Answered step by step

Verified Expert Solution

Question

1 Approved Answer

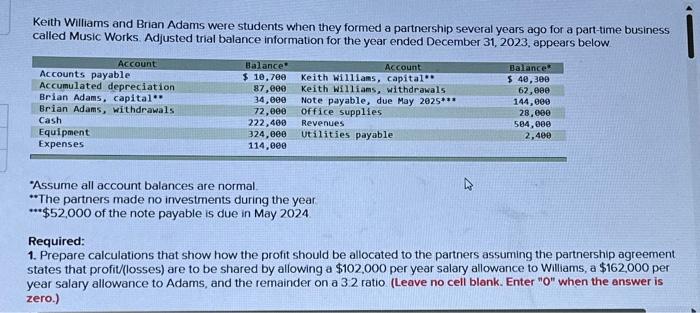

Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial balance

Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial balance information for the year ended December 31, 2023, appears below Account Accounts payable Accumulated depreciation Brian Adams, capital** Brian Adams, withdrawals Cash Equipment Expenses Balance* $ 10,700 87,000 34,000 72,000 222,400 324,000 114,000 Account Keith Williams, capital** Keith Williams, withdrawals. Note payable, due May 2025*** Office supplies Revenues Utilities payable *Assume all account balances are normal. **The partners made no investments during the year ***$52,000 of the note payable is due in May 2024. Balance* $ 40,300 62,000 144,000 28,000 504,000 2,400 Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership agreement states that profit/(losses) are to be shared by allowing a $102,000 per year salary allowance to Williams, a $162,000 per year salary allowance to Adams, and the remainder on a 3.2 ratio. (Leave no cell blank. Enter "0" when the answer is zero.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started