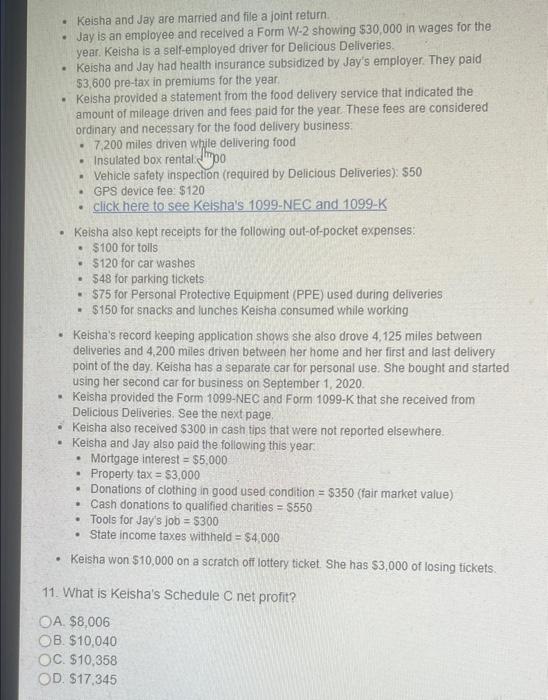

Keisha and Jay are married and file a joint return Jay is an employee and received a Form W-2 showing $30,000 in wages for the year. Keisha is a self-employed driver for Delicious Deliveries Keisha and Jay had health insurance subsidized by Jay's employer. They paid $3,600 pre-tax in premiums for the year Keisha provided a statement from the food delivery service that indicated the amount of mileage driven and fees paid for the year. These fees are considered ordinary and necessary for the food delivery business 7,200 miles driven while delivering food Insulated box rental: 0 Vehicle safety inspection (required by Delicious Deliveries): $50 GPS device fee: $120 click here to see Keisha's 1099-NEC and 1099-K . Keisha also kept receipts for the following out-of-pocket expenses $100 for tolls $120 for car washes 548 for parking tickets $75 for Personal Protective Equipment (PPE) used during deliveries $150 for snacks and lunches Keisha consumed while working Keisha's record keeping application shows she also drove 4,125 miles between deliveries and 4 200 miles driven between her home and her first and last delivery point of the day. Keisha has a separate car for personal use. She bought and started using her second car for business on September 1, 2020 Keisha provided the Form 1099-NEC and Form 1099-K that she received from Delicious Deliveries. See the next page. Keisha also received $300 in cash tips that were not reported elsewhere. Keisha and Jay also paid the following this year Mortgage interest = $5,000 Property tax = $3,000 Donations of clothing in good used condition = $350 (fair market value) Cash donations to qualified charities = $550 Tools for Jay's job = 5300 State income taxes withheld = $4,000 Keisha won $10,000 on a scratch off lottery ticket She has $3,000 of losing tickets. . - . . 11. What is Keisha's Schedule C net profit? OA. $8,006 OB. $10,040 OC. $10,358 D. $17,345 Keisha and Jay are married and file a joint return Jay is an employee and received a Form W-2 showing $30,000 in wages for the year. Keisha is a self-employed driver for Delicious Deliveries Keisha and Jay had health insurance subsidized by Jay's employer. They paid $3,600 pre-tax in premiums for the year Keisha provided a statement from the food delivery service that indicated the amount of mileage driven and fees paid for the year. These fees are considered ordinary and necessary for the food delivery business 7,200 miles driven while delivering food Insulated box rental: 0 Vehicle safety inspection (required by Delicious Deliveries): $50 GPS device fee: $120 click here to see Keisha's 1099-NEC and 1099-K . Keisha also kept receipts for the following out-of-pocket expenses $100 for tolls $120 for car washes 548 for parking tickets $75 for Personal Protective Equipment (PPE) used during deliveries $150 for snacks and lunches Keisha consumed while working Keisha's record keeping application shows she also drove 4,125 miles between deliveries and 4 200 miles driven between her home and her first and last delivery point of the day. Keisha has a separate car for personal use. She bought and started using her second car for business on September 1, 2020 Keisha provided the Form 1099-NEC and Form 1099-K that she received from Delicious Deliveries. See the next page. Keisha also received $300 in cash tips that were not reported elsewhere. Keisha and Jay also paid the following this year Mortgage interest = $5,000 Property tax = $3,000 Donations of clothing in good used condition = $350 (fair market value) Cash donations to qualified charities = $550 Tools for Jay's job = 5300 State income taxes withheld = $4,000 Keisha won $10,000 on a scratch off lottery ticket She has $3,000 of losing tickets. . - . . 11. What is Keisha's Schedule C net profit? OA. $8,006 OB. $10,040 OC. $10,358 D. $17,345