Answered step by step

Verified Expert Solution

Question

1 Approved Answer

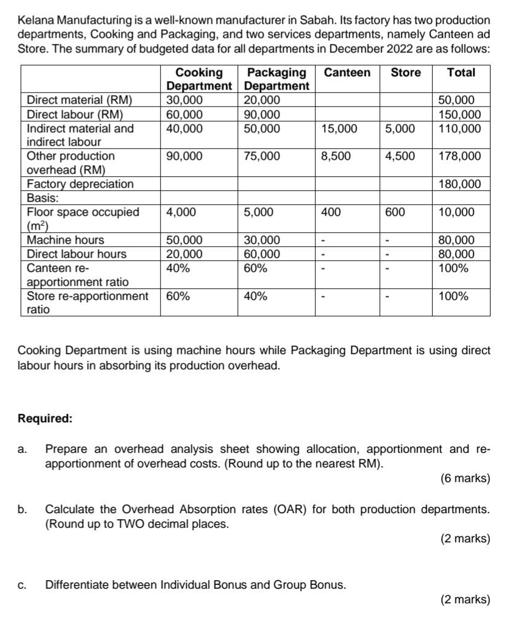

Kelana Manufacturing is a well-known manufacturer in Sabah. Its factory has two production departments, Cooking and Packaging, and two services departments, namely Canteen ad

Kelana Manufacturing is a well-known manufacturer in Sabah. Its factory has two production departments, Cooking and Packaging, and two services departments, namely Canteen ad Store. The summary of budgeted data for all departments in December 2022 are as follows: Total Direct material (RM) Direct labour (RM) Indirect material and indirect labour Other production overhead (RM) Factory depreciation Basis: Floor space occupied (m) Machine hours Direct labour hours Canteen re- C. Required: a. Cooking Department Department b. 30,000 60,000 40,000 90,000 apportionment ratio Store re-apportionment 60% ratio 4,000 50,000 20,000 40% Packaging Canteen Store 20,000 90,000 50,000 75,000 5,000 30,000 60,000 60% 40% 15,000 5,000 8,500 4,500 400 600 Cooking Department is using machine hours while Packaging Department is using direct labour hours in absorbing its production overhead. 50,000 150,000 110,000 Differentiate between Individual Bonus and Group Bonus. 178,000 180,000 10,000 80,000 80,000 100% 100% Prepare an overhead analysis sheet showing allocation, apportionment and re- apportionment of overhead costs. (Round up to the nearest RM). (6 marks) Calculate the Overhead Absorption rates (OAR) for both production departments. (Round up to TWO decimal places. (2 marks) (2 marks)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Overhead Analysis Sheet Department Direct Material Direct Labour ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started