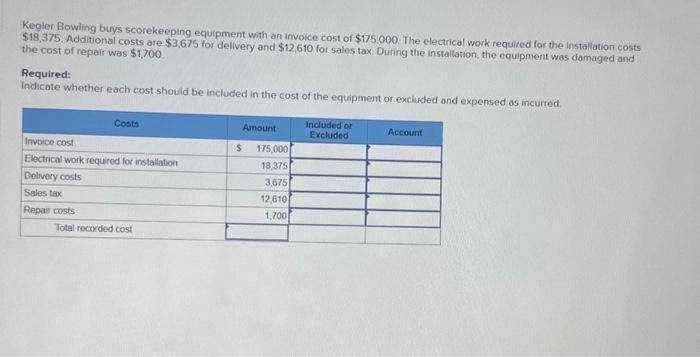

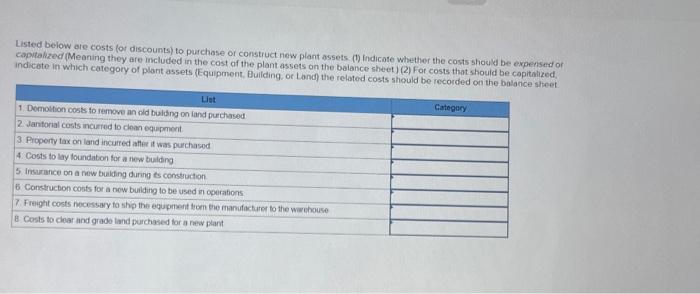

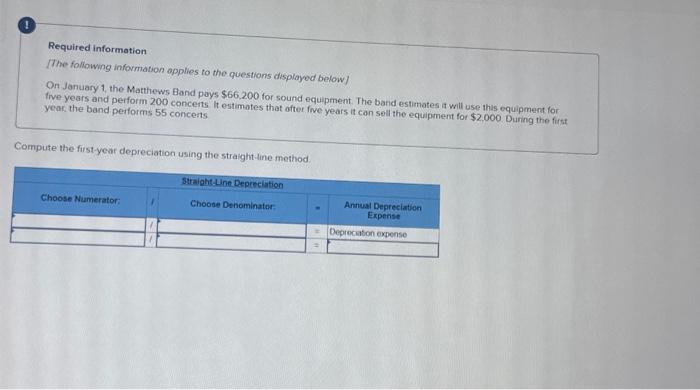

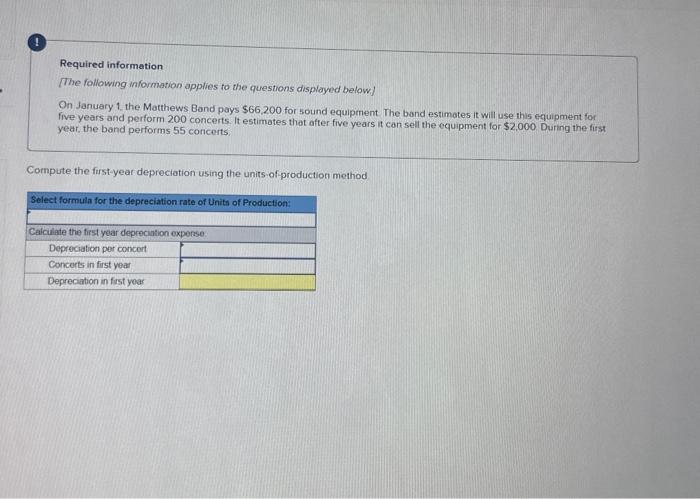

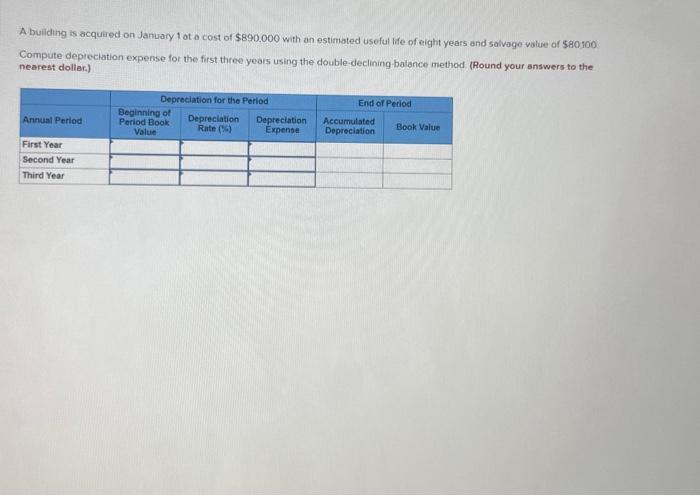

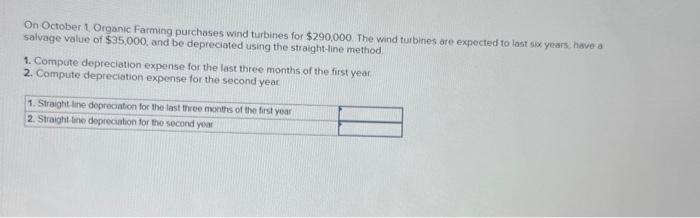

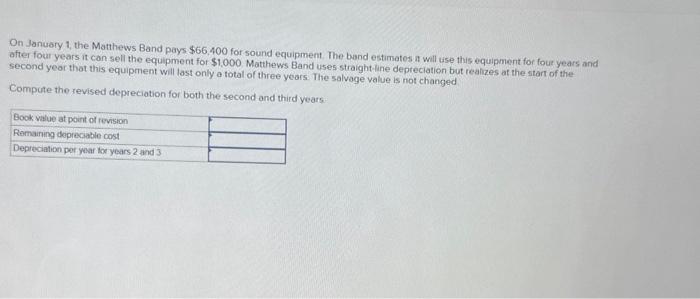

Kegler Blowling buys scorekeeping equipment with an invoice cost of $175.000. The electrical work required for the installation costs $18,375. Additional costs are $3,675 for dellvery and $12,610 for sales tax. During the installation, the equipment was damaged and the cost of repair was $1,700 Required: Indicate whether each cost should be included in the cost of the equipment or excluded and expensed as incurred Listed below are costs for discounts) to purchase or construct new plant assets. (1) indicate whether the costs should be expensed or capvalized (Meaning they are included in the cost of the plant assets on the balance cheet) (2) For costs that should be capitaized indicete in which category of plont assets (Equipment, Building. or Land) the related costs should be recorded on the halarice sheed Required information [The following information opplies to the questions displayed below] On January 1, the Matthews Band pays $66,200 for sound equipment. The band estimates it will use this equipment for five years and perform 200 concents it estimotes that ofter five years it con sell the equipment for $2,000 During the first year the band performs 55 concents Compute the first-year depreciation using the straight-line method. Required information [The following information applies to the questions displayed below] On January 1 , the Matthews Band pays $66,200 for sound equipment The band estimates it will use this equipment for five years and perform 200 concerts. It estimates that after five years it can sell the oquipment for $2,000 During the first year, the band performs 55 concerts. Compute the first-year depreciation using the units of-production method A building is acquired on January 1 of a cost of $890.000 with an estimiated useful life of eight years and salvage volue of $80100 Compute depicciation expense for the first three years using the double-declining baiance method (Round your answers to the nearest dollar.) On October 1. Organic Farming purchases wind turbines for $290,000. The wind turbines are expected to last wax years have a salvage value of $35,000, and be depreciated using the straight-line method 1. Compute depreciation expense for the last three months of the first year 2. Compute depreciation expense for the second yeat On January 1, the Matthews Band pays $66,400 for sound equipment. The band estimates a will use this equipment for four years and after four years it can sell the equipment for $1,000 Mathews Band uses straight-line depreciation but realizes at the start of the second year that this equipment will last only a total of three years. The salvage value is not changed Compute the revised depreciation for both the second and third years