Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (a) Critically discuss THREE (3) measures that an acquirer company can adopt to improve the chances that a takeover will become financially

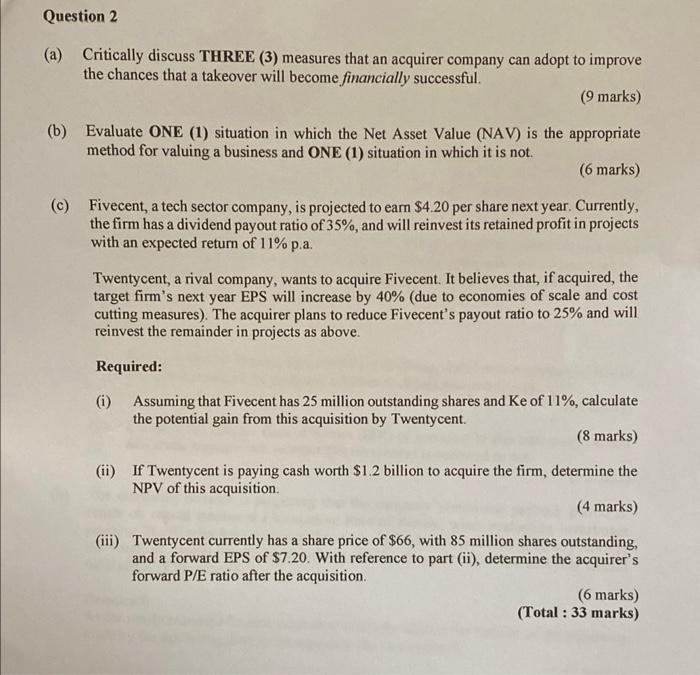

Question 2 (a) Critically discuss THREE (3) measures that an acquirer company can adopt to improve the chances that a takeover will become financially successful. (9 marks) (b) Evaluate ONE (1) situation in which the Net Asset Value (NAV) is the appropriate method for valuing a business and ONE (1) situation in which it is not. (6 marks) (c) Fivecent, a tech sector company, is projected to earn $4.20 per share next year. Currently, the firm has a dividend payout ratio of 35%, and will reinvest its retained profit in projects with an expected return of 11% p.a. Twentycent, a rival company, wants to acquire Fivecent. It believes that, if acquired, the target firm's next year EPS will increase by 40% (due to economies of scale and cost cutting measures). The acquirer plans to reduce Fivecent's payout ratio to 25% and will reinvest the remainder in projects as above. Required: (i) Assuming that Fivecent has 25 million outstanding shares and Ke of 11%, calculate the potential gain from this acquisition by Twentycent. (8 marks) (ii) If Twentycent is paying cash worth $1.2 billion to acquire the firm, determine the NPV of this acquisition. (4 marks) (iii) Twentycent currently has a share price of $66, with 85 million shares outstanding, and a forward EPS of $7.20. With reference to part (ii), determine the acquirer's forward P/E ratio after the acquisition. (6 marks) (Total : 33 marks)

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

One measure that an acquirer company can adopt to improve the chances that a takeover will become financially successful is to due diligence on the target company This includes investigating the targe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started