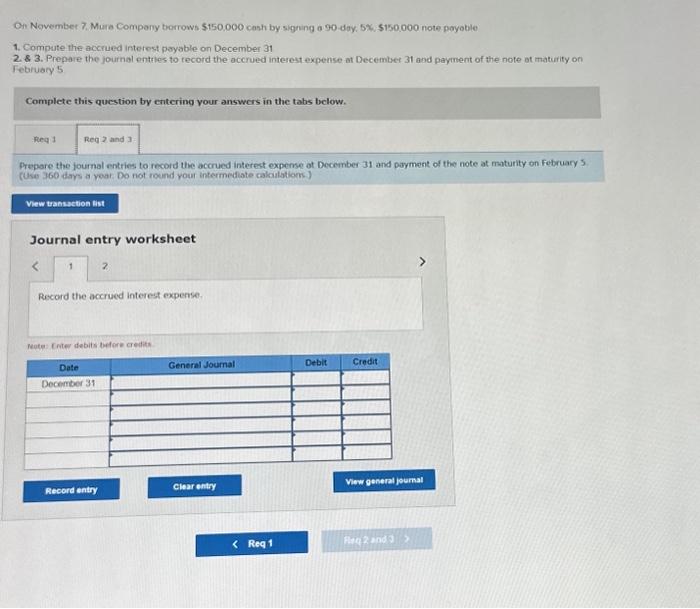

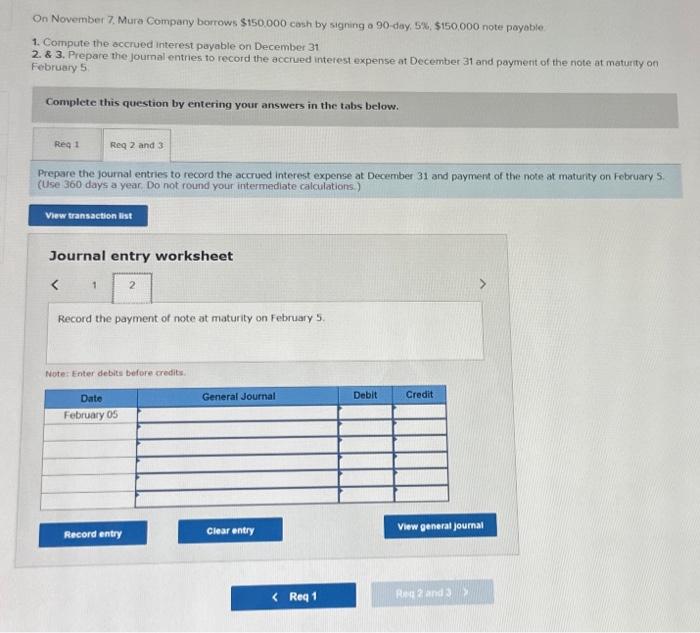

Keesha Company borrows $105,000 cash on December 1 of the curtent year by signing a 150-day, 8\%, $105,000 note 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (a) Issuance of the note, (b) accrual of interest on December 31 , and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. On what date does this note mature? (Assume that february has 28 days.) Keesha Company borrows $105,000 cash on December 1 of the current year by signing a 150 -day, 8%,$105,000 note 1. On what date does this note mature? 2. \& 3. What is the amount of interest expense in the current year and the following year from this note? 4. Prepare journal entries to record (b) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. Complete this question by entering your answers in the tabs below. What is the amount of interest expense in the current year and the following year from this note? (Use 360 days a year. Do not round intermediate calculations and round final answers to the nearest whole dollar.) Keesha Company borrows $105,000 cash on December 1 of the current yoar by siguing a 150 day, 8%,$105,000 note 1. On what date does this note mature? 2.83. What is the amount of interest expense in the current yeor and the following year from this note? 4. Proppe journal entries to record (a) issuance of the note. (of accraat of interest on December 31, and (d) poyment of the note ot: maturity Complete this question by ertering your answers in the tabs below. Prepare lournal entries to record (a) issuance of the note, (b) accrual of interest on December 31, and (c) payment of the note at maturity. (ohe 360 doys a year. Do not roand litermiedlate calculations.) Journal entry worksheet 31 Pocord the issuance of the note on December 1. Bert an Feler dokets befure dredilt. On Novernber 7. Mura Company borrows $150,000 cash by signing a 90 day, 5%,$150,000 note payable 1. Comptate the accued interest payable on December 31 2. \& 3. Prepare the joumal entries to record the accrued interest expense ot December 3t and payment of the note at matuity on February 5: Complete this question by entering your answers in the tabs below. Compute the accrued interest payable on December 31. (Use 360 dovs a year. Do not round your intermediate calculations.) On November 7. Mura Company borrows $150.000 cash by signing a 90 -dxy. 5%. $150.000 note poyoble 1. Compute the accrued interest payable on December 31 2. \& 3. Prepare the journal enthes to record the accrued interest expense at Decemtset 31 and payment of the note at maturity on Februbcy 5 Complete this question by entering vour answers in the tabs below. Prepare the joumal entries to record the accrued interest expeme of December 31 and payment of the note at maturity on February 5 (Use 360 dars a roar. Do not round your intermediate calailation.) Journal entry worksheet 2 Record the accrued interest expense. On November 7. Mura Company borrows $150,000 cash by signing a 90 -day, 5%,$150.000 note payable 1. Compute the accrued interest payable on December 31 2. \& 3. Prepare the joumal entries to record the accrued interest expense at December 31 and payment of the note at maturty on February 5 Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the accued interest expense at December 31 and payment of the note at maturity on February 5 . (Use 360 days a year. Do not round your intermediate calculations.) Journal entry worksheet Record the payment of note at maturity on February 5. Niste: Enter debiti before aredits